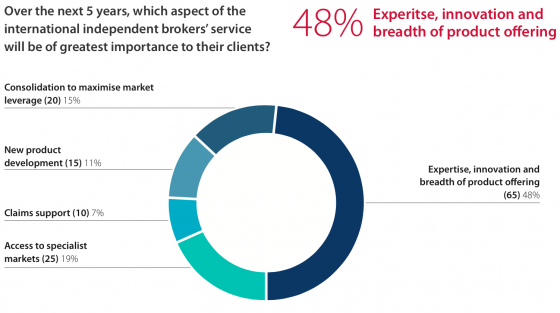

Vendor risk management (VRM) is the practice of evaluating business partners, associates, or third-party vendors both before a business relationship is established and during the duration of your business contract. This is an important concept and practice to put in place during the evaluation of your vendors and the procurement process.

A key feature of VRM is understanding your vendor’s cybersecurity program. This allows you to understand how well they’re going to be able to secure your data, both from a physical and cyber perspective.

VRM helps ensure that your vendors have a contractual obligation for specific requirements and standards, therefore mitigating your organization’s risk.

There are a number of risks vendors can bring to your enterprise, including:

LEGAL RISK

There are many legal risks associated with sharing sensitive information with third parties. For instance, if your vendor is breached and you lose your customers’ personally identifiable information (PII) like social security numbers or health care records, the law clearly states that you are responsible—not your vendor. Or, if you fail to spell out security expectations in your vendor contract, you may have no legal recourse whatsoever if your vendor compromises your data.

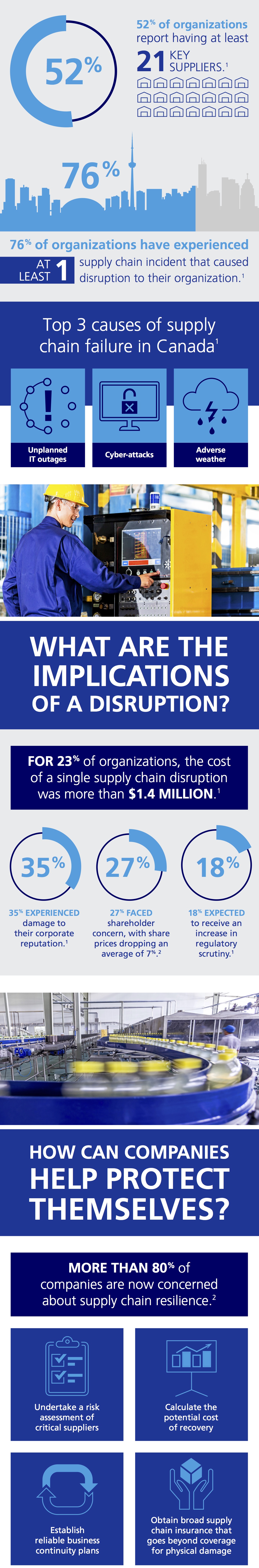

REPUTATIONAL RISK

So much of vendor risk management is based on reputation. You are able to ask a lot of questions at the beginning of the vendor procurement process that may help you weed out the businesses you’d rather not work with, but you should also be monitoring news feeds during the procurement process. You, of course, would want to know if a business associate has been hit with a lawsuit during the time you were engaged with them and how that could affect the performance of their contract with you. And don’t forget about the reputational harm that could affect your company if your customers’ sensitive information is stolen due to an unsecure vendor.

FINANCIAL RISK

If a vendor has a poor financial record or past performance, you’ll want to know that information before engaging in a business relationship. That’s why a lot of companies do credit monitoring for their vendors. You’ll also likely want to ask other organizations who have previously done business with the third party in question for references. This way, you’ll be able to clearly evaluate the vendor’s project plan and all the different things they’re planning to do before entering into a contractual relationship.

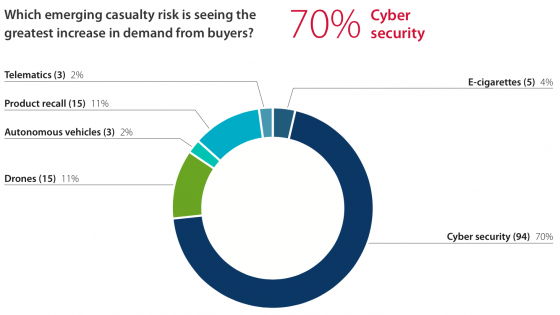

CYBERRISK

Of the various risks a vendor poses, there are some things you need periodic updates on, which are relevant only at certain points of a business relationship. If you’ve established a vendor’s credit worthiness at the beginning of the process, for example, you’ll likely feel quite comfortable about their financial standing during the rest of the process.

This is a good example of how some elements of vendor risk do not require continuous monitoring. Cyberrisk, however, is not quite as simple.

Cyberrisk is unique in that things can happen on a moment’s notice which could catastrophically damage your organization. You simply cannot rely on periodic or infrequent snapshots and assessments of your vendor’s health to understand cyberrisk. The thing that makes cybersecurity “special” is that it can pose financial, reputational, and legal risks.

It’s important to understand that cyberrisk management doesn’t end when your vendor signs a contract. Managing vendor cyberrisk requires persistent awareness of how the vendor is doing with your security expectations. You have to know at all times whether they are accessing your network in an unauthorized manner, or if your most important data could be jeopardized by their actions. Any slip-up or incident may have a catastrophic impact on your business (and lead to some pretty embarrassing headlines).

CONSIDER THIS

Some losses from “traditional risks” can be recuperated easily and quickly. If a food and beverage vendor doesn’t show up one day to cater a meeting, you’re only dealing with a limited amount of loss. Or, if a vendor doesn’t complete a project to your expectations, there are reasonable steps you can take to remedy the situation without dramatically impacting the bottom line.

But if someone hacks into your corporate network through a vendor and steals your most precious data, the outcome could be catastrophic. Your reputation can be damaged irrevocably, financial losses can be huge, and legal liability may be hard to transfer to your vendor. This is why vendor risk management—and especially IT risk management—is not something to be taken lightly. All angles must be examined with every vendor, both large and small.