A survey of more than 1,200 risk managers and corporate insurance experts in over 50 countries identified business interruption as the top concern for 2017. According to the sixth annual Allianz Risk Barometer of top business risks, this is the fifth successive year that business interruption has been seen as the biggest risk.

“Companies worldwide are bracing for a year of uncertainty,” Chris Fischer Hirs, CEO of AGCS said in a statement. “They are concerned about rather unpredictable changes in the legal, geopolitical and market environment around the world. A range of new risks are emerging beyond the perennial perils of fire and natural catastrophes and require re-thinking of current monitoring and risk management tools.”

While natural disasters and fires are what businesses fear most, non-damage events such as a cyber incident, terrorism or political violence resulting in denial of access are moving higher up on the scale, according to the report. These types of incidents can cause large loss of income to companies, without actual physical loss.

The second concern, market developments, could result from stagnant markets or M&As, or from digitalization and use of new technologies.

Cyberrisk, third on the list of perils, has jumped up from 15th place in just four years. Cyber was identified as the second concern in the United States and Europe.

According to Allianz:

The results indicate that cyber risk occupies a significant portion of a company’s exposure map. The risk now goes far and beyond the issue of privacy and data breaches. A single incident, be it a technical glitch, human error or an attack, can lead to severe business interruption, loss of market share and cause reputational damage. Of the top 10 global risks in the 2017 Allianz Risk Barometer, a cyber incident could be a potential root cause or trigger for 50% of them. In addition, the toughening of data protection regulation regimes around the world is also contributing to this risk being at the forefront of risk managers’ minds, as penalties for non-compliance are increasingly severe.

Fourth on the list, natural catastrophes added up to $150 billion in total economic losses in 2016—with insured losses accounting for $42 billion of those losses—up from $28 billion in 2015, according to the report. Businesses also are more concerned about the impact of climate change and increasing weather volatility year-on-year.

Trump outlook for 2017

“Opportunities and challenges,” says Ludovic Subran, head of Euler Hermes Economic Research and deputy chief economist of Allianz research. “Companies which are domestic, either a regional multinational or national, will benefit. However, the business environment for large multi-national corporations who do have global, strongly regionally diversified business models will be more challenging. Stronger regional interests will make the lives of companies more complicated as there will be increasing protectionist regulation.”

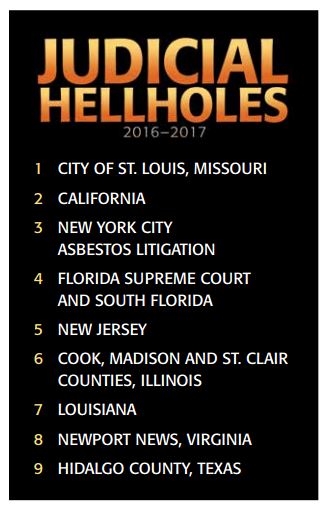

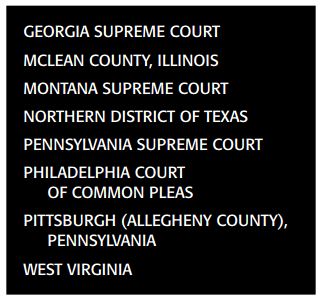

And if that isn’t enough, the report also includes a “Watch List,” calling attention to eight additional jurisdictions “that bear watching due to their histories of abusive litigation or troubling developments.” Those are:

And if that isn’t enough, the report also includes a “Watch List,” calling attention to eight additional jurisdictions “that bear watching due to their histories of abusive litigation or troubling developments.” Those are: But the news isn’t all bad. The report examines “Points of Light,” which are examples of “fair and balanced judicial decisions that adhere to the rule of law and respect the policy-making authority of the legislative and executive branches.” Highlights include positive court rulings from 11 states.

But the news isn’t all bad. The report examines “Points of Light,” which are examples of “fair and balanced judicial decisions that adhere to the rule of law and respect the policy-making authority of the legislative and executive branches.” Highlights include positive court rulings from 11 states.