People are often tired, distracted and overworked. They are bound to make mistakes, inadvertently overlook policies and procedures and have quick lapses in judgement—forgetting hours and hours of training.

Human error is a significant problem when it comes to managing cyber exposures. Most cyber surveys point to people as the root cause of a breach.

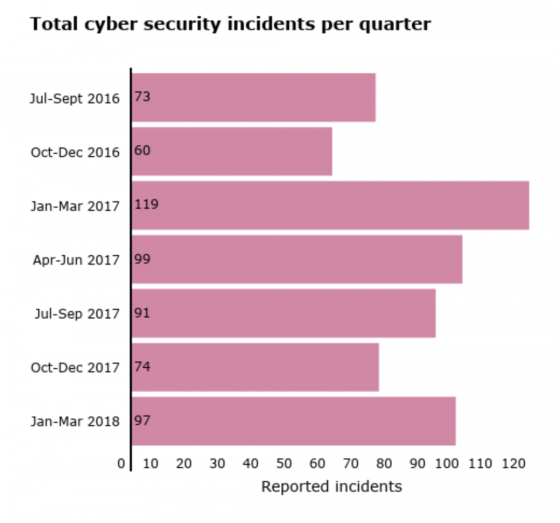

The Information Commissioner’s Office (ICO) compiles statistics about the main causes of reported data security incidents. In its first 2018 quarterly report, four of the five top causes reported to them involved human errors:

- Loss or theft of paperwork – 91 incidents

- Data posted or faxed to incorrect recipient – 90 incidents

- Data sent by email to incorrect recipient – 33 incidents

- Insecure web page (including hacking) – 21 incidents

- Loss or theft of unencrypted device – 28 incidents

James Bone, author of the “Cognitive Hack: The New Battleground in Cybersecurity…the Human Mind,” will lead a RIMS webinar Aug. 23 that explores the cognitive risk framework. Bone asks: are risk professionals considering the “human element” in their cyber risk management plan?

James Bone, author of the “Cognitive Hack: The New Battleground in Cybersecurity…the Human Mind,” will lead a RIMS webinar Aug. 23 that explores the cognitive risk framework. Bone asks: are risk professionals considering the “human element” in their cyber risk management plan?

According to Bone, “The purpose of creating the cognitive risk framework is to begin to educate risk professionals about the need to incorporate the human element into their risk programs, to identify areas where human error or lapses can cause significant damage, and then design effective solutions.”

Bone points to the airline and automotive industries as examples where the value of human element risk management planning has already been realized. “Automation in cockpits, navigation systems, lane assistance technology and, even something as simple as the seatbelt demonstrate organizations’ and industries’ attention to human error risk mitigation.”

“All of us have a limit in our ability to work and focus at a very detailed level for long periods of time,” Bone said. “The ability to design a work environment that simplifies the work that people do will help reduce risk.

”

And, while human error is a piece of the cyber risk management puzzle, it isn’t the only human element cyber concern. Human routine, tendencies and employee processes are constantly monitored by cyber predators. “A sophisticated hacker can spend up to 18 months to two years setting their strategy to attack your organization,” he said. “They are studying the rhythm of the workflow and the movement of data across the firm. They gain a tremendous advantage by just sitting silently and watching.

”

Implementing a cognitive risk framework is no easy task. The key is data. “A lot of data is mislabeled, making it difficult for risk professionals to see the connection between an end result and the human behavior that caused it. In order to use data to its fullest, it needs to be properly categorized with descriptors that allow risk professionals to be able to leverage it,” Bone said.

Organizations with risk frameworks that fail to incorporate the human element are, in his opinion, acting on assumptions. “They are assuming people will be able to follow thousands of policies and procedures with perfect accuracy every time,” he explained. “We shouldn’t assume that people won’t be distracted at work and click on phishing emails. We shouldn’t assume that people will change their passwords as frequently as we want them to. We shouldn’t and can’t be afraid to incorporate new ideas and solutions to improve routines or, at least, make them more difficult to track.”

People are the common denominator. They are not perfect by any means, but incorporating a cognitive risk framework can be a valuable advantage that allows organizations to stay ahead of human element risks while identifying opportunities to improve processes and increase productivity.

revealed, ending at $9.75 in 2017. The main drivers were declines in liability costs (8%), by decreases in property, liability, workers compensation, management liability, and professional liability costs, as well as overall risk management administration costs. TCOR is defined in the survey as the cost of insurance, plus the costs of the losses retained and the administrative costs of the risk management department.

revealed, ending at $9.75 in 2017. The main drivers were declines in liability costs (8%), by decreases in property, liability, workers compensation, management liability, and professional liability costs, as well as overall risk management administration costs. TCOR is defined in the survey as the cost of insurance, plus the costs of the losses retained and the administrative costs of the risk management department. Just when it seemed like things couldn’t get any worse in California, the Carr wildfire ignited, claiming six lives so far. The fire in Northern California near the city of Redding has been burning since July 23 and is now one of the largest in the state.

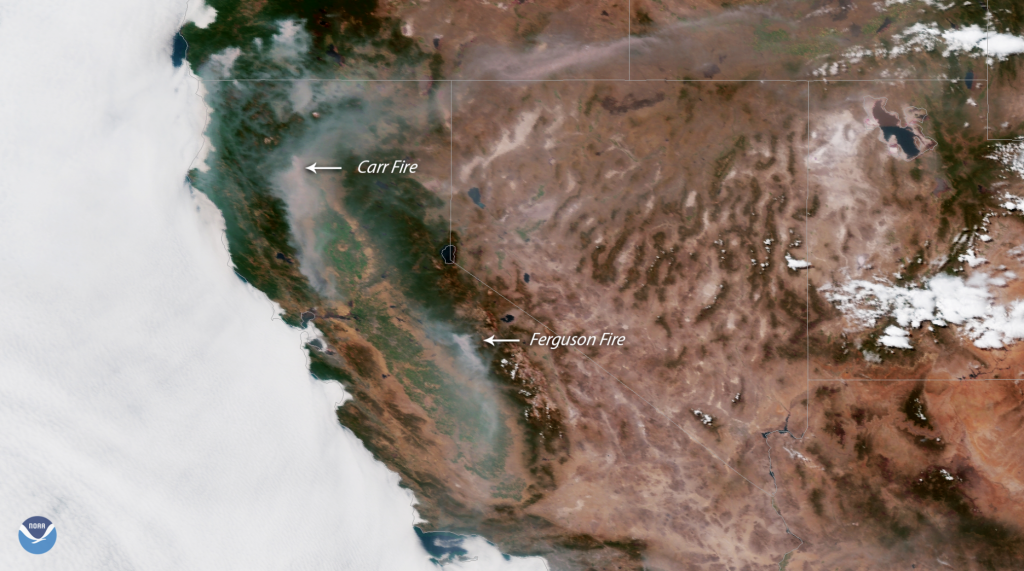

Just when it seemed like things couldn’t get any worse in California, the Carr wildfire ignited, claiming six lives so far. The fire in Northern California near the city of Redding has been burning since July 23 and is now one of the largest in the state.