On August 21st, a total solar eclipse will be visible from North America for the first time in nearly 40 years. Many employers across the country will host viewing parties or may allow employees to take an extra break to observe the phenomenon, while those who employ outdoor workers can expect employees to have a front-row seat for the big event.

It is important to remember that such eclipses can expose workers to safety and worksite hazards, however. For example, outdoor workers should be sure to turn off any equipment or machinery before sun-gazing.

So what further information can employers pass on to reduce the risk of worksite and on-the-job injuries? NASA’s Total Solar Eclipse safety page suggests the following:

- Never look directly at the sun.

- If you are within the path of totality, remove your solar filter only when the moon completely covers the sun’s bright face and it suddenly gets quite dark. Experience totality, then, as soon as the bright sun begins to reappear, replace your solar viewer to look at the remaining partial phases.

buy amoxil online pelmeds.com/wp-content/uploads/2023/10/jpg/amoxil.html no prescription pharmacy

- Use eclipse glasses and handheld solar viewers verified to be compliant with the ISO 12312-2 international safety standard for such products.

- Always inspect your solar filter before use; if scratched or damaged, discard it. Read and follow any instructions printed on or packaged with the filter.

buy mobic online pelmeds.com/wp-content/uploads/2023/10/jpg/mobic.html no prescription pharmacy

- Do not look at the sun through a camera, a telescope, binoculars, or any other optical device while using your eclipse glasses or hand-held solar viewer — the concentrated solar rays will damage the filter and enter your eye(s), causing serious injury.

- Keep normal eyeglasses on, if normally worn, and place eclipse glasses over them.

buy diflucan online pelmeds.com/wp-content/uploads/2023/10/jpg/diflucan.html no prescription pharmacy

Check out the map below to see if your business is in the path of totality for the upcoming eclipse:

