This Sunday, the Denver Broncos and Seattle Seahawks will square off in Super Bowl XLVIII. For many fans, making a wager of some sort—such as betting on the point spread, the over-under, a family/office pool, etc.—is a part of the experience. Most bets are relatively straightforward; however, if you’ve ever been to Las Vegas to watch the big game, you’ll find Super Bowl wagers are taken to an entirely different—and more complex—level. In addition to traditional wagers, you’ll find an almost unlimited number of proposition—or “prop”—bets that can stray into more peripheral aspects of the game. Consider the following prop bets from last year’s Super Bowl between the Ravens and 49ers:

This Sunday, the Denver Broncos and Seattle Seahawks will square off in Super Bowl XLVIII. For many fans, making a wager of some sort—such as betting on the point spread, the over-under, a family/office pool, etc.—is a part of the experience. Most bets are relatively straightforward; however, if you’ve ever been to Las Vegas to watch the big game, you’ll find Super Bowl wagers are taken to an entirely different—and more complex—level. In addition to traditional wagers, you’ll find an almost unlimited number of proposition—or “prop”—bets that can stray into more peripheral aspects of the game. Consider the following prop bets from last year’s Super Bowl between the Ravens and 49ers:

- Who will win Super Bowl MVP? (Winning bet: Ravens’ QB Joe Flacco at 11/4 odds)

- What color will the Gatorade (or liquid) be that is dumped on the winning coach? (Winning bet: Clear/water at 7/4 odds)

- Will Alicia Keys’ rendition of the national anthem be over/under 2:15? (Winning bet: Over, at 2:42)

One of the more talked-about on-the-field wagers of this year’s game centers around how many touchdown passes Broncos quarterback Peyton Manning will throw against the Seahawks vaunted defense. During the regular season, Manning set single-season NFL records for touchdown passes (55) and passing yards (5,477) and led Denver to 603 regular season points, which is also a record. Countering that attack will be the Seahawks, which featured the league’s stingiest defense. Here’s a comparison of Manning and the Seahawks’ per-game passing stats:

|

Manning |

Seahawks |

| Passing yards/game : 342.3 | Passing yards allowed/game: 172 |

| Passing TDs/game: 3.4 | Passing TDs allowed/game: 1 |

“If you really spend your time on it, I think you can make money on prop bets,” says Dr. Wayne Winston, a professor of operations and decision technologies at the University of Houston Bauer College of Business and a nationally respected sports probabilities expert. On his website, Winston offers a variety of sports probabilities, and he’s even written a book, Mathletics: How Gamblers, Managers, and Sports Enthusiasts Use Mathematics in Baseball, Basketball, and Football, that breaks down how probabilities are utilized in athletics.

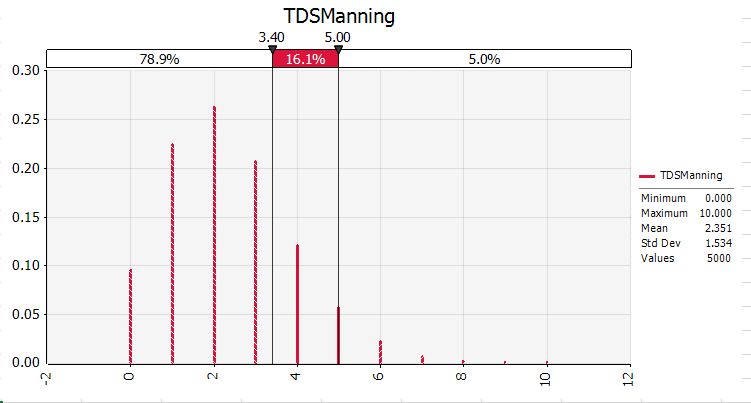

So how many touchdowns will Manning throw in the Super Bowl? Las Vegas has its opinion, and Winston—who ran 10,000 simulations using Monte Carlo simulation—has his. As the table below indicates, Winston and Vegas agree most closely on whether or not Manning will throw zero or one touchdown pass. However, the gap widens—with Winston having less confidence in Manning—when calculating the possibility of two, three or four TD passes.

|

Obviously, such predictions aren’t an exact science, but it is interesting to see how probabilities can differ, based on the data inputs utilized. And if your inputs are better than Vegas, then you may stand a chance to come out ahead. That said, Winston hasn’t determined how many times Manning will utter the phrase “Omaha” at the line of scrimmage on Sunday. Not surprisingly, Vegas has considered it, and has the over/under at 27.5.