With an innovation worthy of the digital age, the field of vehicle telematics is bringing auto manufacturers and insurance companies into sharper alignment. Now, data recorded in an individual vehicle can be “crunched” to yield insights about driving behavior—insights that can shed light on a driver’s risk category. In a further innovation, 2016 brought the establishment of a telematics data exchange, enabling risk managers to make use of this data with the consent of drivers.

about driving behavior—insights that can shed light on a driver’s risk category. In a further innovation, 2016 brought the establishment of a telematics data exchange, enabling risk managers to make use of this data with the consent of drivers.

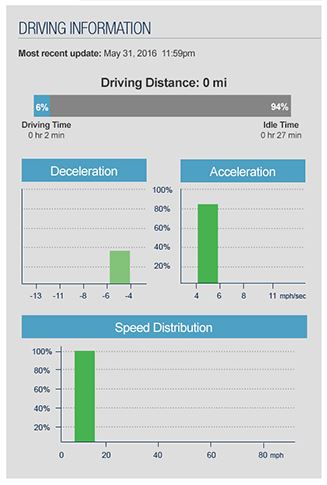

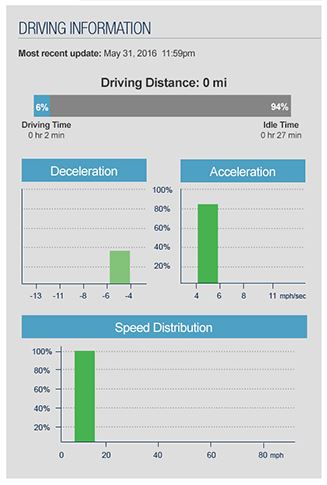

Telematics data can potentially benefit consumers, fleet owners and insurers. Instead of insurers generally relying on a driver’s general information—age or gender, for example—policies can be written to address specific levels of risk supported by actual driving data (speed, acceleration, braking and time of operation).

buy prelone online https://royalcitydrugs.com/prelone.html no prescription

So the elements are falling into place to tap telematics-derived data, with potential for also attaining higher fuel efficiency and better fleet vehicle performance.

How do consumers and fleet owners benefit?

- Rewards: Discounted insurance for drivers who have fewer risks or lower annual miles

- Ease: Greater convenience, flexibility, and portability when shopping for auto insurance

- Safety: Promotion of good driving habits

- Savings: Insurers’ enhanced ability to segment risk types, potentially lowering premium costs for commercial fleet owners and managers

History of an idea

The seed for telematics was planted in the early 1960s, during a period when tensions between the United States and the former Soviet Union were escalating. That is also when the U.S. government, intent on national security and concerned about a potential nuclear threat, funded development of Global Positioning System (GPS) technology. Initially, GPS was intended for military and intelligence applications. By the early 2000s, telematics technologies were used in web-based fleet management systems that featured real-time information updates to remote networks. At that time, slow tracking rates limited data transmissions to one or two instances per hour. It wasn’t long, however, before GPS-based vehicle navigation systems flooded the consumer market.

Aligning value

In recent years, telematics has brought auto manufacturers and insurers into alignment, with both industries recognizing the potential of telematics. Automakers have found value in using telematics data to communicate information to car owners about their vehicle’s maintenance needs and performance and to convey information to consumers about their driving behavior, which could lead to safer driving. In turn, safer driving—such as fewer sharp turns and hard-braking incidents—could positively affect vehicle performance and fuel efficiency. And insurers have found a means to help better define risks.

Automakers also recognized that better fuel efficiency and less wear and tear (requiring less maintenance) could potentially save money for consumers, thereby reducing the total cost of car ownership.

Many insurers, too, quickly saw the inherent value of telematics data. Traditionally, insurers rate consumers on various factors that typically include proxy data to predict an individual’s risk level, which helps determine rates. Some consumers may complain that not enough insight goes into the rating process. Yet telematics data, applied through usage-based insurance (UBI) programs, allows insurers to consider details of individual driving behavior—which might lead to more accurate and customized pricing. Insurance rating could become more focused on individual behavior and performance. Insurers understand that a benefit of using telematics data as part of their underwriting practices can include the consumer’s perception that carriers are operating with greater transparency—and potentially give consumers greater understanding of their auto insurance expenses.

Consumers could now examine their own driving data—and likely this data overlapped with the data their insurance company reviewed when establishing their rate in the first place.

Great leap forward

For some time, we’ve said that a telematics data exchange might represent the future of usage-based insurance. That future isn’t far away. Consider this: It is estimated that by 2020, more than 90% of all new vehicles sold in the United States will be able to connect to the internet. Today, about 5% of vehicles are so equipped. That is a powerful leap forward in terms of the data that will be available from connected cars.

This gives auto-makers the potential to capitalize on vast amounts of data collected by the connected cars they sell. Insurers can benefit by potentially enhancing their efforts to acquire and retain safer drivers and monitor their policyholders’ driving behavior and vehicle mileage.

There can be corresponding challenges related to such connected vehicle data, however. The volume of data from connected cars is enormous and growing. The hardware, software, and carrying costs needed to store and manage that data can run into the millions of dollars—a cost many insurers may find onerous.

Automakers face their own set of issues, chief among them being the “many-to-many” problem: how to connect with hundreds of insurers that might be interested in accessing their data. While those are just a few of the multiple hurdles to overcome when harvesting exponentially growing stores of data, these are challenges that a telematics data exchange can help address. That is why the launch of the first data exchange marks such a critical milestone in the history of telematics.

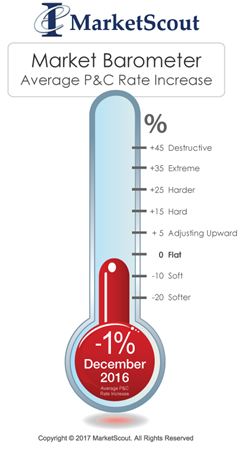

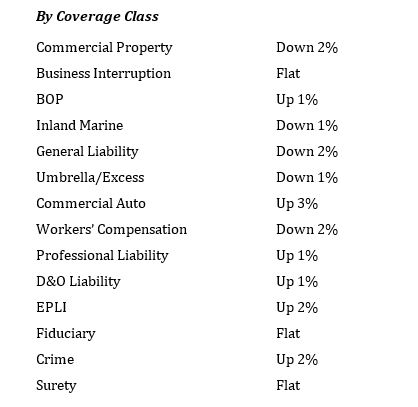

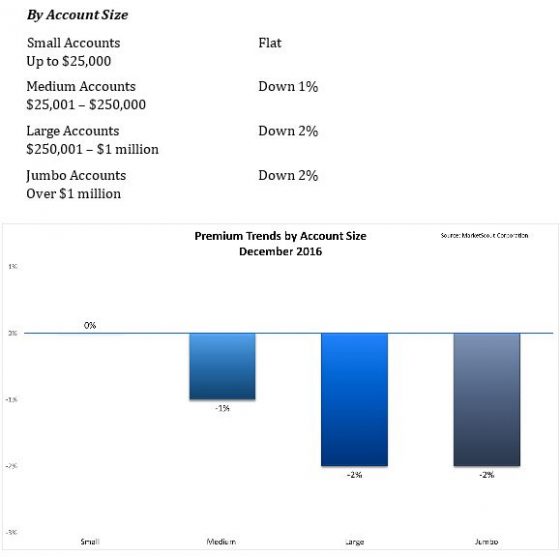

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.

April, rates began to moderate and continued reductions of 1% to 2% per month. The year closed with a composite rate reduction of 1%, according to MarketScout.

North Carolina has the worst, according to the

North Carolina has the worst, according to the  about driving behavior—insights that can shed light on a driver’s risk category. In a further innovation, 2016 brought the establishment of a telematics data exchange, enabling risk managers to make use of this data with the consent of drivers.

about driving behavior—insights that can shed light on a driver’s risk category. In a further innovation, 2016 brought the establishment of a telematics data exchange, enabling risk managers to make use of this data with the consent of drivers.