Holiday parades will be marching down many U.S. city streets during the next six weeks, with millions of revelers expected to attend. And while these are historically joyous occasions, safety is a top concern for businesses located near the festivities—especially considering the high-profile violence that has recently dominated headlines. Rezwan Ali, risk solutions group head of security at Falck Global Assistance, which advises companies about security, safety and travel risks, spoke about the challenges and best practices faced by businesses and employees located near parade routes.

Risk Management Monitor: How are companies responding to the rise in low-tech terrorism and violence?

Rezwan Ali: Companies have become more aware of the need for crisis management. Recent terror events in cities such as Paris, London, Las Vegas and New York have shown companies that duty of care is much more than just health and safety – it is knowing where your employees are traveling and aiding them if affected by terror or violent events. As companies become more globally oriented, their employees are required to travel more, which expands the company’s duty of care responsibility and creates a need for travel risk management. In recent years, there has been an increase in the demand for travel risk management, which originates in a company’s acknowledgement of providing duty of care services to travelling employees to mitigate the possible impact of attacks on the business, its reputation and employees.

RMM: What steps can businesses take to prevent disruption?

RA: The best way to mitigate disruption caused by terrorism is to be prepared at both the business and individual level. On a business level, companies should implement a crisis management process and a contingency plan. A crisis management process includes appointing a crisis management team and training the organization using various scenarios. The contingency plan provides guidelines on how to maintain business as usual when a crisis occurs and works in parallel with the crisis management process. On an individual level, training can provide employees with tools to cope with stressful situations and alleviate the impact of an incident. When employees know how to manage demanding situations, the effect on the company will also be minimized.

RMM: How can businesses located near a parade route or major event protect their employees?

RA: All businesses should have emergency and evacuation plans, which can be applied in the event of emergency. These plans should cover procedures for evacuating the office, safe areas and roles and responsibilities. Businesses located in areas identified as potential targets for terror attacks should incorporate specific emergency measures related to terrorism into their plans. They should also ensure that all employees know and understand that the emergency plans exist.

These plans could include guidelines for what to do should a terror attack take place outside the office, as well how to react in the event of an active shooter. It is crucial that these plans and procedures are trained, exercised and tested.

Having an office in an area prone to various incidents requires the company to be informed of relevant developments. Sound intelligence can alert the company of an event, enabling quick initiation of applicable plans.

Many companies use their network to provide intelligence or rely on local media to provide alerts. Regardless of the information, it is important to use trustworthy sources to ensure validity. The company can choose to develop a trigger system that determines whether the alert should activate any emergency procedures.

RMM: How likely is it that someone will be a victim of terrorism or violence during a large event?

RA: Although terrorism has severe consequences, the likelihood of being a victim of terror is low when compared to other risks such as traffic accidents and illness. The impact of a traffic accident on the individual can still be high, while the impact on the business will be minimal, in most cases.

What makes terror so dangerous is not likelihood, but the fear of it happening. Terror literally means “fear,” and it is the uncertainty and severity of terror that is pivotal for how we perceive it. Employees may express a somewhat irrational fear that must be addressed and taken seriously by the company, as it affects the employee and his/her work.

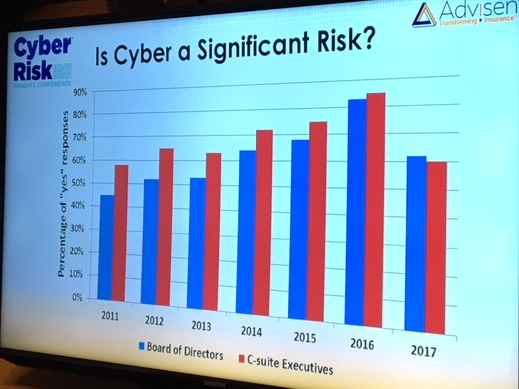

urity industry, noting that, “the defense trails the offense by about five years.” Comparing the newest waves of protection software to a strong rookie pitcher, he said, “A new pitcher may come along and strike everybody out as he goes through the league a few times. But eventually he gets figured out and [hackers] figure it out,” he said. “It needs at least a year of being attacked for real,” to find the gaps in efficiency, and leads to the “the kind of experimentation that will yield better results.”

urity industry, noting that, “the defense trails the offense by about five years.” Comparing the newest waves of protection software to a strong rookie pitcher, he said, “A new pitcher may come along and strike everybody out as he goes through the league a few times. But eventually he gets figured out and [hackers] figure it out,” he said. “It needs at least a year of being attacked for real,” to find the gaps in efficiency, and leads to the “the kind of experimentation that will yield better results.” Advisen

Advisen  Cyberthreats have become seaborne in recent years, and preventative measures are on the radars of governments and the shipping industry.

Cyberthreats have become seaborne in recent years, and preventative measures are on the radars of governments and the shipping industry.