If forecasters were attempting to gauge the worst disasters that could happen, a major oil spill gushing for some 90-plus days into the Gulf of Mexico would probably have rated fairly high. By some estimates, this whole mess will cost BP around $60 billion. (Other, more conservative estimates have it costing closer to 1/10th that number.)

But while this might seem like the one of the worst things that possibly could happen on American soil, it isn’t. Forbes, in its latest issue, has a list of seven other incidents that could be even more catastrophic. Here’s a recap of their list.

1. Nuclear Meltdown

Depending on the severity and location, a disaster at a major plant could wreak unfathomable carnage. Writes Forbes:

The industry has $19 billion set aside to pay for accidents. But what would a Chernobyl-type release of radioactive gases into the air do to death rates and the habitability of some large area? The Institute for Policy Studies says a spent-fuel fire could cost hundreds of billions of dollars.

While nuclear energy very may well be a good option in a country (rhetorically) trying to slow climate change and wean itself off of foreign oil, the possibility of a meltdown can be sobering — even when you realize that it has thus far been very effective and safe in some parts of the world for the past several decades.

2. Liquefied Natural Gas Explosion

With supertankers out there carrying some 100,000 tons of liquid methane, the explosive potential of a single ship is equivalent to the blast that would occur if two billion sticks of dynamite went off. The last major tanker explosion killed 128 people in Cleveland in 1944. The next one? Well, it would likely be much, much worse.

And anyone who has seen the controversial — and terrifying — documentary Gasland knows that there may be other, more subtle risks involved in natural gas extraction that deserve the attention of regulators and the industry.

3. Chemical Plant Explosion

The Bhopal disaster was the worst industrial accident in history. Recently — and very controversially — seven involved officials were sentenced to two years in prison and fined $2,000 for negligence more than 25 years after the 1984 Union Carbide leak of poisonous gases (mostly methyl isocyanate) that killed some 15,000 people directly (and up to 23,000 by some estimates) while also leaving another 500,000 with injuries and ailments related to exposure. Human rights groups, victims and Bhopal locals were outraged at the leniency given, particularly since proper clean-up efforts were never conducted and that the $470 million settlement paid by Union Carbide in 1989 now looks laughable by any standard.

If something like that were to occur today, it’s almost impossible to predict how much such a politically charged incident with so many casualties would end up costing. But Forbes lists a hypothetical plant explosion in Houston that kills 600 people as totaling $20 billion, according to Risk Management Solutions.

4. Dam Failure

I have never done any research into a major dam failure, but it sure doesn’t sound good at all.

One of the worst scenarios would be a cascading series of failures in the Columbia River Basin of the Pacific Northwest, where the dams start in Canada, pass the Department of Energy’s Hanford Reservation, with its 50 million gallons of plutonium-laced waste, and include the 6.8-gigawatt Grand Coulee Dam, the largest hydroelectric plant in the U.S. The odds of such a catastrophe are extremely low, but the costs would quickly exceed the $85 billion tab for cleaning up Hanford.

Hopefully, someone is looking into lowering the threat for all “one-third of the 80,000” U.S. dams that FEMA claims pose at least a “high” risk.

5. Category 5 Hurricane Hits New York

A few years ago, I wrote an in-depth feature article for Risk Management about the hurricane potential for New York. Honestly, I’m not really sure a cat 5 hitting NYC is even close to likely over, say, the next 100 years or so, even if ocean sea-surface temperatures continue to rise to alarming extents. But a category 3 storm hitting the area is not only likely — it’s inevitable.

In 1938, the “Long Island Express” raced up the Atlantic coast at a breakneck pace, inundating Long Island, Connecticut and, particularly, Providence, Rhode Island, with floodwaters and storm surge that, while devastating even back then when the areas were sparsely developed, would lead to well over a $100 billion in losses today. The loss of life in this densely populated, frightening unprepared region could be even worse.

