Improving reputation remains a chief objective in the financial services industry — and rightfully so, according to a new study that reports firms saw an average of 27% of revenue lost in the past two years due to reputation and customer service issues stemming from the financial crisis.

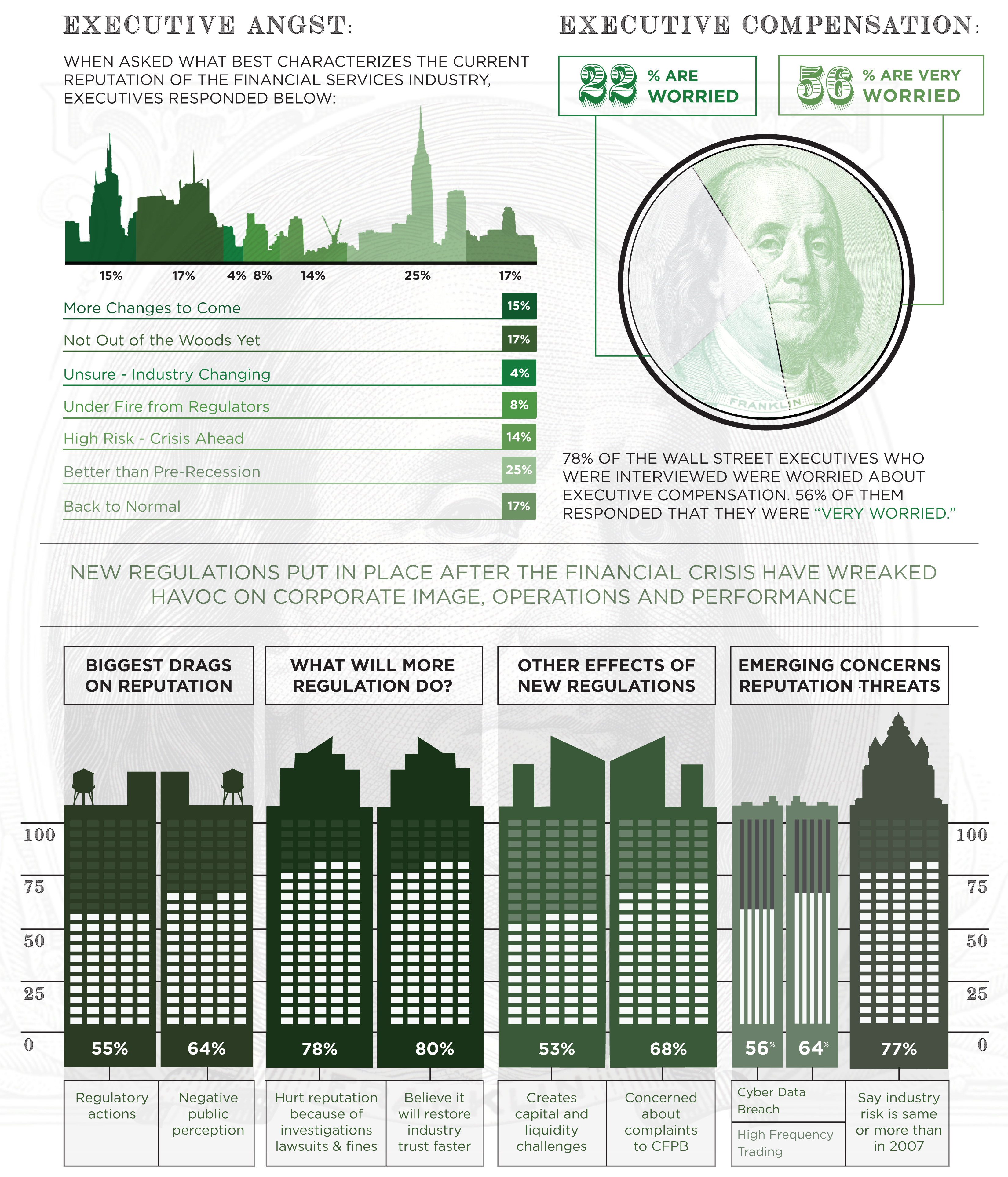

The 2014 Makovsky Wall Street Reputation Study found that 81% of financial service firms are still feeling major negative impacts on stakeholder perception, and over three-quarters of financial services executives say industry risk is the same or worse than in 2007.

Public perception, riskier markets, and regulatory actions are the biggest impediments to industry recovery, executives told the communications firm. The biggest drags on reputation come from negative public perception (64%) and regulatory actions (55%), they said. A majority agreed that the top emerging reputation risks are high frequency trading and cyber data breach.

Further, four out of ten executives say their company’s reputation has already suffered due to recent cyber data breaches.