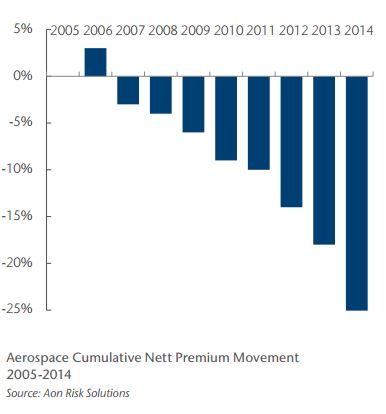

Favorable loss records and low claims in the aerospace industry has led to steadily falling premiums of about 5% for the past eight years and jumping to 8% in 2014, according a report by Aon Risk Solutions.

Favorable loss records and low claims in the aerospace industry has led to steadily falling premiums of about 5% for the past eight years and jumping to 8% in 2014, according a report by Aon Risk Solutions.

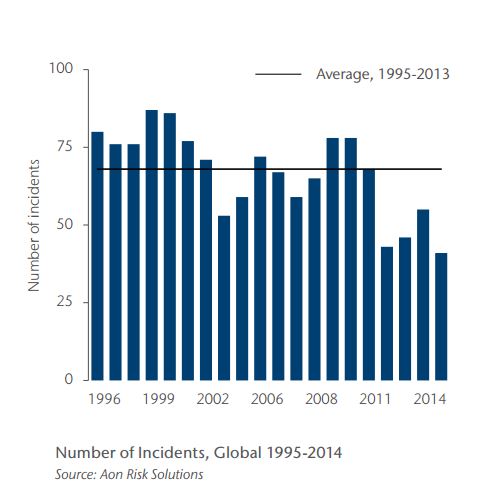

Aon’s Aerospace Insurance Market Report 2015 found that the industry’s improved risk profile is the result of enhancements in technology and security as well as better working practices. Claims have averaged about $200 million, while annual premium is more than $700 million, which could suggest “that despite the price of lead premium falling for eight consecutive years, there is still a long way for the sector to fall,” Aon said, noting that the reality is that the premium level reflects the potential for massive, exceptionally complicated claims. “As a result, while the price of premium could continue to decline gradually in the absence of major claims, the soft market conditions are unlikely to accelerate.”

While an improved risk profile plays an important role, another major factor is that the insurance industry “has become a haven for global investment capital, offering enhanced returns in comparison with other financial markets,” according to the study. This has increased capacity in the market and created competition that has driven down prices. “This could mean that current levels of competition in the market for aerospace business will decline and the pace of reduction in the aerospace insurance markets will slow. There is little evidence that this process is taking place at this stage, but it is a factor that could change during the next couple of years,” the study said.

According to Aon: