Yesterday, Aon released its quarterly D&O pricing index, finding that the average price for $1 million in coverage limits increased 4.9% from the first quarter of 2010 and, more importantly, that D&O pricing decreased 16.4% in the second quarter as compared with the same quarter in 2009. According to the report, this is the largest decrease since the fourth quarter of 2007 and the second consecutive double-digit decrease.

As for D&O securities class action claims activity, Aon found that, for the second quarter of 2010, the average D&O securities class action settlement was $39.87 million (excluding settlements of $1 billion or greater). This is an increase of almost 28% from the preceding three-year average settlement value of $31.18 million.

The report makes an interesting point in terms of mitigating factors for D&O pricing.

We all know that D&O pricing and the stock market are inversely correlated. Meaning, when the stock market goes up, securities class action litigation tends to decrease, and D&O prices go down.

But have you heard of the presidential election year cycle and its effect on the stock market (and thus, D&O pricing)?

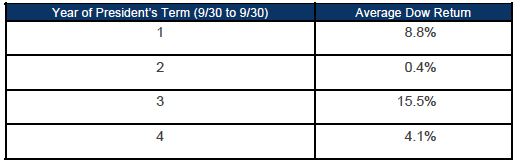

The report cites Mark Hulbert, founder of the Hulbert Financial Digest, as saying that, on average, the third year of a presidency is the most bullish of a president’s term. Hulbert researched yearly returns for the Dow back to 1896 (the year the Dow Jones Industrial Average for founded).

Here’s a snapshot of his findings:

Clearly, there is a big spike in the third year versus the others. If this theory holds true, then there may very well be continued downward pressure on D&O rates for at least the next 12 to 24 months, the report states.

In addition, Aon’s D&O Peer Benchmarking report, which was conducted jointly with NASDAQ, outlined six best practices for organizations to follow when looking to purchase or analyze their coverage:

- Examine the D&O policy to determine corporate executive indemnification provisions

- Question any generic worldwide coverage language in the D&O policy; it may be inadequate

- Recognize what triggers a claim under the D&O policy

- Scrutinize the limits of the excess policies

- Understand how coverage under the D&O policy is affected by the wrongful acts of others

- Know how the organization and the directors and officers are protected during a financial crisis

All in all, the information in the report bodes well for buyers of D&O insurance through the remainder of 2010, as the current soft cycle for D&O underwriting is expected to continue.

I think when stock market goes up; it means companies are doing well economically and financially. They inspire trust and not generate big risk. One can infered that D&O are doing well too. Therefore, their coverage is important because anything can happen in the future; but securities class action litigation decrease compared to when companies are not doing well and stock market goes down. D&O price goes down to reflect their efforts and “to encouraged them.” It’s like car insurance. The price is high at the beginning and decreases when the driver is doing well without any accident, but when an accident occurs, his insurance price goes up.