There’s no doubt fraud, committed by both external and internal parties, is on the rise as methods for committing theft become more available and easier to hide due to technology. And according to a recent survey by the Association of Certified Fraud Examiners, businesses around the world lose an estimated 5% of their annual revenues to fraud, for a total loss of more than $3.5 trillion.

The 2012 “Report to the Nations on Occupational Fraud & Abuse” found the following:

- Fraud schemes are extremely costly. The median loss caused by the occupational fraud cases in the study was $140,000. More than one-fifth of these cases caused losses of at least $1 million.

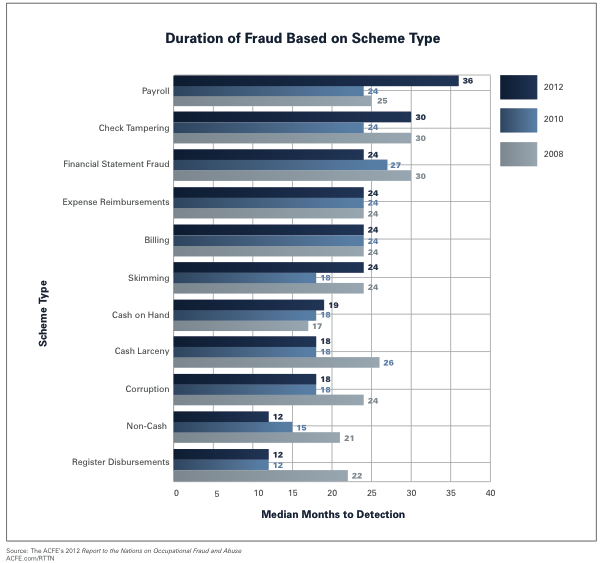

- Schemes can continue for months or even years before they are detected. The frauds in the study lasted a median of 18 months before being caught.

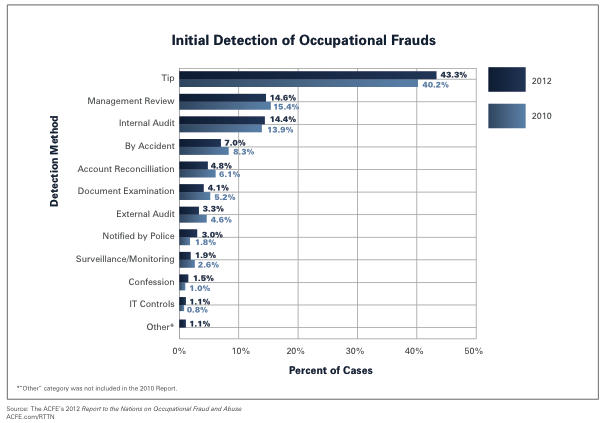

- Tips are key in detecting fraud. Occupational fraud is more likely to be detected by a tip than by any other method. The majority of tips reporting fraud come from employees of the victim organization.

- Occupational fraud is a global problem. Though some findings differ slightly from region to region, most of the trends in fraud schemes, perpetrator characteristics and anti-fraud controls are similar regardless of where the fraud occurred.

- High-level perpetrators do the most damage. The median loss among frauds committed by owner/executives was $573,000, the median loss caused by managers was $180,000 and the median loss caused by employees was $60,000.

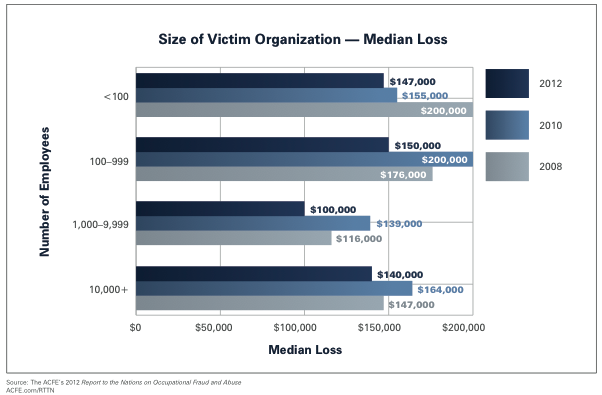

- Small businesses face increased risk. The smallest organizations in the study suffered the largest median losses. These organizations typically employ fewer anti-fraud controls than their larger counterparts, which increases their vulnerability to fraud.

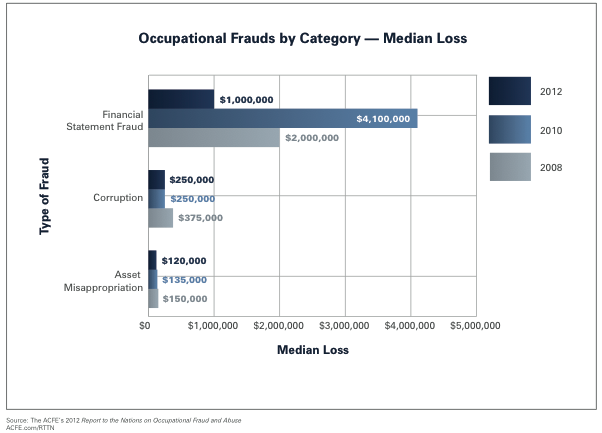

The report goes on to break down occupational frauds by category, duration of fraud based on scheme type, size of victim organization and initial detection of occupational frauds. Here is the breakdown in graphical form:

The full report can be downloaded here.

I think it’s important that companies develop a strong understanding of how fraud is committed in order to take steps to prevent fraud from taking place – or at least detect it sooner. Understanding behavioral red flags and training employees to identify and report fraud are increasingly important, as are regular audits and other anti-fraud measures.

The company I work for had the opportunity to interview ACFE President and CEO James Ratley after the report was released. Along with the interview, we also released an infographic based on some of the key findings from the ACFE’s report. You can check it out here: http://i-sight.com/investigation/infographic-acfe-global-fraud-study-hammers-home-the-message/