Despite extensive, persistent drought in the western United States, 2014 saw notably low numbers of wildfire incidents, both for total number of fires and acreage burned. According to CoreLogic, there were 63,345 wildfires in 2014, which ranks second only to 2013 as the lowest annual number of wildfires over the past 20 years. In comparison with 2013, which was the second lowest annual total acreage burned in the past 10 years, the 2014 season saw even lower numbers, with 3,587,561 acres burned by wildfires.

More intensive response to small fires and ignitions, increased overwinter snowpack and timely precipitation during wildfire season, and greater efforts to boost public awareness and homeowner mitigation efforts have all contributed to more effective control over wildfires, the company pointed out. But responding agencies, homeowners and insurers should not allow the decline to translate into a sense of security.

“Even though we haven’t seen the type of wildfire activity over the last few years that seemed to be thematic in the 2000s, there have been record setting wildfire events even during the recent periods of overall reduced wildfire numbers,” the report said.

“With continuing residential growth in the West, the opportunity for fires to find homes and businesses is going to increase as well. This is why it has never been more important to know where wildfire risk is located and understand the likelihood of it occurring.

”

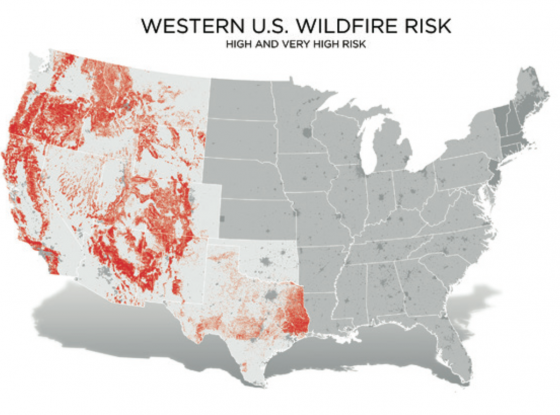

Across the western states, the highest risk areas can be found:

Based on CoreLogic wildfire analysis, there are 897,102 residential properties in the region that are currently located in High or Very High wildfire-risk categories, with a reconstruction value of more than $237 billion. In the Very High risk category alone, there are just over 192,000 residences with a reconstruction value of more than $49 billion. “Taking into consideration the combination of risk factors both inside and outside the property boundary to assess numeric risk score, more than 1.

1 million homes in the U.S. with a total reconstruction value of more than $268 billion fall into the highest wildfire risk segment of 81-100. This total is more than five times the number of homes that fall under the Very High risk category,” CoreLogic reported.

The company also broke down the statewide totals for potential exposure to wildfire damage, in reconstruction value per risk category:

Check out the full report for more details on the risks of wildfire damage.