After years of denying that the game of football could have caused degenerative brain disease in some players, the National Football League has finally admitted there is a link connecting the game to chronic traumatic encephalopathy (CTE). According to the New York Times:

Representative Jan Schakowsky, Democrat of Illinois, asked during a round-table discussion about concussions whether “there is a link between football and degenerative brain disorders like CTE,”

Jeff Miller, the NFL’s senior vice president for health and safety policy, said, “The answer to that is certainly, yes.” His response signaled a stunning about-face for the league, which has been accused by former players and independent experts of hiding the dangers of head injuries for decades.

Miller’s comments were backed the next day by league spokesperson Brian McCarthy. Miller’s answer may actually help the NFL, as “It could make it harder in the future for a player to accuse the league of concealing the dangers of the sport,” the Times said.

“Strategically, the NFL’s admission makes a world of sense,” Jeffrey A. Standen, dean of the Chase College of Law at Northern Kentucky University, told the Times. “The league has paid a settlement to close all the claims previous to 2015. For future sufferers, the NFL has now effectively put them on notice that their decision to play professional football comes with the acknowledged risk of degenerative brain disease.”

While CTE has been found in former players, the NFL has for decades denied the danger, even after researchers with Boston University announced in 2014 that, in autopsies of 79 brains of former NFL players, 76 tested positive for CTE. A report in 2003 by the Center for the Study of Retired Athletes at the University of North Carolina found a connection between concussions and depression among former professional football players.

According to a 2007 UNC study, Recurrent Concussion and Risk of Depression in Retired Professional Football Players:

Our observed threefold prevalence ratio for retired players with three or more concussions is daunting, given that depression is typically characterized by sadness, loss of interest in activities, decreased energy, and loss of confidence and self-esteem. These findings call into question how effectively retired professional football players with a history of three or more concussions are able to meet the mental and physical demands of life after playing professional football.

The NFL has directed millions of dollars to research of CTE and head trauma and it gave $45 million to USA Football to promote safe tackling and reassure parents that football’s risks can be mitigated through on-field techniques and awareness, the Times said.

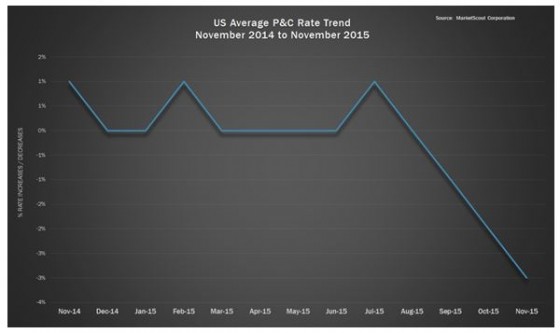

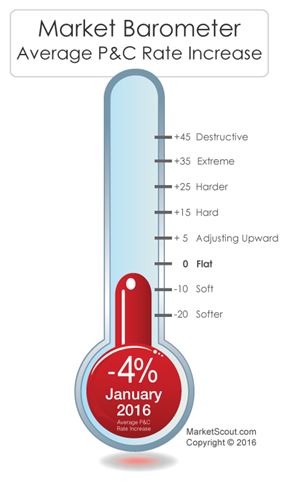

prevent commercial property rates from dropping further.”

prevent commercial property rates from dropping further.”