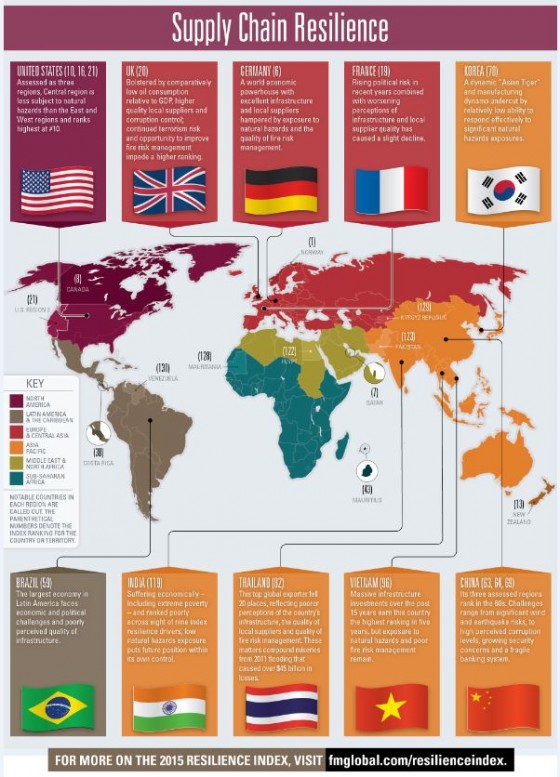

Today, more businesses around the world depend on efficient and resilient global supply chains to drive performance and achieve ongoing success. By quantifying where and how value is generated along the supply chain and overlaying of the array of risks that might cause the most significant disruptions, risk managers will help their businesses determine how to deploy mitigation resources in ways that will deliver the most return in strengthening the resiliency of their supply chains. At the same time, they will gain needed insights to make critical decisions on risk transfer and insurance solutions to protect their companies against the financial consequences of potential disruptions.

As businesses evaluate their supply chain risk and develop strategies for managing it, they might consider using a quantification framework, which can be adapted to any traditional or emerging risk.

- Begin with a “bricks and mortar” risk assessment. Start with the traditional property business interruption risk, focusing first on exposures related to your company’s owned physical plants and facilities as well as those of critical trading partners.

- Understand and analyze your global business model, as well as any changes that have been implemented to create efficiencies or as a result of mergers, acquisitions or divestitures. Determine exactly how and where value is created and use this information to identify and assess potential vulnerabilities.

- Distinguish between volume and value. You may have significant trade volume in dollar terms with one partner that can be easily replaced while the dollar volume of trade with a supplier of a critical raw material, component or ingredient may be small, but difficult and costly to replace. In this case, the supplier with the least spend could be the one that has the most impact if disrupted.

- Tie financial impacts to risk of disruption. This will enable your company to establish priorities and allocate resources in dealing with potential exposures.

- Beginning with your most significant potential exposures, understand what mitigation options are available and compare them to what you already have in place.

- Quantify your worst-case exposures in terms of maximum foreseeable losses.

- Know your company’s ability to respond to events and threats, especially those that might affect the most critical elements of your supply chain. Identify specific emerging risks that are likely to have the greatest potential financial consequences, such as: cyber network interruption; political and expropriation risk; infectious disease and pandemic; product liability and recall, as well as other potential exposures.

- In evaluating various supply chain exposures, leverage findings from the traditional business interruption study conducted earlier in the process. This can help determine how other risks might affect specific operations and individual trading partners and, in turn, cause disruptions along the supply chain. Remember, all business interruption risk resides on your company’s P&L and within your unique business model, regardless of cause.

- Revisit your business continuity, incident response and crisis management plans in the context of the wider range of potential risks confronting your supply chain and individual trading partners.

- Quantify worst-case financial exposures. This will give you the ability to pinpoint how and where to allocate resources to mitigate exposures as well as to set priorities with respect to your risk transfer decisions, including coverages purchased, limits and optimal program structure.