2017 has so far been a wild ride of change. Companies are navigating through a new U.S. administration, Brexit and cyber risks that are more daunting each day. We are bombarded with uncertainty and unchartered waters. Nevertheless, it’s a great time to be a risk manager.

This kind of disruption is the reason many of us got into the risk and insurance industry. Addressing disruption is what we do best. According to a recent CNN report, in fact, Risk Management Director is the number-two Best Job in America for 2017. Recognizing the meaningful contributions and rewarding work of a risk manager, the report highlighted the role in “identifying, preventing, and planning for all the risks a company might face, from cybersecurity breaches to a stock market collapse.”

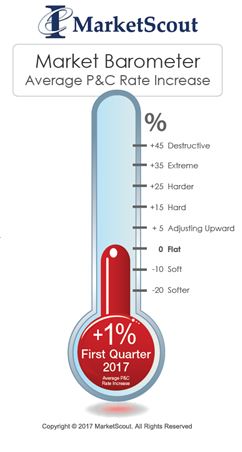

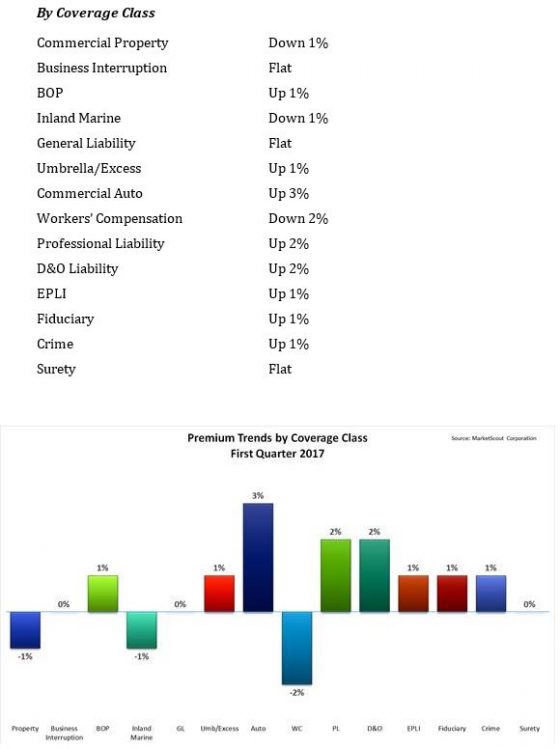

In the midst of a riskier environment, the insurance industry that serves risk managers faces highly competitive market conditions. The result is more choices and better services for the risk management community. Now is the time for the risk manager to take the lead.

As thousands of risk professionals soon head to the RIMS Annual Conference in Philadelphia, it’s a good time to consider the opportunities in this growing profession.

Why the time is right for risk managers:

- 2017 brings a new risk profile. Every company, regardless of industry or size, needs to evaluate the new risks from the shift to nationalist policies in the U.S. and abroad. Our new administration’s efforts to increase America’s manufacturing raises a host of new insurance needs—more U.S. production means more U.S. liability. We are also seeing a shift in global supply chain and an increase in the political risks of operating outside our borders. These changes require board-level and C-suite attention. We expect to see risk managers play a more significant role with management in building risk mitigation into their company’s strategic direction.

- Rise in specialists. This is your time to be selective about specialists that understand your business and the specific challenges you face. Insurers are differentiating through specialization. Work with an underwriter that knows the risks, regulations, complexities and nuances of your industry. Many industries, such as construction and health care, will experience rapid change this year. Find partners that have been in the same trenches and can help you navigate changes.

- Tailored products and solutions. The highly competitive insurance market is also driving product innovation for clients with more tailored solutions. Take the time to learn about less-understood products, such as accounts receivable insurance, which protects companies from non-payment risks and gives them the ability to borrow, receive loans, and as a result, improve their credit quality. In Europe, 70% of companies purchase this coverage, compared to only 8% of U.S. companies. Understand the risks across your supply chain and work with your broker to customize insurance programs and bring innovative solutions.

- At the center of technology and innovation. The insurance industry is on the front lines of the cutting-edge technologies: internet of things (IoT), robots and drones. These advances will only grow and thrive with the right risk and insurance programs. For example, the technology surrounding drones or unmanned aerial systems is rapidly evolving. The ability to collect and analyze aerial data has improved efficiencies, enhanced safety and lowered costs within the construction, agriculture, telecommunications, oil & gas and real estate industries. As usage grows, risk managers will be central to the successful operation of drones by understanding and managing the risks and compliance needs.

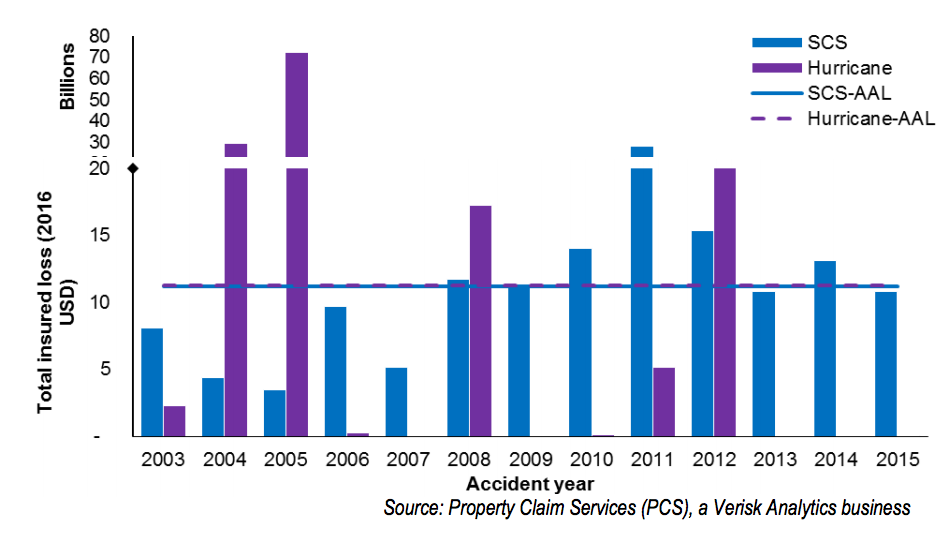

- Ability to leverage the best in data analytics. Risk managers have the data, tools and skills to anticipate the risks from this tumultuous environment. The insurance industry views these challenges with a different lens, drawing on past catastrophes and predictive analytics to plan for the challenges ahead. Risk professionals who know how to leverage this information can bring a sense of preparedness and control at a time of heightened uncertainty. There is also a role for risk managers to advise senior management on the use of data. But because models are continually amended and updated after losses occur, it is important to avoid an over-dependence on data and false sense of security.

- Opportunity to participate in growing your business. Risk managers do not just protect a business, they grow a business. Companies are reevaluating strategies based on new policies. Will they build manufacturing plants? Will they buy a strategic target? Risk professionals have an important role in mergers and acquisitions deals as insurance can be used to help quantify contingent liabilities and allow for accurate pricing models. The most common is representation and warranties insurance, which can help strengthen and facilitate a transaction.

- Better risk management services. Insurers realize it is not enough to write a check for a claim. Take advantage of risk mitigation services that are built into your insurance policies. They include education, training, tabletop exercises and risk assessments.

- A thriving profession. With more and more universities offering undergraduate risk management majors, we will see a dedicated, high-caliber talent pool focused on careers in risk and insurance. The Spencer Foundation, for example, has completed an eight-month competition between students of 29 universities from around the country, analyzing, developing and presenting the most comprehensive risk management solutions for a case study. The top eight teams will be in Philadelphia to present at RIMS.

The risk and insurance industry is made up of some of the most agile and level-headed professionals. Risk managers have always moved with the changing environment and crisis situations, developing programs to address their entity’s risk profile. Hopefully, we will see more companies include risk management in their strategic planning and leverage the experience and skills of their risk managers.