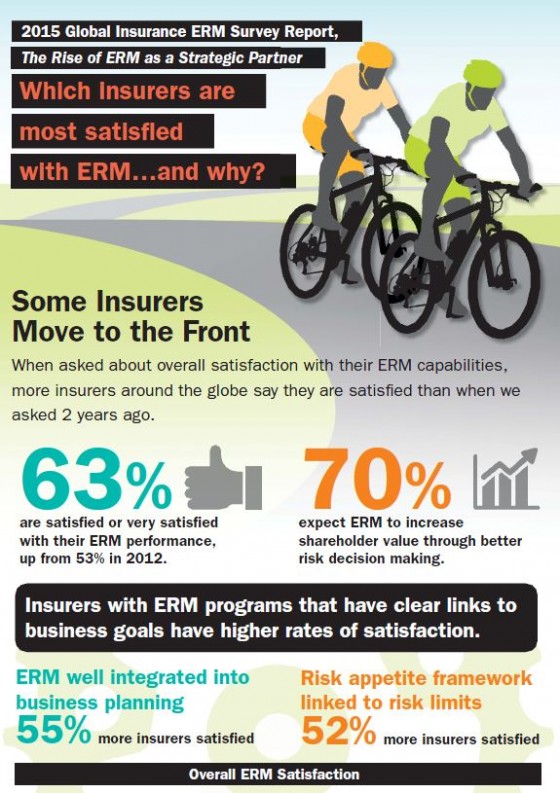

Global insurers’ level of satisfaction with their enterprise risk management (ERM) performance grew by 10 percentage points over the last two years (63% compared to 53%). This was highlighted by a 16-percentage-point increase in Asia Pacific (51% compared to 35%) and less pronounced in North America and Europe (with a seven-point increase), according to Towers Watson’s Eighth Biennial Global Enterprise Risk Management Survey.

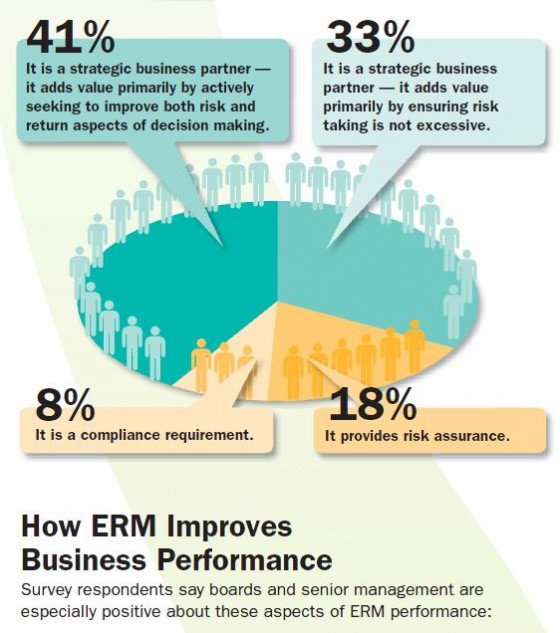

According to the survey, 74% of global insurers said their executives and board members view the risk management function of their enterprise as an important strategic partner that adds value to the business. Notably, carriers that share this view are almost twice as likely to say they’re satisfied (73% compared to 38%) with their company’s ERM performance compared to those that believe ERM is merely a provider of risk assurance (18%) or for regulatory compliance (8%).

Insurers’ opinions of their ERM program were determined by factors such as clear links to business goals. In fact, carriers with ERM functions that are well integrated into their business planning noted higher rates of satisfaction (82%) than those without an integrated strategic plan (53%). Similarly, those with a risk appetite framework linked to specific risk limits expressed higher rates of satisfaction (76%) than their peers with no framework in place (50%).

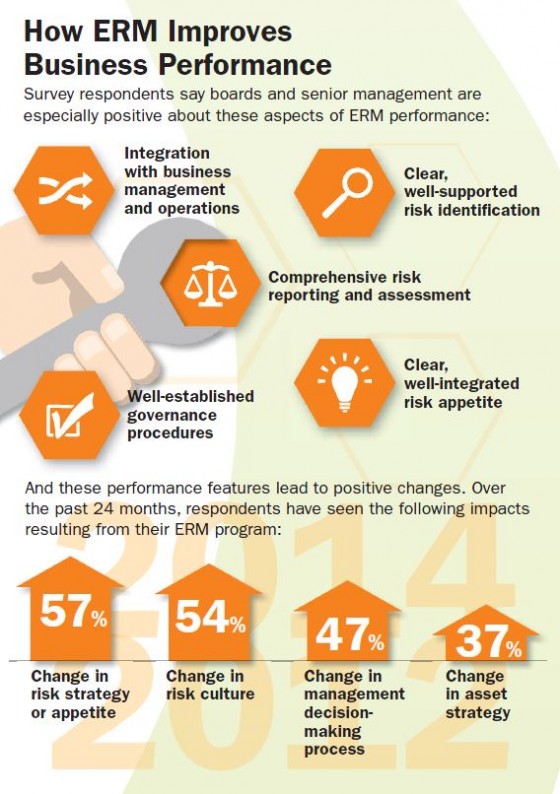

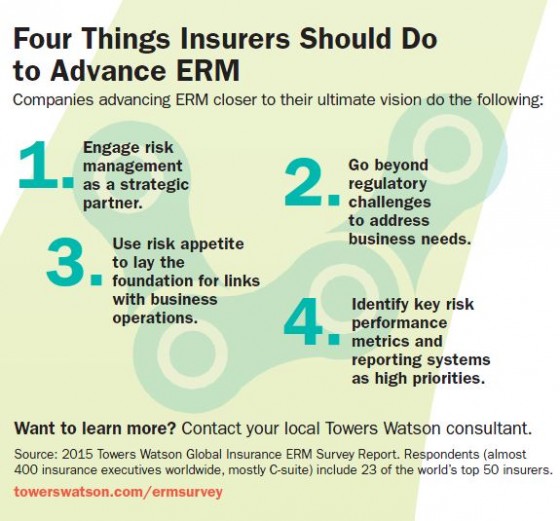

“Companies that strive for strategic value in their risk management function — as opposed to simply using ERM for regulatory compliance — typically differentiate themselves, in part, by integrating risk management into their strategic decision-making process from the beginning,” Martha Winslow, senior consultant of the Americas P&C practice with Towers Watson, said in a statement. “Too often, senior management incorporates risk management later in the process or even after it is complete, when there’s not much chance of it influencing critical decisions.”

Towers Watson survey findings: