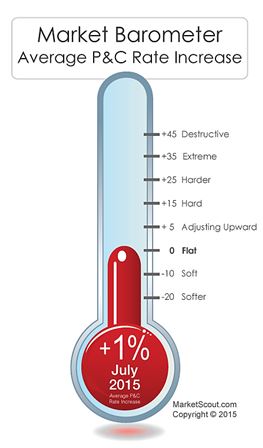

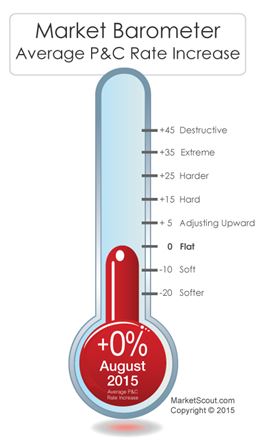

The August 2015 composite rate for property and casualty insurance placements in the United States were flat or showed no change compared to the July 2015 composite rate,  which was up 1%, according to MarketScout.

which was up 1%, according to MarketScout.

“Thus far, 2015 is proving to be a steady year.

Rates were up very slightly in February and July but all other months were flat,” said Richard Kerr, chief executive officer of MarketScout.

“Again, it appears soft markets are not as soft as they once were and hard markets aren’t as hard. The cycles are moderating, probably because underwriters have so many tools to assure pricing is appropriate. These tools and increased board level oversight keep the cowboys in check—at least most of the time.”

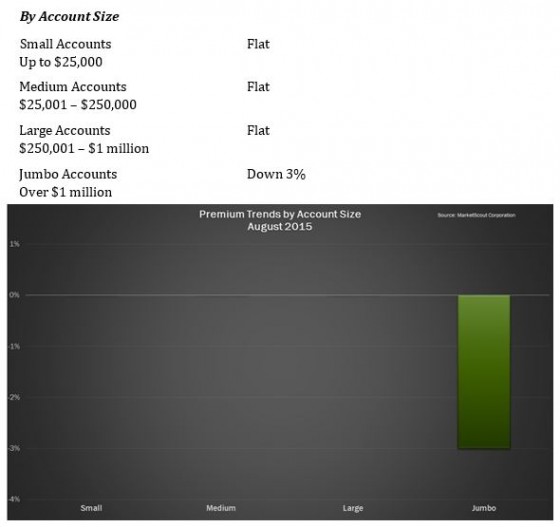

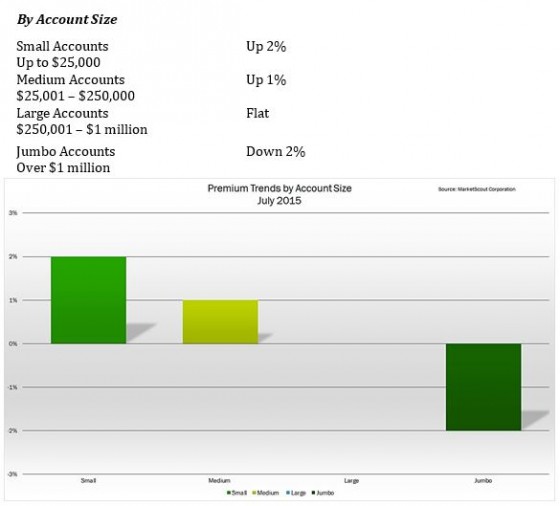

All accounts with premiums under $1,000,000 were flat. Insureds with premiums in excess of $1,000,000 paid 3% less than in the same period last year. “Clearly, large insurance buyers are getting preferential pricing from insurers,” MarketScout said.