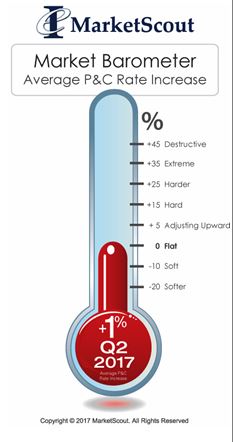

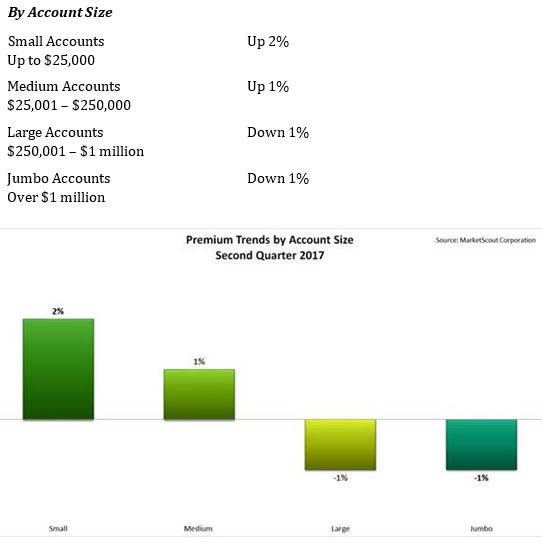

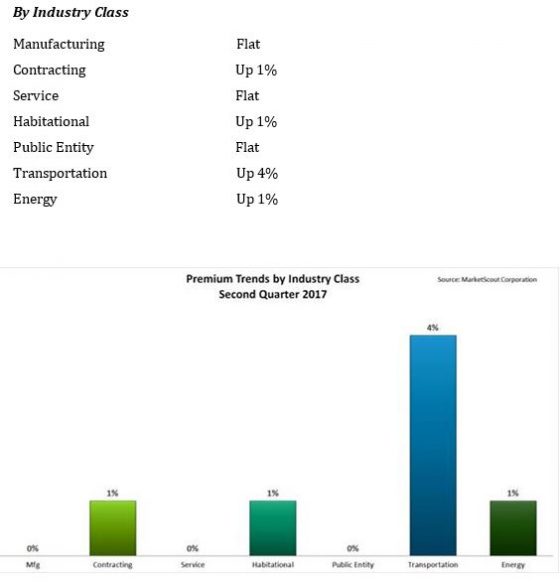

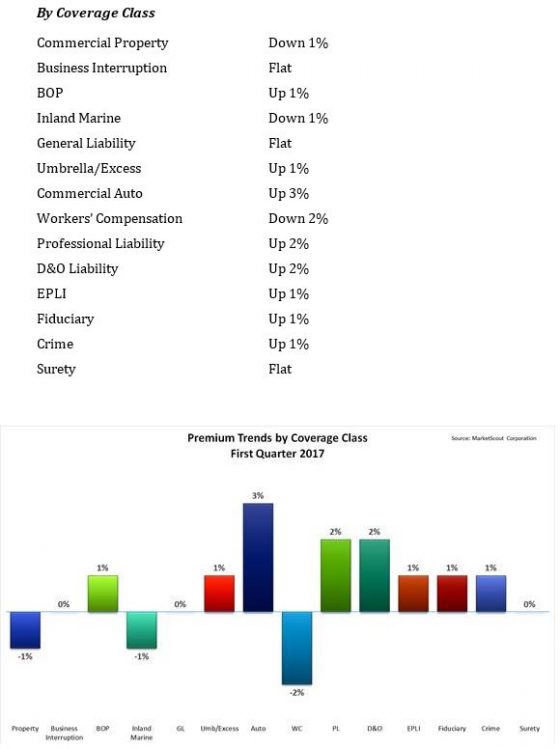

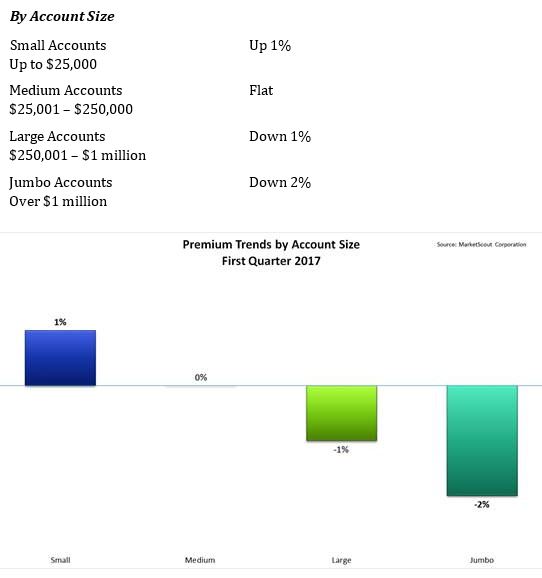

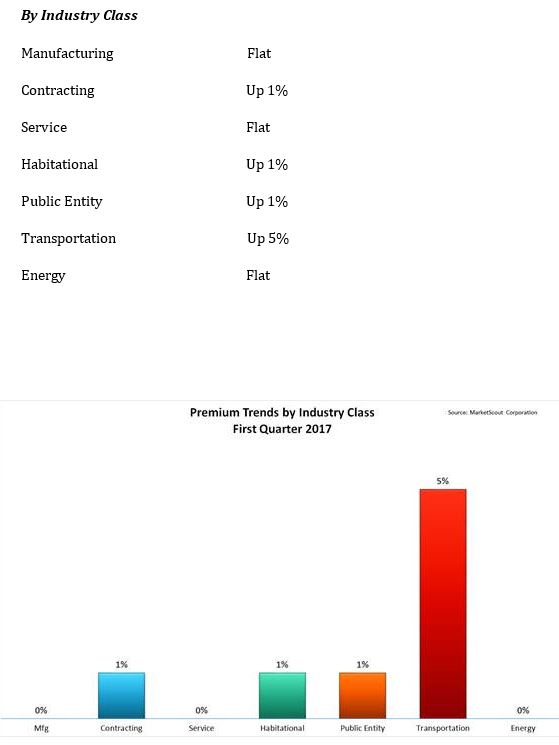

transportation sector, most notably auto-related exposures, is seeing the highest increases, up to 4%, according to a report released today by MarketScout.

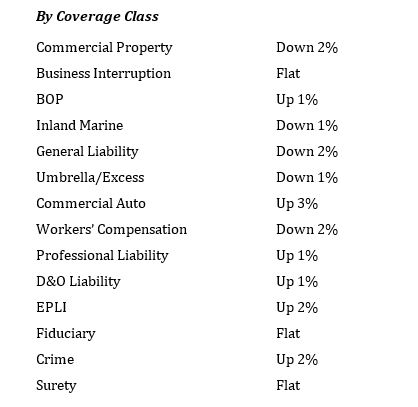

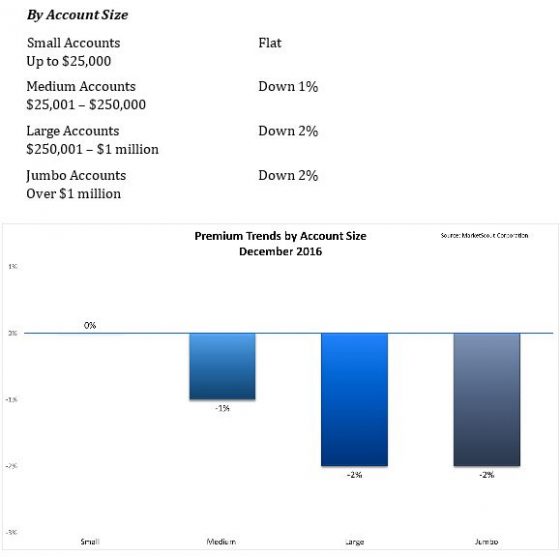

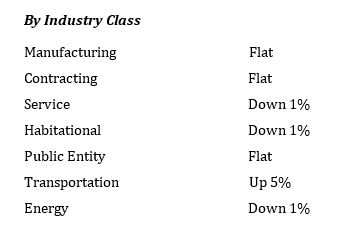

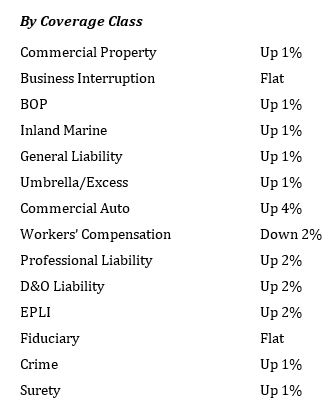

transportation sector, most notably auto-related exposures, is seeing the highest increases, up to 4%, according to a report released today by MarketScout. By coverage class, commercial property and inland marine adjusted from down 1% in the first quarter, to up 1% in the second quarter. Commercial auto rates rose from up 3% to up 4%. EPLI also went from up 1% to up 2%. Fiduciary adjusted downward to flat or no increase compared to up 1% in the prior quarter. All other coverage classifications were unchanged from the previous quarter, according to the report.

By coverage class, commercial property and inland marine adjusted from down 1% in the first quarter, to up 1% in the second quarter. Commercial auto rates rose from up 3% to up 4%. EPLI also went from up 1% to up 2%. Fiduciary adjusted downward to flat or no increase compared to up 1% in the prior quarter. All other coverage classifications were unchanged from the previous quarter, according to the report. By industry class, public entity rates moderated from up 1% to flat.

By industry class, public entity rates moderated from up 1% to flat.

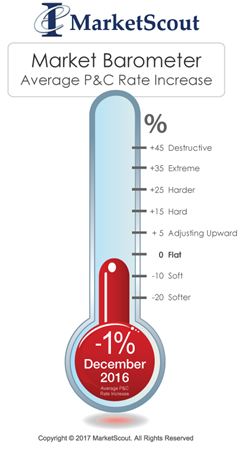

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.