You remember the 2005 hurricane season, right? Of course — how could you forget Hurricanes Katrina, Dennis, Emily, Wilma and Rita — five of the seven hurricanes that year that were responsible for 3,865 deaths and $130 billion in damage?

Well, in trying to recover some of the $5.7 billion in claims payouts from the most active Atlantic hurricane season in recorded history, the Florida Hurricane Catastrophe Fund Finance Corp. is selling $693 million in tax-exempt revenue bonds.

The fund’s credit score was boosted one level this week by Fitch Ratings to AA, the third-highest, from AA-. The sale should be helped as investors seek safety from market turmoil stemming from a $1 trillion rescue of heavily indebted European nations, said Philip Villaluz, a New York-based municipal analyst at Advisors Asset Management Inc. of Monument, Colorado.

Fitch says the bonds are secured by emergency assessments levied on almost all P&C insurance policies in Florida — what the ratings agency calls “a very stable source of revenue.”

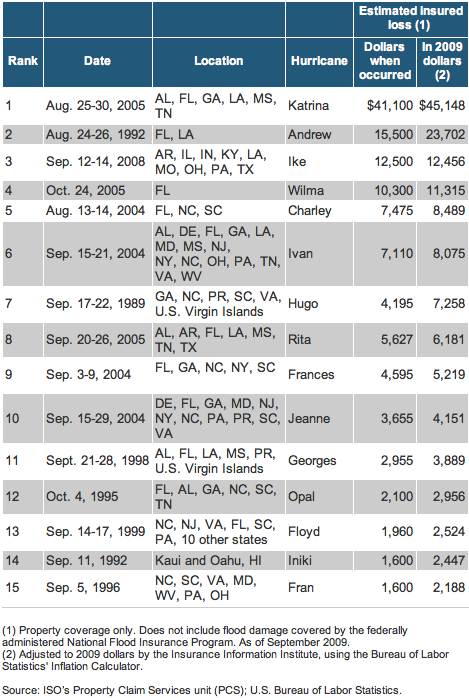

With the 2010 hurricane season predicted to be above average, it’s imperative that insurers replenish their coffers. The next major hurricane season could be just a few weeks away. And here, courtesy of the Insurance Information Institute, are the 15 most costly hurricanes in the United States (in millions).