Companies in the United States should begin preparing now for climate change, which is predicted to cause extreme weather conditions, according to FM Global’s report, The Impact of Climate Change on Extreme Precipitation and Flooding. As the climate warms, areas that are dry will become drier and moist areas will see higher precipitation. The characteristics of precipitation will also change. “We feel climate change not so much through subtle changes in the mean, but through changes in the extremes,” MIT Prof.

Kerry Emanuel said in the report.

While the overall amount of precipitation might remain the same, it will become less frequent but more intense.

A specific region of the country that has historically seen 10 inches of rain each May might see the same volume that month, for example, but those 10 inches may occur in a much shorter period of time, increasing the risk of flooding, according to the study.

By the end of the century, as temperatures rise, it is possible for precipitation to change by 8%, which could exacerbate wildfires in some areas and flooding in others.

The danger is that, because these extreme events are infrequent, they lack urgency, so planning can easily be put off. Risk managers are advised to check their facility’s resilience in terms of the building’s ability to withstand flooding, focusing on 500-year flood levels rather than 100-year.

Extreme wet or dry conditions can affect a company’s buildings, machinery, data centers, transportation networks, supply chains, people and sales. Organizations should focus on water management—diverting water from property, optimizing drainage and protecting water supplies, and they should consider new weather extremes when managing supply chains.

Flood hazard mapping is increasingly proving helpful as understanding of water risk is improving, Louis Gritzo, vice president and manager of research with FM Global, wrote in “Mitigating Evolving Water Threats,” from this month’s Risk Management Magazine. Advances in technology have led to improvements in weather satellites, geospatial data acquisition and physical model development, making old models obsolete. Anyone working with information from a flood map that is more than 15 years old should consider an update, he wrote.

Those with a flood map should make sure it includes potential coastal flooding areas as well as river flooding, also taking into account the local topography of coastal locations. “Areas along the coast that are surrounded by hills and mountains will likely experience far more wind-blown water (storm surge), as the local terrain directs more water in spaces between steeper slopes,” Gritzo wrote.

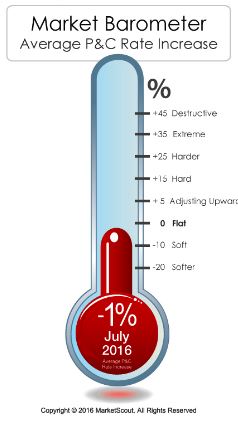

underwriters they can control losses are left with few options “and ultimately end up paying a much higher rate/premium which impacts their profit margins,” he said.

underwriters they can control losses are left with few options “and ultimately end up paying a much higher rate/premium which impacts their profit margins,” he said.

statutory combined ratio to 99.5% in 2016 from 97.6% in 2015 and reduction of pretax returns on equity to 8.7% from 10.8%—or to 7.5% from 9.9% when adjusting for the impact of prior-year reserve development.

statutory combined ratio to 99.5% in 2016 from 97.6% in 2015 and reduction of pretax returns on equity to 8.7% from 10.8%—or to 7.5% from 9.9% when adjusting for the impact of prior-year reserve development.