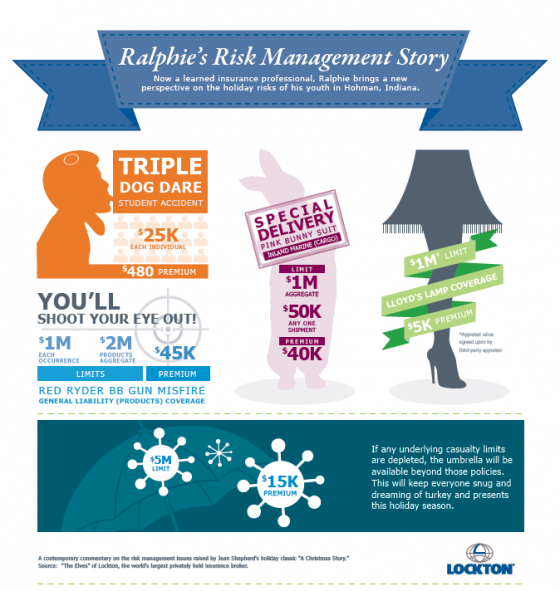

Who knew A Christmas Story was so full of dangerous and costly risks? Think about it. A “double dog-dare” could have led to a disasterous school yard injury and we all know what can happen when kids play with BB guns.

Lockton, which recognized the huge risks involved, has published a white paper examining these and other risks in the classic movie. They have even gone a step further, outlining the potential costs of coverage.

For example, consider this: unsupervised children left to amuse themselves on an icy cold playground.

“Winter is filled with fun, but also dangerous with recess activities like snowball fights and playing tag on icy blacktops. Even with the best of intentions, some injuries are unavoidable and parents are bound to hold the school liable,” according to the report, Ralphie’s Risk Management Story: An Insurance Perspective on the Holiday Classic, “A Christmas Story.” Cost of insurance for this risk? A policy with limits of ,000 for each individual—with a premium cost of 0.

And who could forget the “priceless” leg lamp, won through a newspaper sweepstakes, but broken during a “vacuuming accident?” In this scenario it’s Lloyd’s to the rescue with $1 million in coverage and a premium of $5,000.

But wait, there’s more. The paper looks at exposures including shipment of Ralphie Parker’s pink bunny suit; workers compensation for employees of the Chop Suey Palace—where a worker cuts his finger preparing the Parkers’ Christmas dinner; the Parker home and automobile risks; Santa’s infamous slide at Higbee’s Department Store; and the risks of a Red Ryder BB gun misfire. Now that’s a lot of risk, but fortunately, all manageable.

Happy Holidays!