When most people think of product contamination and recalls, the first thing that comes to mind is food poisoning cases from bacteria such as e-coli and listeria. Food and drug companies, however, are experiencing malicious and intentional product tampering that can be equally deadly and dangerous. Many of us can’t forget the 1982 cyanide Tylenol crisis, Johnson & Johnson’s worst nightmare as reported cases of death from their products came pouring in, causing recalls nationwide.

The Tylenol case was long ago, but unfortunately, decades later and despite modern day advancements in packaging and processes, there is still a steady flow of cases globally, where bad actors contaminate products. This can lead to possible danger for customers, recalls, lasting reputational damage and potentially huge financial losses.

For example, in 2013, unsafe levels of the insecticide malathion was found in a Japanese frozen food company’s product after customers reported a chemical smell coming from the products and almost 3,000 incidences of sickness from consuming them. As a result, the products were recalled and the company shut down, causing its stock to plummet.

Why does it happen?

The main motive for tampering with food products is to make a statement. Bad actors aim to cause injury or economic and reputational harm to companies, especially since news of these acts can go viral, creating the negative impact on companies they hope to achieve.

As with cases of cybercrime, these companies are in a sense being “hacked” and need protection. Like with the mysterious hacker, manufacturers and retailers are facing this threat from both inside and outside the organization.

Oftentimes an employee within the company is the culprit, such as in the case of Just Bare Whole Chicken. A recall of 55,608 pounds of chicken sold nationwide went into effect last June, after black sand and soil was found in some Gold’n Plump and Just Bare branded poultry. The employee responsible was identified and terminated, but the effects of the disruption were lasting.

Taking Preventative Measures

Food companies should have a full understanding of the risks they face, the insurance available, and the regulations associated with product tampering.

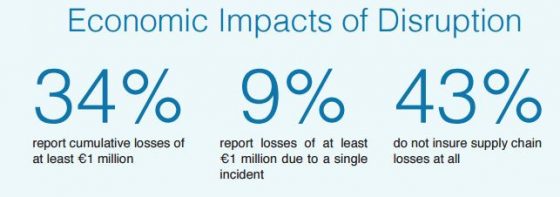

Insurance: Malicious Product Tampering (MPT) insurance addresses deliberate contamination, or the threat of such contamination of products when a company or the public has a reasonable belief that the products might cause bodily injury if consumed. MPT insurance should be considered as part of a total product recall risk management solution. Many of these insurance programs provide experienced crisis management consultants to help a company manage and recover from such incidents efficiently and effectively in order to minimize loss. When putting together a risk management program, make sure to have first and third party coverage for product recall, including malicious contamination, business interruption, product extortion, product recall costs, rehabilitation expenses, replacement costs and consultant costs.

Defense initiatives: There is a difference between food safety processes, which protect food from unintentional contamination by products that are present in the production plant, and food defense initiatives, which protect from intentional tampering by unknown substances. Some people use the terms interchangeably, but food defense is key to protecting against tampering.

In 2016, the FDA issued a final rule on Mitigation Strategies to Protect Food Against Intentional Adulteration and, as part of this initiative, released the Food Defense Plan Builder program, which assists food facility owners and operators with developing personalized food defense plans. This user-friendly tool should be quite valuable to your food defense strategy.

Regulation: The Food Safety and Modernization Act aims to ensure that the U.S. food supply is safe by focusing on preventing contamination before it happens rather than simply responding to it. It requires mitigation strategies to be put in place in certain food facilities.

With these risk management strategies and the right insurance plan in place, companies can protect themselves and help mitigate their risks of food or product tampering.