The price of not having good information governance is steep. Despite storage costs being cheap ($0.20/GB), e-discovery costs ($3,500/GB) and lawsuits are not. The following legal cases demonstrate the price of not managing your data while in litigation and offer best practices for when litigation is pending.

Zubulake v. UBS Warburg

Laura Zubulake sued her former employer, UBS, over gender discrimination, requesting key information that was archived in emails. When the e-discovery took place, backup tapes and some emails had been deleted prompting the court to conclude that UBS acted willfully. The jury was instructed to assume that the deleted emails were detrimental to the case. Ultimately, costs were reimbursed to Zubulake in addition to her receiving $9.1million in compensatory and $20.2 million in punitive damages. This case established the framework of electronically stored information (ESI) retention while also setting the legal precedence for e-discovery.

It underscores the importance of complying with electronic data preservation and production while also suspending document destruction and putting legal holds in place when a party is subject to litigation.

Lessons learned:

- The scope of a party’s duty to preserve digital evidence during the course of litigation

- Duty of the lawyer to monitor clients’ compliance with electronic data preservation and production

- The imposition of sanctions for the spoliation of digital evidence

- Data sampling, so that knowledge about costs and effectiveness of the recovering process are known in advance

Apple v. Samsung Electronics

In April 2011, Apple sued Samsung for $2.5 billion over patent infringement. Throughout the case, Samsung did not disable its bi-weekly auto-deletion of emails, despite asking employees to manually save their emails due to the litigation. Although Samsung sent initial litigation-hold notices to 27 employees notifying them of a “reasonable likelihood of future patent litigation between Samsung and Apple,” it wasn’t for another eight months that they sent litigation-hold notices to an additional 2,700 employees.

Samsung was faulted for failing to send notices to all relevant employees and not providing instructions regarding how to save their emails.

As it turns out, Apple was doing the same thing by sending automatic notices to employees asking them to reduce the size of their email accounts. As a result of these missteps, both parties agreed not to instruct the jury to assume that the deleted emails were detrimental to the case.

Lessons learned:

- If litigation is anticipated, issue litigation holds to all potentially relevant employees

- When litigation is reasonably anticipated, disable any auto-delete functionality

- The duty to preserve documents arises when there is a reasonable likelihood of litigation prior to litigation being formally filed

- Businesses should audit employees to assure they are following the preservation instructions

915 Broadway Associates v. Paul Hastings

915 Broadway brought its former counsel, Paul Hastings, to court alleging that he had committed legal malpractice. Due to the litigation, 915 Broadway issued a legal notice to its employees instructing them to save files and not delete their emails; however, compliance was not monitored and automatic deletion was not stopped. Throughout the two years of litigation, 915 Broadway made no effort to preserve relevant documents from its employees, while failing to suspend its document retention policy which automatically deleted emails after 14 days. Additionally, 915 Broadway went so far as to replace its email servers, preventing any recovery of deleted emails, after Hastings raised concerns about spoliation to the court. Because crucial files were deleted, the million complaint was dismissed and Paul Hastings’ motion for spoliation sanction was granted.

Lessons learned:

- Courts have the liberty to dismiss a case if plaintiff does not comply with e-discovery obligations

- e-discovery compliance needs to be treated with greater importance and urgency

- It’s imperative to invest in a solid e-discovery infrastructure

The Importance of Information Governance

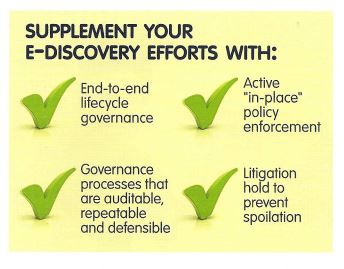

Information governance has long been viewed as essential for global companies that handle large amounts of data, and continues to become increasingly mission critical each day as demonstrated by the above cases. Take note of these best practices should you ever find yourself in a similar situation:

- Govern information so that it can be retrieved in a timely manner and you’re not reviewing old documents

- Don’t just instruct a legal hold, make sure key documents are not being deleted

- Suspend automatic deletion and document destruction when litigation is pending

- Comply with electronic data preservation and production

With more than 14,000 laws and regulations related to information management—jurisdiction specific requirements, regulatory compliance, litigation and e-discovery, planned and unplanned audits—it can be difficult to enforce across an organization’s IT infrastructure, although critical during a litigation period. Governance programs are long-term solutions to challenges of frequent litigation and investigations.