SAN ANTONIO – When the White House declared opioid use a national Public Health Emergency under federal law in 2017, businesses began reviewing their policies and making efforts to curb their employees’ abuse of the drug in its prescribed form. This escalating risk to organizations is why the business impact of prescription opioid use was such a hot topic at RIMS 2018, where a session on April 17 focused on the practical and bottom-line costs of workforce use of prescription opioids. In a session the next day, attendees learned how liability policies are responding to government-led lawsuits against opioid manufacturers, and how to prepare for similar suits brought against other industries.

New Insights into the Impact of Opioid Prescribing to Injured Workers

Data displayed on Tuesday explored opioid-related correlations between worker, industry and employer. Presenters John Ruser, president and CEO of the Workers Compensation Research Institute (WCRI) and Michael Fenlon, senior director of corporate risk management for United Parcel Service (UPS) discussed opioid-related claims and suggested evidence-based information that can encourage a return to work without the prescriptions.

The effectiveness of prescription drug monitoring policies (PDMP) was explored, and Ruser explained that a reactive shift among prescribers has meant that states obligated to adhere to these policies have fewer prescriptions written.

“This shows that the more queries there are, the bigger the drop in opioid prescribing,” he said, using Kentucky as an example of a successful PDMP. He added that Kentucky’s HB1 law mandated the use of the PDMP and has set a standard among states since it was enacted in July 2012. Between 2011 and 2013, WCRI information indicated a 10% decline in prescriptions in the state, whereas prescription levels were flat in others that did not have comprehensive opioid reforms.

Fenlon said that when he learned in recent years that opioid overdoses—almost half of which arise from prescriptions—surpassed car accidents as the number one cause of accidental death, he realized the severity of the issue and its impact on the UPS workforce.

“Once someone gets to that third or fourth script, you can see how it leads to a vicious cycle,” he said. “We need to take ownership of this—in the workers comp space as well as the healthcare side.”

He noted that UPS’ overall pharmacy spend is about 7% of its total medical costs per year for lost-time (LT) patients, with opioids comprising about 22% of that amount. UPS employs more than 454,000 workers, and Fenlon said the company continually pays close attention to the LT patients who are the higher-risk group, with three or more scripts. He added that the collaboration of drug formularies, third-party administrators and UPS case supervisors has contributed to the 44% decrease of the higher-risk group between 2013 and 2017.

Both presenters conceded, however, that injured workers will likely get the medication they need, even if it is not in the form of opioids. “Those who are worried about pain management are noticing the trend in the decline of opioid prescriptions in some areas and ask: ‘What’s the alternative?’” Ruser said. “While there was a drop in that drug, there was an increase in the amount of NSAIDs [nonsteroidal anti-inflammatory drugs]. Clearly, that’s what these prescribers are shifting to, so it’s not that these injured workers are not receiving pain meds.”

Members may access this PowerPoint presentation by logging in at the RIMS 2018 session handout page.

Opioid Lawsuits: A Tsunami of Litigation and Associated Coverage Issues

The topic shifted from boardrooms to courtrooms the next day, as current and pending multidistrict litigations filed by various governments (local, city and state) were examined. Covington & Burling LLP Partner Anna Engh and Marsh Managing Director John Denton (pictured below) discussed insurance policies’ responses to lawsuits and provided insight as to how to prepare should similar suits be brought against other industries.

Manufacturers, distributors, retailers, prescription benefit managers, doctors and clinics are all seemingly in the crosshairs of local municipalities and governmental entities, Engh noted.

Manufacturers, distributors, retailers, prescription benefit managers, doctors and clinics are all seemingly in the crosshairs of local municipalities and governmental entities, Engh noted.

“The main focus against the manufacturers is of alleged misrepresentation of the addictive nature of opioids. With respect to the distributors, it is the failure to report and detect suspicious orders, or failing to have controls in place for their diversions,” Engh said. “You’ll see negligence pled in different ways, like common-law negligence, and also pled as violations of states’ controlled substance acts.” She added that public nuisance and RICO claims (Racketeer Influenced and Corrupt Organizations Act) also appear on the dockets.

With nearly 500 claims against pharmaceutical companies, distributors and pharmacies consolidated in Ohio alone, Denton said that the volume of work involved is daunting for insurance, risk and legal professionals.

“That’s thousands of pages of pleadings coming in every month. It’s a very difficult burden,” he said. “I think a lot of companies are tendering them to as many policies as possible. Hopefully, a lot of insurance carriers will be understanding of this. And a lot of this will be sorted out later, either through discussions with the carriers or litigation.”

Denton added that because there is no federal judicial precedent on insurance suits, the progress on such matters will continue to be slow.

“Insurance coverage issues are typically an issue of state law. And with lawsuits in nearly every state, it would be nice to have a [United States] Supreme Court decision on some of these coverage issues, and that would bind everybody,” he said. “But the reality is that’s not going to happen. There will be decisions in multiple states so it may take some time before these issues get sorted out.”

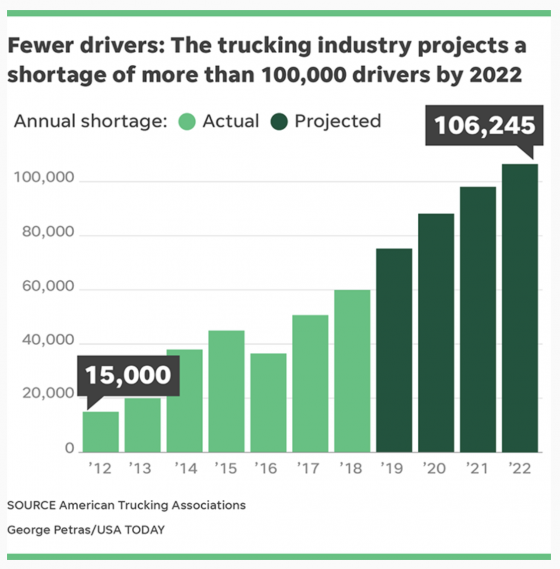

“We’ve probably never had a situation like we have today, where the demand is strong and capacity is constrained,” Bob Costello, chief economist of the American Trucking Associations (ATA), a trade group representing trucking companies told USA Today. The ATA also reported that transportation companies are taking steps to attract drivers, such as pay increases and signing bonuses.

“We’ve probably never had a situation like we have today, where the demand is strong and capacity is constrained,” Bob Costello, chief economist of the American Trucking Associations (ATA), a trade group representing trucking companies told USA Today. The ATA also reported that transportation companies are taking steps to attract drivers, such as pay increases and signing bonuses.

On a recent list of the fastest growing American cities, Nashville jumped from 20th to 7th in a year. There are more than 210 active construction projects in the downtown core alone. We are hardly alone. Denver, New York, Charlotte, Atlanta and more are experiencing similar growth. Cities are booming and growing, and the construction cycle is showing little sign of letting up soon.

On a recent list of the fastest growing American cities, Nashville jumped from 20th to 7th in a year. There are more than 210 active construction projects in the downtown core alone. We are hardly alone. Denver, New York, Charlotte, Atlanta and more are experiencing similar growth. Cities are booming and growing, and the construction cycle is showing little sign of letting up soon. Manufacturers, distributors, retailers, prescription benefit managers, doctors and clinics are all seemingly in the crosshairs of local municipalities and governmental entities, Engh noted.

Manufacturers, distributors, retailers, prescription benefit managers, doctors and clinics are all seemingly in the crosshairs of local municipalities and governmental entities, Engh noted.