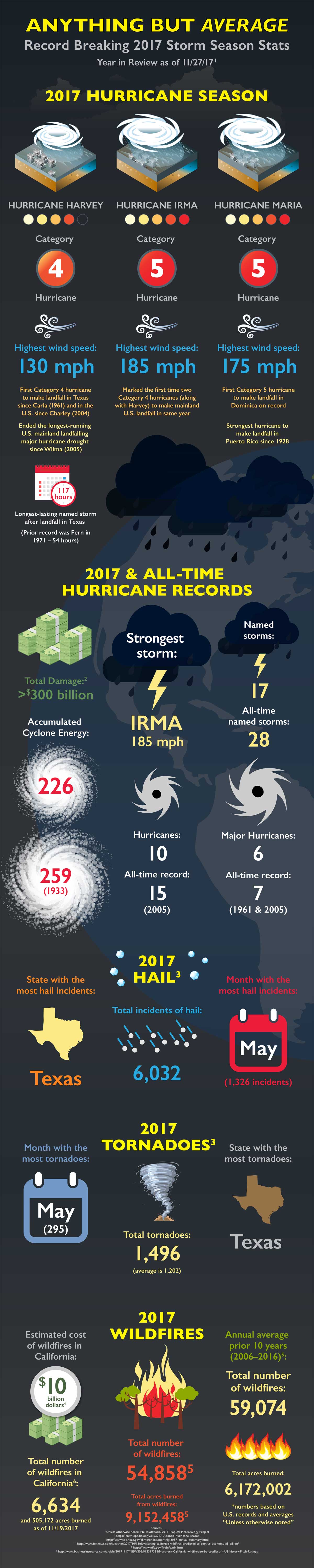

In its newest annual outlook report for property and casualty insurers, Fitch Ratings noted that while the 2018 rating outlook for insurers is stable, the fundamental forecast remains negative. Underwriting results deteriorated in the second half of 2017 following events including Hurricanes Harvey, Irma and Maria, along with fourth quarter California wildfires. As a result, Fitch projected that industry-estimated statutory net profits would fall by about 50% in 2017, projecting a market combined ratio of 104.4% for the year compared to 100.7% in 2016.

events including Hurricanes Harvey, Irma and Maria, along with fourth quarter California wildfires. As a result, Fitch projected that industry-estimated statutory net profits would fall by about 50% in 2017, projecting a market combined ratio of 104.4% for the year compared to 100.7% in 2016.

Fitch said that even with the substantial catastrophe-related losses, U.S. property and casualty insurers’ operating performance appears to be on the rebound. The agency estimates that the industry combined ratio will approach break-even levels in 2018 if natural catastrophe-related losses revert towards long-term averages.

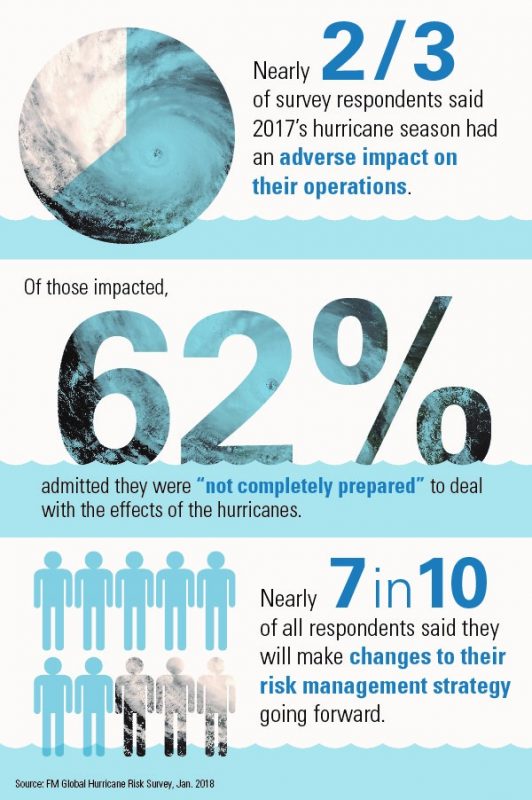

How does all this affect the market for insurance buyers? James Auden, managing director at Fitch Ratings, Inc. told the Risk Management Monitor that from a pricing standpoint, while there is some deterioration in results, especially in property, there is plenty of capacity for coverage in just about every segment.

“We haven’t seen a reduction in capital in the broader market, so how much these losses will carry over and make changes in another segment is a question,” he said. “And there are some segments that have been suffering in their own right, such as commercial and personal auto rates, which have been going up tremendously. We’ve seen a lot of turnaround, but there is still a need for rate hikes there. You’ll probably see that continue.”

Property

Markets affected by catastrophe losses should see some large rate increases in property, which could carry over geographically, he said. Commercial property lines, which have been very soft for a while, should see broader increases. Other factors include companies’ loss history and the types of perils they face.

“I think we’ll see more rate increases geographically throughout the market next year,” Auden explained. “They will be higher in areas hit by hurricanes, but we will see them elsewhere as well. In Houston, the losses were much more commercial than residential in nature. In Florida the losses were more skewed to residential, but there were plenty of commercial losses there, too.” How far rates will rise may be dampened by the amount of capacity that still exists. “If you go back historically, when we’ve had true hard markets, it’s been tied to capacity shortages,” he said.

Auden added, “We are not seeing companies withdrawing from the market right now. We did see that in areas like commercial auto over the last couple of years, especially in long-haul trucking. In commercial property, however, I don’t think there is a big withdrawal of capacity. Companies are seeing an opportunity to improve the economics of their business and relieve pressure around pricing.”

M&A

In the area of mergers and acquisitions, there have not been many with the magnitude of last year’s Chubb-Ace deal. “We have had a few things, like Liberty Mutual’s purchase of Ironshore,” he said, adding that “There is always potential for M&As, but one thing that could restrict them is that with the stock market up so much, insurance markets have benefitted, so evaluations are a bit richer and that may limit interest from a value standpoint.”

Lloyd’s

The Lloyd’s market, which has been affected by competitive pricing over several years now, is on negative outlook. “There have been more exposures in the catastrophe piece and a weaker performance, so that has been driving our opinion there,” he said. “And there definitely are a lot of losses at Lloyd’s from the catastrophes this year.”

Competition

Despite the huge losses being seen, however, competition is still going on. “It’s relentless. There are plenty of underwriters out there trying to write the same business and to differentiate themselves on things like service,” Auden said, adding that he believes turnover will remain steady because insurance buyers typically shop their coverage frequently. “I don’t think there will be more turnover than usual.”

He concluded that in the area of property, while that there will be positive rate actions, making response to the losses more substantial, this may not be sustainable. “Do we see multiple carriers with rate increases? We think it’s likely that is not sustainable, unless we have a really bad year next year in terms of catastrophes,” Auden said.

events including Hurricanes Harvey, Irma and Maria, along with fourth quarter California wildfires. As a result, Fitch projected that industry-estimated statutory net profits would fall by about 50% in 2017, projecting a market combined ratio of 104.4% for the year compared to 100.7% in 2016.

events including Hurricanes Harvey, Irma and Maria, along with fourth quarter California wildfires. As a result, Fitch projected that industry-estimated statutory net profits would fall by about 50% in 2017, projecting a market combined ratio of 104.4% for the year compared to 100.7% in 2016.