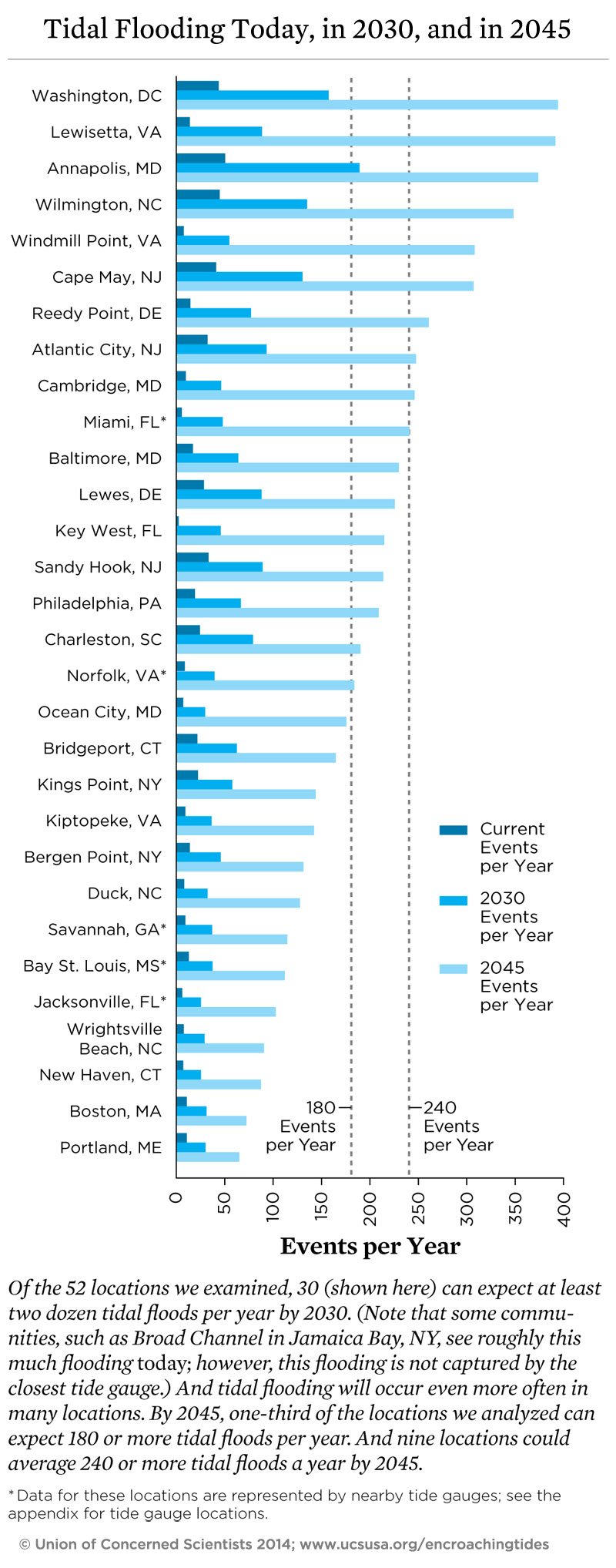

Are companies prepared for skyrocketing energy costs to combat extreme heat? Can farmers handle average crop losses of up to 73%? Should businesses invest in oceanfront property that is virtually guaranteed to flood? Because of climate change, these are just some of the crucial questions the United States will face before the end of the century, according to “Risky Business: The Economic Risks of Climate Change in the United States,” a report co-chaired by business experts Michael R. Bloomberg, Henry Paulson and Tom Steyer. The report quantifies and publicizes the economic risks posed by a changing climate. While climate change can be a politicized topic, there is little controversy that the phenomenon presents a great deal of risk to everyone, from individuals to institutions.

Decision-makers already use risk analysis to address uncertain situations, routinely evaluating potential threats and challenges such as bad investments or schedule delays. The report adds climate change to the risks that all decision-makers should account for. Robert E. Rubin, co-chair of the Council on Foreign Relations and member of the report’s risk committee, said, “Companies should disclose both their potential exposure to climate risk, and the potential costs they may someday be required to absorb to address carbon emissions.”

The report uses risk analysis, Monte Carlo simulation (MCS) and models to illustrate how different regions are likely to be affected by climate change. The project’s simulation also analyzes efforts to mitigate climate change, showing a changed distribution of probabilities if those efforts are made in the coming years. “As there a very high number of permutations and combinations of weather events, it would be very difficult to analyze these meaningfully using an averaged or deterministic approach,” said Robert Kinghorn, associate director at the consulting firm KPMG Australia. “MCS overcomes this by allowing thousands of possible combinations of extreme weather events to be analyzed.”

MCS can illustrate the potential costs if no adaptation takes place, or if adaptation is employed. The “Risky Business” report demonstrates that ignoring climate change risks will lead to disaster, while taking steps now will have a big impact. Luckily we have tools to face these challenges.

Many forward-thinking business and communities have already applied MCS to climate change risk analysis. For example, AECOM, a professional technical and management support company, used MCS software and optimization techniques to evaluate the risk and costs of climate-change-related flooding of the Narrabeen Lagoon near Sydney, Australia.

AECOM was asked by the Australian Federal Government to conduct an economic analysis of climate change impacts on infrastructure. When the Narrabeen lagoon’s entrance is blocked, it can fill like a bathtub, flooding the surrounding land and houses.

The community can tackle this problem in various ways—such as a lagoon entrance opening, levee construction, flood awareness and planning controls. Because climate change is expected to increase flooding in the Narrabeen catchment over the coming century, decision-makers needed a clearer understanding of the different possible adaptation measures.

“The objective of the study was to use an economic cost-benefit analysis to identify both what measures government should invest in to prevent the impacts from flood events and when they should invest,” said Kinghorn, who, along with his KPMG colleague Lisa Crowley, developed, designed and ran the project as previous employees of AECOM.

Kinghorn and Crowley estimated the social benefits of adaptation to climate change in terms of willingness to pay, rather than just costs avoided. Using MCS, they generated more realistic probabilities of overall costs and benefits, and modeling the expected future values of variables such as rainfall.

As the report states, even modest global emission reductions can avoid up to 80% of projected economic costs resulting from increased heat-related mortality and energy demand. While many companies may be resistant to change, the report makes an undeniable case; we cannot afford to ignore the momentous climate risks that threaten our near- and long-term future. “Responding to climate change is no longer a problem without a solution, said Crowley.

“It is not a question of do I need to respond, but how do I respond. An effective response to climate change is possible. The complex set of climate change data can be processed through a cost benefit analysis using MCS, producing a set of economic indicators to inform a more meaningful decision-making process on how and when to respond.”