Record-breaking Storm Jonas, which struck a large portion of the East Coast last weekend, was yet another reminder to have property insurance policies up to date and be familiar with claims procedures. To get the claims process moving, risk professionals whose business suffered damage should contact their insurer and broker as soon as possible.

According to the Insurance Information Institute, business owners need to:

▪ Fill out claims forms as soon as possible—including a “proof of loss” form, which must be completed within 60 days.

▪ Make a list of damaged property; the more detailed the better. Take photos or video to back up the claim.

▪ Be prepared to show the adjuster the damaged property as well as financial records or other documents.

▪ Get at least two bids for repairs or replacements.

▪ Keep copies of all correspondence regarding the claim and note the name, title and phone number of everyone you speak with. For more details, see Filing a Business Insurance Claim.

What Is, and Is Not, Covered

Business property owners also need to understand what is and is not covered by insurance, and the various coverage options available to protect their business. Property damage is typically covered under a business owners policy (BOP) or through a commercial multi-peril (CMP) policy.

Most commercial property policies provide either:

▪ Replacement cost coverage – pays to rebuild or repair the property, based on current construction costs.

▪ Actual cash value coverage – pays to rebuild or replace the property minus depreciation

Depreciation is a decrease in value due to wear and tear or age so with actual cash value coverage a business that is destroyed may not be in a position to completely rebuild. Business owners can also opt for a combination of both types of coverage.

Business income insurance, also known as business interruption, is typically included in a BOP or CMP and provides coverage for:

▪ Revenue lost due to the closure.

▪ Fixed expenses, such as rent and utility costs.

▪ Expenses of operating from a temporary location.

To receive appropriate reimbursement from business interruption coverage, there must be direct physical damage to the property resulting from an insured event. Also, there is generally a 24- to 48-hour waiting period before business income coverage kicks in.

Determining a business interruption loss involves establishing what the business would have earned had there been no loss. Insurers will consider past tax returns, profit and loss statements, projected sales and non-continuing expenses.

If basic business interruption insurance and property insurance coverage was expanded to include utility interruption, you may be covered if either electrical or water service was discontinued as a result of the storm.

Businesses that rent or lease a building can purchase tenant coverage, which insures your on-premises property, including machinery, furniture and merchandise. The building owner’s policy will not cover contents, however.

At Risk for Flood Damage?

Location is the most important factor for weighing your risk for flood damage. Is your business located in or near a flood zone? (Flood map search tools can be found online.) In what part of the building is your businesses equipment and inventory located? Anything housed on a lower floor, for instance, will be at greater risk.

Standard commercial insurance policies exclude flooding from melting snow or tidal surge. Commercial flood coverage is available from the National Flood Insurance Program (NFIP) and from a few private insurers. The NFIP provides up to $500,000 in building coverage and $500,000 for contents. Excess flood insurance is also available for businesses.

For more information on coverage options and disaster preparedness, see the Business Insurance section of the III website.

Related Links

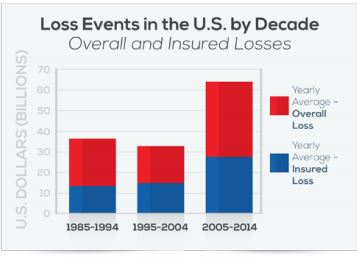

▪ Facts and Statistics: Catastrophes

▪ Articles: When Disaster Strikes: Preparation, Response and Recovery; Does My Business Need Flood Insurance?; Does My Business Need Earthquake Insurance?; Does My Business Need Terrorism Insurance?;

While there are many factors that impact highway safety, an improving economy and lower gas prices have led to an increase in the number of miles being driven.

While there are many factors that impact highway safety, an improving economy and lower gas prices have led to an increase in the number of miles being driven.