Here’s an excerpt from the piece I wrote about “The Northeast Unthinkable”:

Given its geography, population density and general affluence, New York’s Long Island in particular faces a tremendous risk. When the Long Island Express hit in 1938, it was eastern Suffolk County that endured the greatest winds, storm surge and flooding, resulting in approximately 50 deaths. According to 1940 census data, the population at the time was just under 200,000. Today, nearly 1.5 million people live in Suffolk. And another 1.34 million reside in the neighboring Nassau County compared to the roughly 400,000 there in 1938.

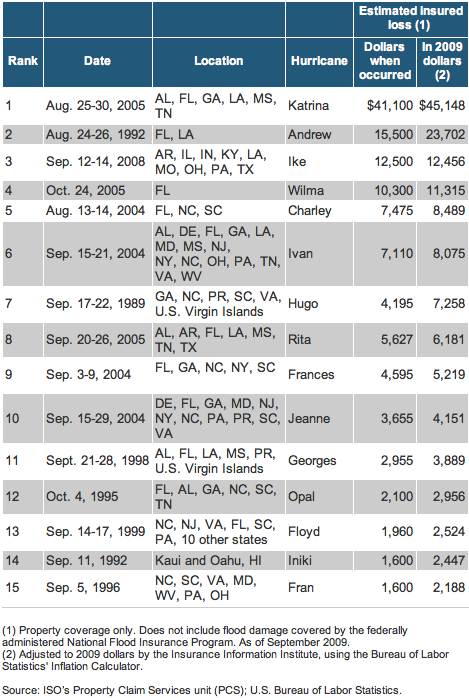

“What really drives significant catastrophe losses is a major event hitting a major metropolitan area,” says Clark. “Otherwise, you can have a lot of activity, but you’re not going to have a lot of losses. It’s those chance occurrences where you have major events hit Galveston, Houston, New Orleans, Tampa, Miami, the Mid-Atlantic or the Northeast—those are the real areas where you’re going to get the mega-catastrophes.”

According to a study by AIR, there is some $4.4 trillion worth of commercial exposure and $3.4 trillion in residential property from New Jersey to Maine. And with almost a million households in Long Island alone, this 1,200-square-mile strip of land accounts for over $1 trillion in combined commercial and residential exposure.

It is with this boom in population and wealth in mind that Roger Pielke, Jr., director of the Center for Science and Technology Policy Research at Colorado State University, set out to formulate new projections for the scale of destruction a replay of the Great New England Hurricane would cause now.

In today’s dollars, the 1938 storm caused over $4 billion in insured losses alone. But this adjusted figure only accounts for the elevated currency values and ignores 68 years of regional growth in population, infrastructure, industry and commercial enterprise. “You can’t adjust for the damages that never occurred,” says Pielke.

As someone who lives in New York, this — even more so than terrorism — is the possible disaster that disturbs me the most, in part, because I believe there is actually some sort of official developed to react to the next terrorist attack. I doubt there is any comprehensive, inter-county plan at all that will be effective in the days leading up to an following the category 3 hurricane that will someday hit.

6. Ferry Capsizing

This one honestly sounds less plausible as a “worse than BP disaster” for the United States than it does elsewhere, but here’s what Forbes wrote:

Ferryboats and riverboats are extremely stable because of their wide, flat design, but they also often travel in dangerous waterways with lots of passengers. As many as 4,300 passengers and crew died after the Philippine ferry MV Dona Paz collided with a tanker, caught fire and sank in 1987.

I suppose that could happen anywhere, but it seems less likely than the others listed in the developed world — especially when compared to this last, but certainly not least, one…

7. Supervolcano

Forbes quotes a Lloyd’s report that volcanoes pose an $85 billion risk “including disruption and air travel” and includes Mount Vesuvius in Italy and Mount Rainier outside of Seattle as two of the scariest locations for a major eruption.

$85 billion sure is a lot of money, but anyone who has seen the History Channel’s “Mega Disasters” episode on what will happen when the Yellowstone Caldera blows probably has worse fears on their minds. Were this thing to erupt, the only adjusters and insurers left to tally the total will likely be roaches and reptiles.

You’ve been warned.