The death toll on Indonesia’s island of Sulawesi has risen to 1,200 as of this morning, in the aftermath of a 7.5 magnitude earthquake on Friday and the tsunami that followed. As emergency crews still lead efforts to locate and save victims and clear debris, officials warn that the number of casualties could rise further.

The current warning system is comprised of tidal gauge stations augmented by land-based seismographs, sirens in about 55 locations and a system to disseminate warnings by text message. Time reported that the country had not updated its emergency notification systems (ENS) following the 2004 tsunami that devastated the region, due in part to lack of funding. According to Time:

The high-tech system of seafloor sensors, data-laden sound waves and fiber-optic cable was meant to replace a system set up after an earthquake and tsunami killed nearly 250,000 people in the region in 2004. But inter-agency wrangling and delays in getting just 1 billion rupiah ($69,000) to complete the project mean the system hasn’t moved beyond a prototype developed with $3 million from the U.S. National Science Foundation.

Analysts say that a proper ENS would have provided earlier warnings of the disasters and may have prevented some of the casualties.

At the time of impact, the country was already dealing with the fallout of major seismic activity in the region. Within the span of about a week in late July and early August, the Indonesian resort island of Lombok was the site of intense earthquakes that killed hundreds, displaced hundreds of thousands and destroyed more than 13,000 houses.

Indonesia is prone to earthquakes because of the country’s location in the “Ring of Fire,” the arc of volcanoes and active fault lines in the Pacific Basin.

Sutopo Purow Nugroho, a National Disaster Mitigation Agency spokesman, said communications with the earthquake-stricken region were disrupted.

“Our early estimation, based on experience, is that it caused widespread damage, beginning from Palu northward to Donggala,” he told MetroTV.

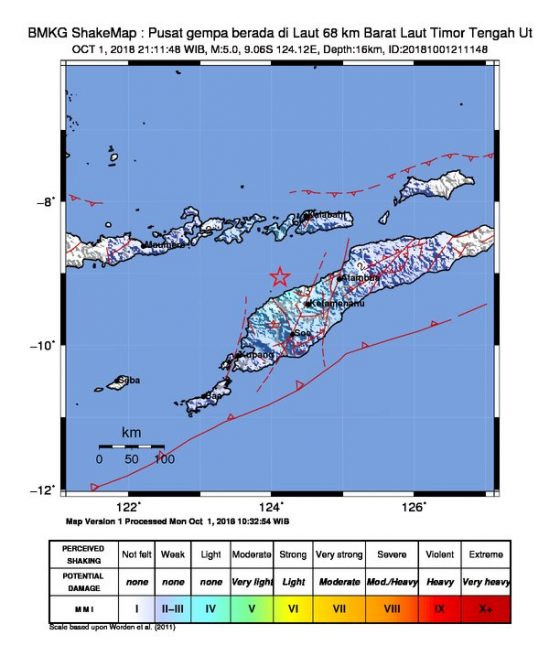

It seems as though social media will have to play a more central role in alerting the public of new disasters. This morning, Indonesia’s Meteorological, Climatological and Geophysical Agency (BMKG) tweeted a new alert of a 5.0 magnitude quake near the North Central Timor Regency in East Nusa Tengarra – an Indonesian province – that could potentially lead to a tsunami.

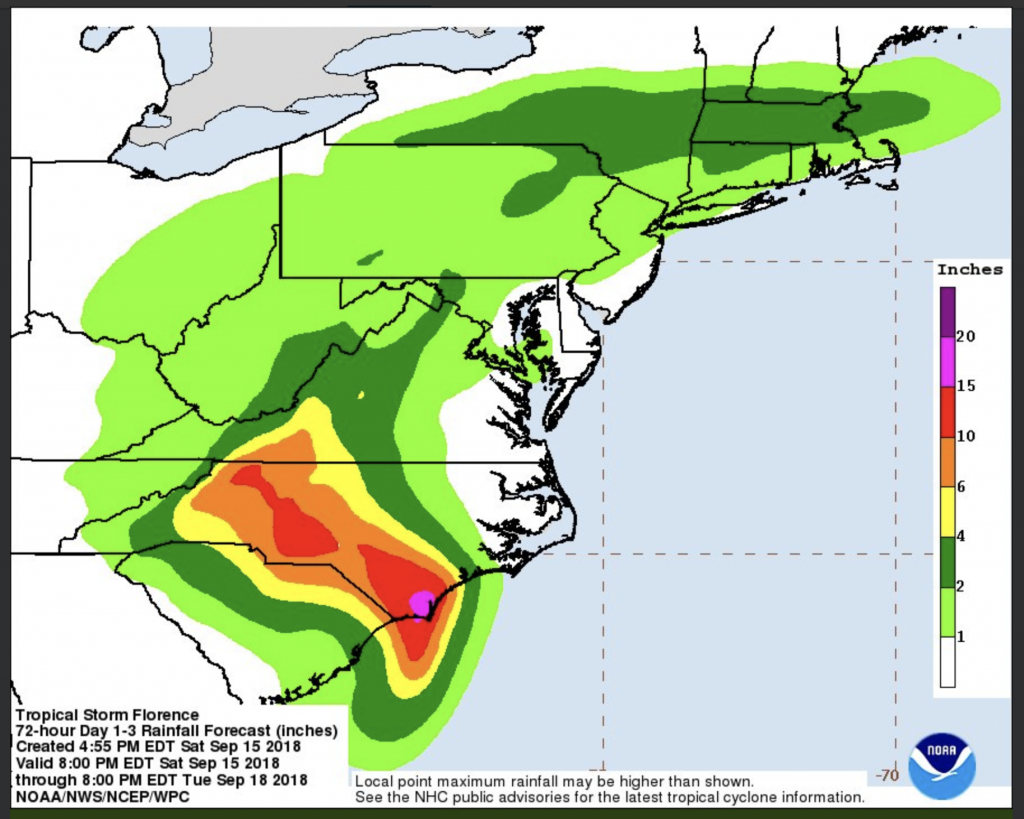

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.

Think of the human supply chain as a network of individuals who help your business to survive and continue to thrive after a disaster, like Hurricane Harvey, which dumped trillions of gallons of water on Texas a year ago.

Think of the human supply chain as a network of individuals who help your business to survive and continue to thrive after a disaster, like Hurricane Harvey, which dumped trillions of gallons of water on Texas a year ago.