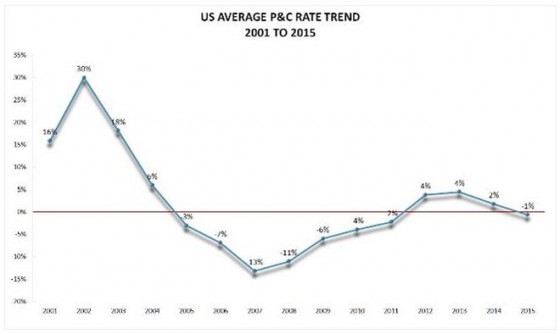

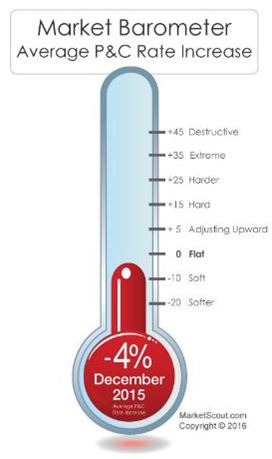

Insurers’ competition and ongoing fight for market share resulted in a composite rate down 4% in December for the U.S. property and casualty market. But while market cycles are here to stay, the current cycles are tame compared to some previous years. In 2002, there was a mean average rate increase of 30% and, in 2007, a mean average decrease of 13%, according to MarketScout.

In 2002, there was a mean average rate increase of 30% and, in 2007, a mean average decrease of 13%, according to MarketScout.

“Market cycles are part of our life, be it insurance, real estate, interest rates or the price of oil. Market cycles are going to occur without question. The only questions are when, how much and how long.” MarketScout CEORichard Kerr said in a statement. “While it may seem the insurance industry has already been in a prolonged soft market cycle, we are only four months in.

The market certainly feels like it has been soft for much longer, because rates bumped along at flat or plus 1% to 1½% from July 2014 to September 2015.” He pointed out that the technical trigger of a soft market occurs when the composite rate drops below par for three consecutive months.

MarketScout has been tracking the U.S. property and casualty market since July 2001. Kerr pointed out that during that time, the length and veracity of the market cycles has become less volatile in the last five or six years. “Thus, the impact of a hard or soft market in today’s environment may be 5% or 6% up or down,” he said. “Can you imagine how we would react today in a market such as that of July 2002 when the composite rate was up 32%? Or in December 2007 when the composite rate was down 16%? Underwriters today have better tools to price their products and forecast losses. Further, the chances of a rogue underwriter or company are greatly reduced by the industries’ checks and balances. There may be less excitement but there are probably far fewer CEO heart attacks.”

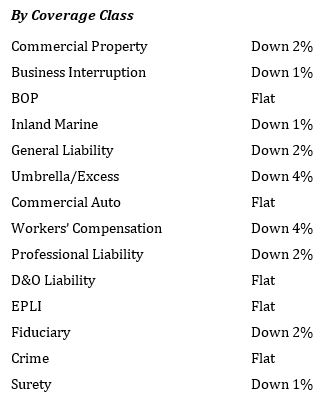

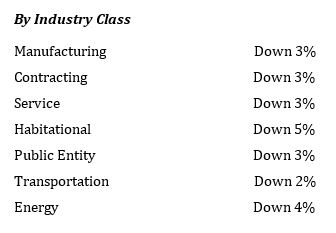

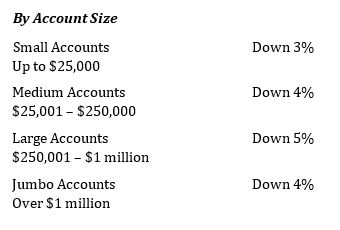

December 2015 rate summary by coverage, industry class and account size: