HOUSTON—The recent spike in oil and natural gas production has led trucking companies to grow so quickly that they sometimes scramble to find qualified drivers. This has meant tightening coverage with a limited number of carriers and a market in “disarray,” Anthony Dorn, a broker with Sloan Mason Insurance Services, said today at the IRMI Energy Risk and Insurance Conference.

“Carriers have taken a bath on construction risks,” he said. “Only nine carriers will write crude hauling.”

There is a huge need for risk management in trucking right now, he added. “A lot of these are fly-by-night companies. They are running with drivers that have no experience, they are getting violations from the DOT left and right for not having licenses and adequate brakes on their trucks and they are running on dirt roads that aren’t made for 100,000 pound units,” Dorn said. “It’s a very risky place for underwriters. If we don’t do something as agents and as risk managers there will be fewer carriers.”

The recent downturn in the oil and gas market has also been a game-changer for some companies. Dorn predicts a “cleaning of the crop” of truckers. Inexperienced companies with new drivers will “fall by the wayside. What we are going to be left with are companies that are well-run with proper safety procedures in their fleet.”

Once that happens, he believes more carriers will enter the market. “But as of now, in general the whole market is in disarray,” he said.

He noted that agencies such as the Department of Transportation have vehicle reports available online, which insurers now frequently access when considering whether to take on a trucking company as a risk. He suggested that companies looking for coverage also check these reports and work closely with their risk managers and safety directors to correct any problems, such as drivers without adequate experience.

“There is a huge opportunity out there right now for risk managers to approach these companies and tell them, ‘If you don’t have a risk manager to help with your losses, you are not going to be able to find insurance.’ Right off the bat, I’d say 50% [of trucking companies] are declined as soon as they walk in the door,” Dorn said. As a result, he has seen companies declined by every insurer and forced to form a new LLC or even shut down.

Loren Henry, also a broker with Sloan Mason, said that another thing they are seeing as oil prices drop is companies formed to haul salt water for hydraulic fracturing looking to other opportunities. “They start hauling agricultural products and paper products, whatever there is that is not oil and gas related,” he said. “That is typically not going to be covered under their auto policy.

” He advised fleet owners to be aware of this and communicate any changes to their broker to find out specifically what is covered.

“We have had some losses recently, where a company made a shift from what they were hauling because they had lost some saltwater accounts. They were hauling cattle and they had a loss and it wasn’t covered because it is not in the policy language,” Henry explained.

“I don’t know where all these water-haulers are going to go,” Dorn added. “You’re going to see massive fleets go on sale and you’ll get huge discounts on trucks. You are going to see some transitions.”

Dorn added that one of his clients is now hauling salt water with half of his trucks and cattle with the rest. He advised his client to form another LLC for the cattle-hauling if he expects to get insurance coverage, as insurers would cover one or the other, but not both.

Asked whether companies are hiring risk managers and if they are also listening to their advice, he said, “Yes, especially after they get their premium. When they go from $5,000 a unit to $12,000 a unit their ears perk up pretty quick. They are willing to do almost anything to get that pricing down. It’s sad because companies are actually being put out of business because their premiums are too high.”

He expects the next year to see a lot of changes. “A lot of companies will go by the wayside,” he said. “A lot of smaller companies will be gone—they will sell their trucks or be bought out by bigger fleets.”

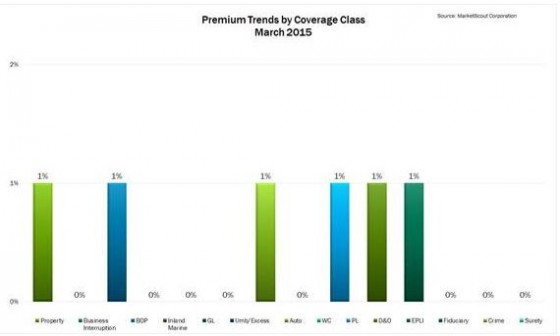

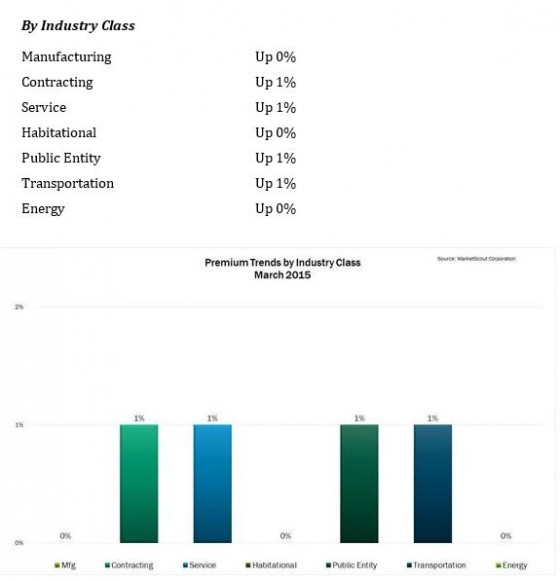

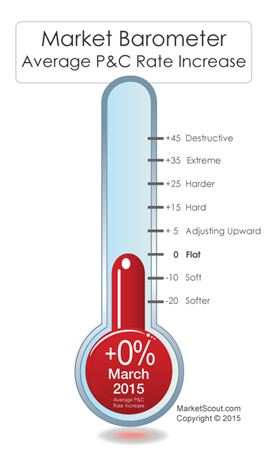

indicating a softening market, according to MarketScout.

indicating a softening market, according to MarketScout.