Munich Re was very happy to recently announce that billionaire Warren Buffett has invested even more money in the company. He now holds a 3.045% stake in the company and news of the investment boosted share price by 2%.

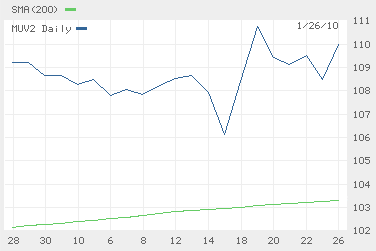

A 30-day view of Munich Re's share price, compared to the 200-day simple moving average.

In early 2008, Buffett’s investment company, Berkshire Hathaway, bought a 3% stake in Swiss Re. During the U.S. subprime crisis, the company helped rescue Swiss Re from financial trouble with a major loan, helping to strengthen the reinsurance company’s balance sheet.

Berkshire Hathaway itself has reinsurance operations, Berkshire Hathaway Re, which is among the largest three reinsurers worldwide by gross premium income. Buffett has repeatedly said in the past that he isn’t eyeing a takeover of the Swiss company. However, during the past two years, Swiss Re and Berkshire have entered several reinsurance deals, raising speculation that the two firms could merge at some point.

Buffett is no stranger to the reinsurance market. Berkshire Hathaway owns Berkshire Hathaway Re, one of the largest three reinsurers worldwide in terms of gross premium income. Berkshire also owns various other insurance companies, including GEICO, which it acquired in 1996, General Re, which it acquired in 1998, NRG (Nederlandse Reassurantie Groep), which it bought in 2007 and Berkshire Hathaway Assurance, a government bond issuance company.