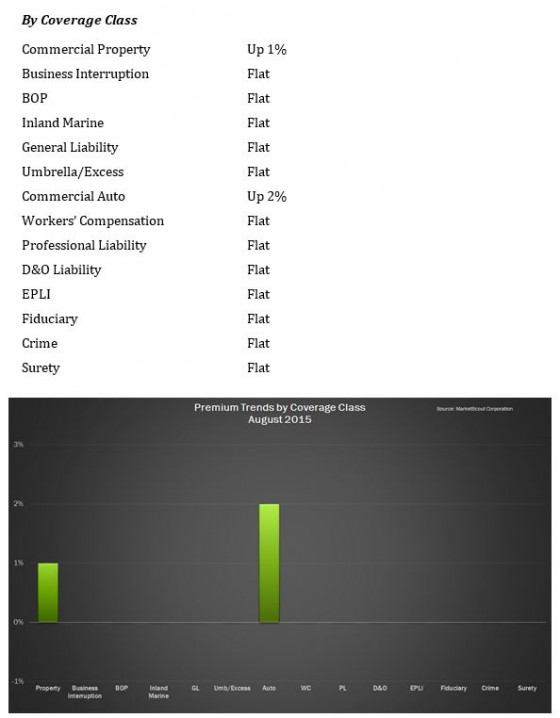

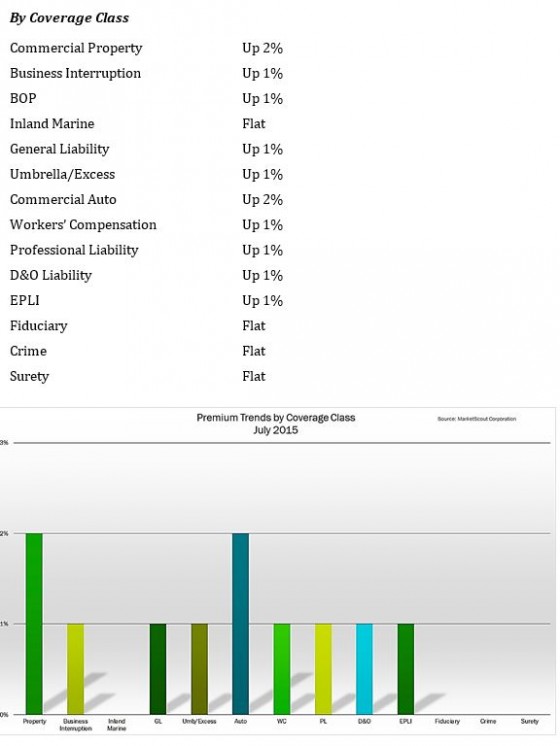

Rates by coverage classification were flat except for commercial auto, which was up 2%, and commercial property, which was up 1%.

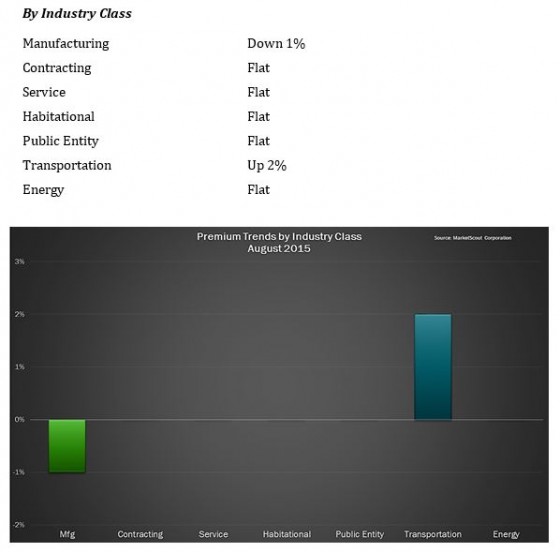

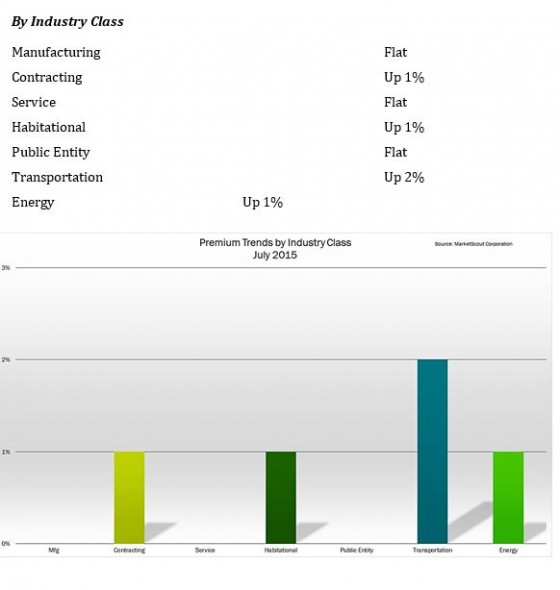

By industry classification, all rates were flat except manufacturing, which was down 1%, and transportation, which was up 2%.

Summary of August 2015 rates by coverage, industry class and account size: