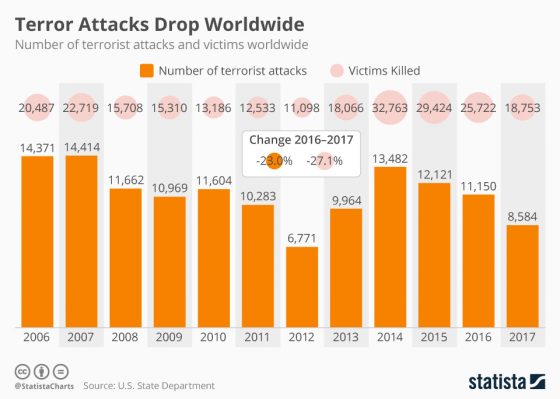

BOSTON—The odds of dying in a terrorist attack: 1 in 9.3 million. The odds of getting sick while traveling: 1 in 2. But both should concern companies sending their employees around the world for business, panelists Kathleen Ellis of CNA International, Erin Wilk of Facebook and Andrew Miller of International SOS said at a RIMS 2019 panel titled “Is Insurance Enough When Employees Travel?”

The answer to this question, the panel agreed, was emphatically “no.” But, as Ellis and Wilk noted, insurance coverage is an important part of the equation for many of the biggest things that do go wrong. Even though the risk of catastrophic incident is minor compared to seemingly mundane travel concerns like weather and petty theft, companies should still prepare for the worst in advance.

This is true whether employees are going to common destinations within the United States traditionally thought of as safe or to less familiar places.

It is also true, Wilk said, whether the employee is an experienced traveler (who can be over-confident) or a novice (who can over-prepare and miss warning signs around them).

The panelists repeatedly stressed that companies should approach travel risk with protecting employees as their priority. Not only do companies have a “duty of care” (a legal responsibility to mitigate the risks traveling employees face), but they also need to be cognizant of the “standard of care” and “duty of loyalty.” Standard of care is the industry standard for employees’ travel risk protection, and companies’ obligation to meet that standard.

Duty of loyalty is the employees’ responsibility to abide by the safety measures the company has put in place. As recently discussed in Risk Management, this is largely on the employee, but the panel noted that employers also have a critical role to play in creating a culture that enables and encourages their people to take the necessary steps to protect themselves while traveling. As Wilk said, “Policy is a piece of paper. Employee practice is what actually matters.”

When it comes to insurance, companies should make sure they are covered, but not over-covered. For example, Miller discussed cases in which companies’ benefits, HR and legal department have all purchased travel coverage without communicating their purchases to the other departments. Businesses may also be unfamiliar with the coverage they have and pay to remediate travel problems themselves when their insurance policies would actually cover those issues.

Key insurance options include:

- Foreign voluntary workers compensation, which covers workers traveling on business in a way similar to traditional workers’ comp, paying for disease, or repatriation or evacuation

- Business travel accidental death and dismemberment coverage, which works like life insurance and covers both work-related and non-work-related incidents, and is an option for covering employees’ spouses and dependents

- Kidnap and ransom coverage, which provides pre-trip support, crisis management services during an incident, and reimburses for ransoms paid for kidnapping extortion, wrongful detention and hijacking

- Expatriate medical, which is an option for employees who are traveling long-term, and

- Defense base act coverage, which handles government contractors overseas at embassies and military bases

The panelists also emphasized that travel risk not only endangers employees’ well-being, but also the company’s bottom line. If an employee gets sick while traveling for business, for example, the company’s investment in the trip can be wasted. Additionally, traveling employees who feel unsafe or unprepared for the risks they are facing feel less loyal to their company, and can also be distracted, potentially derailing the important business they are traveling to conduct. The panel urged that pre-trip training and a thorough understanding of the company’s existing coverage are the best ways to mitigate these risks and help employees succeed when traveling for work.