The typical organization loses 5% of revenue each year to fraud – a potential projected global fraud loss of $3.7 trillion annually, according to the ACFE 2014 Report to the Nations on Occupational Fraud and Abuse.

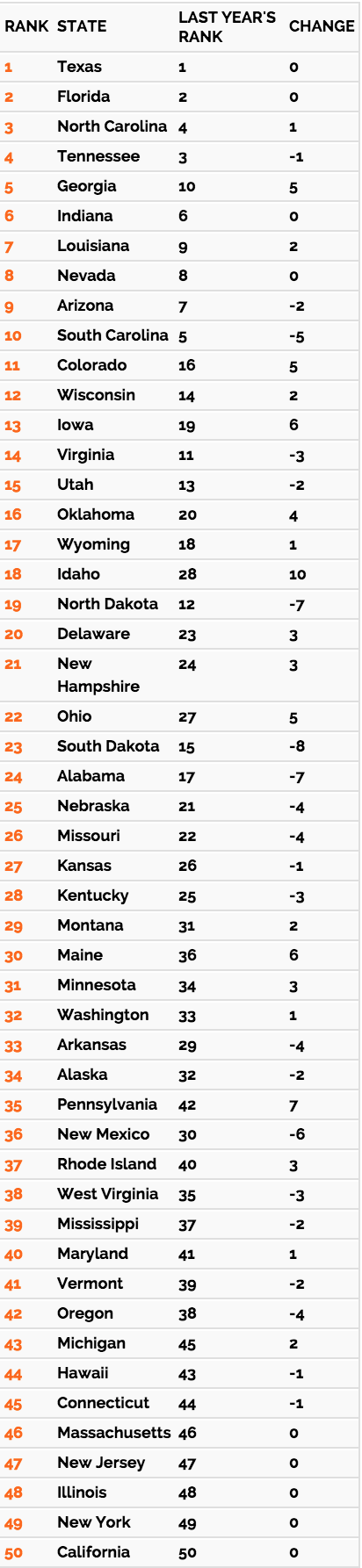

In its new Embezzlement Watchlist, Hiscox examines employee theft cases that were active in United States federal courts in 2014, with a specific focus on businesses with fewer than 500 employees to get a better sense of the range of employee theft risks these businesses face. While sizes and types of thefts vary across industries, smaller organizations saw higher incidences of embezzlement overall.

According to the report, “When we looked at the totality of federal actions involving employee theft over the calendar year, nearly 72% involved organizations with fewer than 500 employees. Within that data set, we found that four of every five victim organizations had fewer than 100 employees; more than half had fewer than 25 employees.”

Overall, they found:

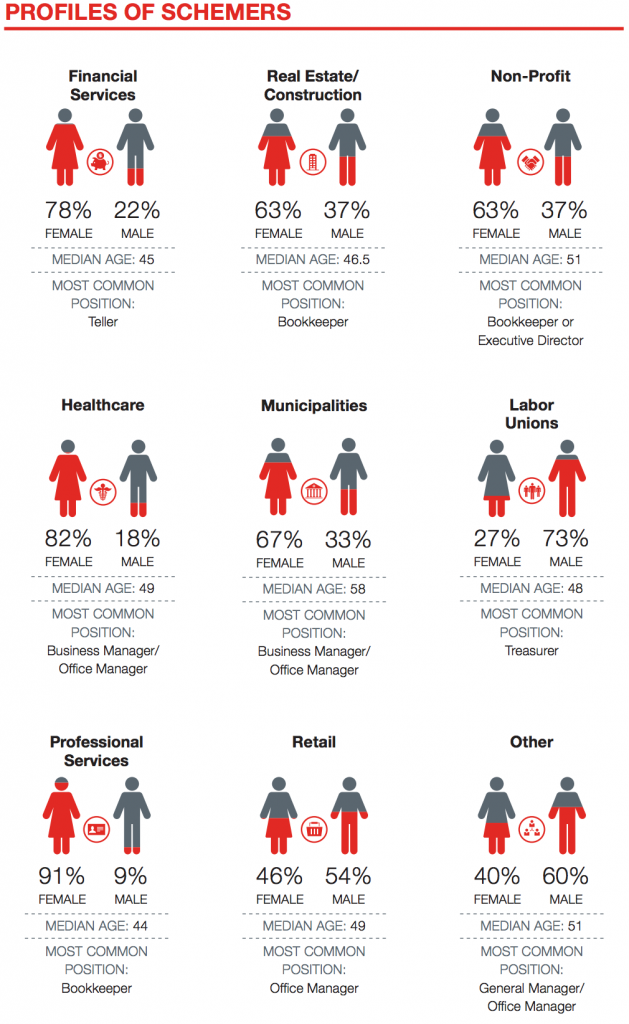

It is particularly interesting to note that women orchestrate the majority of these thefts (61%) – a rarity in many kinds of crime. Yet the wage gap extends even to ill-gotten gains, Hiscox found: While they were responsible for more of these actions, women made nearly 30% less from these schemes than men.

Drilling down into specific industries, Hiscox found that financial services companies were at the greatest risk, with over 21% of employee thefts – the largest industry segment – targeting an organization in this field, including banks, credit unions and insurance companies. Other organizations frequently struck by employee theft include non-profits (11%), municipalities (10%) and labor unions (9%). Groups in the financial services, real estate and construction, and non-profit sectors had the greatest total number of cases in the Hiscox study, while retail entities and the healthcare industry suffered the largest median losses.

For more of the report’s insight on specific industries, check out the infographic below: