The city of Venice, Italy, faced the worst flooding of its famous canals since the devastating floods of 1966. Venice has suffered major economic impact from this new round of flooding, with Mayor Luigi Brugnaro predicting that the damage will cost hundreds of millions of Euros, and claiming climate change is to blame.

The recent flooding paralyzed many local businesses, forcing schools to close and disrupting the city’s bustling tourist industry. When the salt water of the canal rises, it can destroy centuries-old architecture and wipe out entire inventories.

And since insurers have refused to provide flood coverage to Venetian businesses due to the ever-present flooding threat, costs can surge even more.

After the 1966 floods, the city began planning a sea barrier to combat the increasing flooding, called the Mose Project, but it has largely languished since then, reportedly due to corruption and delays. The barrier consists of gates that rise with the tide to prevent flooding at different inlets of the Venetian Lagoon, the bay surrounding Venice. The project has been formally underway since 2003 and has cost billions of Euros so far, with its engineers now predicting the barrier will be in place by the end of 2021, while others say 2022.

As the floods have gotten worse, Venetians have taken to the streets to protest the city’s mismanagement of flood prevention and response measures, as well as tourist cruise ships that produce waves they allege have eroded the city’s foundations. Venice has also seen a slow trickle of people leaving the city, as the constant flood risk has made life and business operation untenable for many. According to NBC News, of about 53,000 residents in the city’s center, Venice lost over 800 residents last year alone.

As with many recent extreme weather events around the world, some experts believe the floods may be the result of climate change. Environmental economist Shouro Dasgupta told NBC News that the frequency and severity of the city’s floods have increased significantly. “Since 1951 until today, we have had 21 severe flooding events,” he said.

“Out of those 21, 13 have been since 2000 and, out of those 13, eight have been since 2012.”

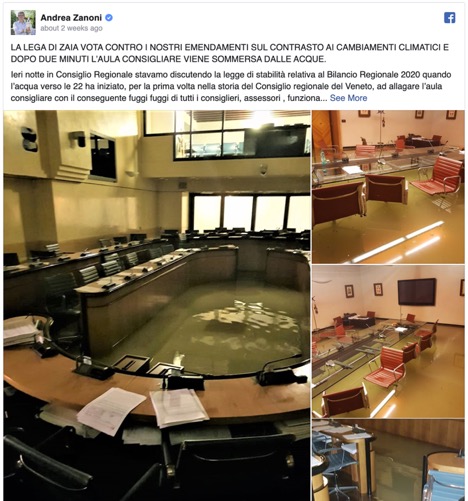

The Venice city council reportedly rejected measures to combat climate change minutes before floodwaters actually reached the council chambers. Pictures of the flooded government chambers posted by city councilor Andrea Zanoni went viral—an ironic symbol of official inaction in the face of climate change’s effects. Zanoni told CNN that the council rejected measures to fund renewable energy, to make city buses (currently running on diesel) “more efficient and less polluting,” and to address the local use of polluting stoves and plastics.

The council’s president, Roberto Ciambetti, refuted the assertion that the city’s government was ignoring climate change, citing budget provisions dedicated to fighting air pollution and smog.

Last week, the United Nation’s Environment Program released a report stating that countries must increase their carbon-cutting measures dramatically to prevent warming of 3.2 degrees Celsius by the end of the century. The report noted that the many of the world’s 20 richest countries, which are responsible for 78% of global emissions, have not committed to reducing their emissions to zero. Italy is one of the few countries that have made this commitment, albeit as a long-term target.