Microelectronics is changing the way we live, work and do business. With circuitry thousands of times smaller than a human hair, microelectronics has become the brains behind almost every business. But shrinking technology makes equipment more vulnerable to breakdowns, especially when it’s portable and fragile. To manage the risk, you need to keep up with these evolving exposures to protect your organization from loss.

Insurance is changing as well, to reflect this new technology. Think of all the equipment that relies on micro-circuitry. From building systems to communications, if it uses electricity, it likely operates with tiny transistors and microprocessors. Our claims data shows that micro-circuitry is prone to break down and is difficult to repair.

Yet, most property coverage does not cover equipment breakdowns and typical equipment breakdown insurance requires proof of physical damage. That can leave a business without coverage for repair or replacement, business interruption and data loss caused by today’s technology losses, unless the policy specifically covers microelectronics failures.

When electronics fail, the components are so small it may be difficult or impossible to see the damage. How small? Intel Corporation reports that more than 100 million of its 22 nanometer tri-gate transistors could fit onto the head of a pin; more than six million transistors would fit in the period at the end of this sentence.

With each innovation, the technology also becomes faster, more powerful and more complex. Transistors are the building blocks of integrated circuits, with billions of transistors integrated and interconnected with circuitry baked into a single microchip. Integrated circuits are used in microprocessors to run computers and programmable devices.

What’s more, the technology is changing so rapidly, it is hard for most people to keep up. And that’s the challenge for business, industry, and their insurers. In the marketplace, new technology isn’t about theory and experimentation—equipment is an investment and a breakdown can be costly and disruptive.

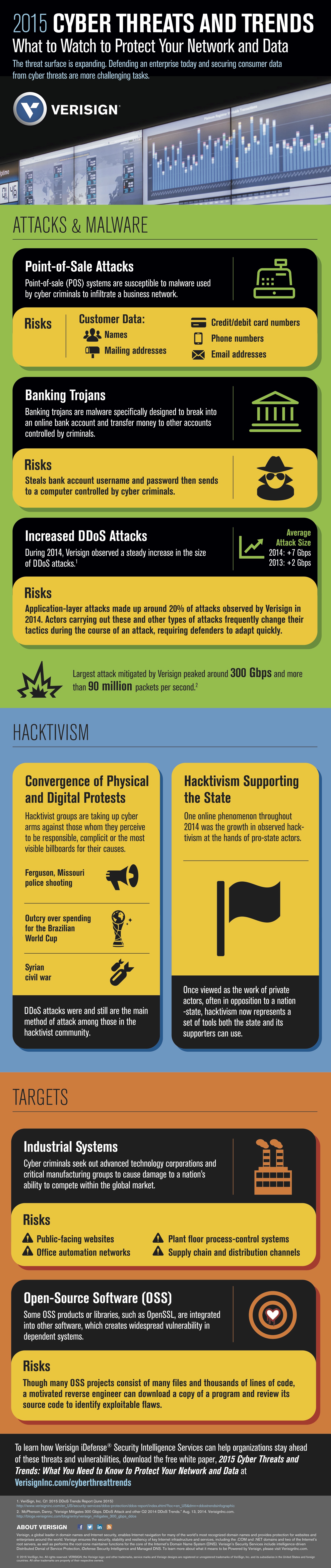

The evolution of equipment with circuit board technology is causing equipment to fail differently than with previous technology. Microelectronics makes equipment more vulnerable to a breakdown, especially since it’s frequently used in the field. Increasingly, equipment damage is not detectable and sometimes not even physical.

Equipment may stop functioning for no obvious reason, with no apparent physical damage. If a wire one micron wide breaks, it’s almost undetectable. Most electronic equipment requires firmware, embedded software instructions that can become corrupted. The equipment stops working, but it’s not because of physical damage.

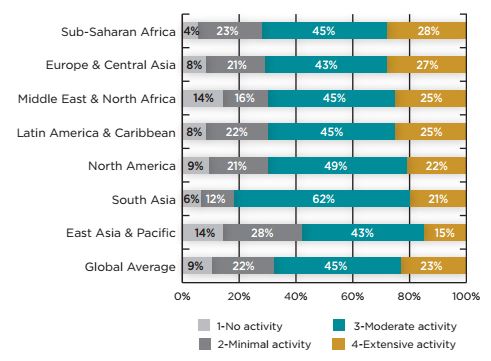

With the internet and cloud computing, a loss may also be virtual. Studies show the majority of U.S. businesses use the cloud; some estimates report that up to 75% or more use some type of cloud services. The loss of internet broadband service and cloud connectivity can cripple many business operations.

Gartner Incorporated, the information technology research and advisory company, estimates there will be 26 billion connected devices by 2020. Already, Wi-Fi connections and radio-frequency identification using sensors and monitors enable the remote management of everything from retail business inventories to building thermostats.

It’s difficult to predict when the next leap will come in new technologies for microelectronics. In what seems like science fiction, some researchers aim to break through the limits of conventional electronics using silicon chips by integrating biological and nanoelectrical systems.

What will this mean for business and industry?

Some of the old concepts of property insurance, developed over a century ago, may no longer serve businesses and insurers as well. Technology is too complex. In a digital world, we live and work online. Technology connects us and provides the tools to communicate, create products and deliver services. Data is what drives a successful business.

For decades, the trigger for equipment breakdown and other property insurance has been based on loss due to physical damage that can be observed and identified. As more equipment breakdowns involve micro-circuitry, however, it’s time to take a different approach.

When purchasing equipment breakdown insurance, ask what “failures” are covered for micro-electronics. There should be no additional sublimits or deductibles—microelectronics claims should be like other equipment breakdown losses. Are cloud services covered under service interruption? Is data restoration included? When does off-premises coverage apply?

Insurers must offer new and innovative products and insurance solutions to cover today’s micro-technology for breakdowns. In a complex world, it’s as simple as that.