When reputational crises hit, market cap, sales, margins and profits are all on the line. And these situations are becoming more frequent—and more costly—than ever, with a recent study showing an increase in losses from reputational attacks increasing by more than 400% in the past five years.

But it is not only the corporate entity facing challenges, individuals in leadership—particularly CEOs—face personal risk as well. It has become clear that CEOs need tools to protect themselves as well as their companies’ reputations. Since damage from reputational attacks takes place in the court of public opinion, traditional liability solutions, such as directors and officers coverage, are not effective. But new tools are available in the form of a reputation assurance solution that can help deter attacks from even happening and bundled insurances to mitigate the damage when they do occur.

Research by Steel City Re has found that:

- Financial losses related to reputational attacks have increased by more than 400% in the past five years, a trend that continues.

- There is an increase in public anger and, as a result, more blame is being cast upon recognizable targets, such as CEOs.

- Anger by stakeholders is fueled by disappointment—the gap between expectations and reality—which is all too often fueled by the company’s own actions.

Against that backdrop, the turnover rate among CEOs is increasing, with 58 of the S&P 500’s CEOs transitioning out of their jobs in 2016 according to SpencerStuart (although not all as a result of reputational crises). That is the highest number since 2006, a 13% increase over 2015, and a 57% increase over 2012.

If that weren’t enough reason for concern, history shows that when strong companies and their brands come under fire, their reputations eventually recover, despite the initial and medium-term impacts. Individual reputations of those companies’ leadership are not nearly as resilient, however, especially at a time when society; be it the media, social media, politicians or direct stakeholders; seems intent on personifying crises and affixing blame on individuals in positions of authority. And for CEOs, a reputational crises can affect their career and compensation for many years ahead.

In this environment, it is essential that risk managers understand the tools that are available to protect both companies and senior executives personally. Serving as a third-party warranty and available only to highly qualified insureds, reputation insurance attests to the efficacy of the company’s governance and operational practices, as adopted and overseen by the board and implemented by the CEO. Such coverage can deter reputational attacks in much the same way as a security sign on the front lawn deters burglars. It is a sign of quality governance. And when incidents do occur, it provides a built in alternative narrative to counter the attacks that are bound to occur. Finally, it gives the company and key individuals financial indemnification to mitigate any damage that ultimately does take place.

Just as “doing the right thing” did not protect directors and officers from liability in the era before the wide adoption of D&O insurance, it is no guarantee that attacks in the court of public opinion won’t take a significant financial toll. But it is one of the few solutions proven in the court of public opinion. In today’s culture, reputations are in jeopardy as never before and risk managers must utilize all tools available to protect those on the front lines.

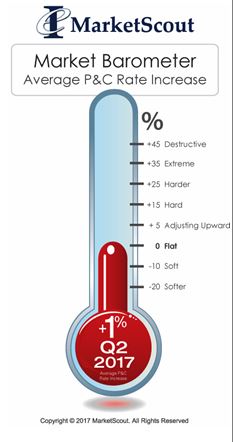

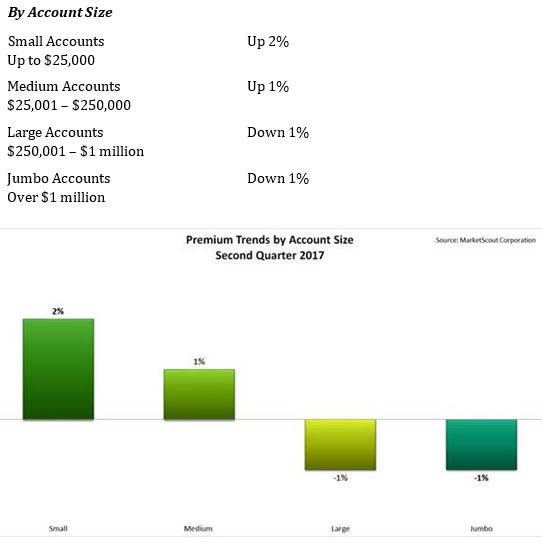

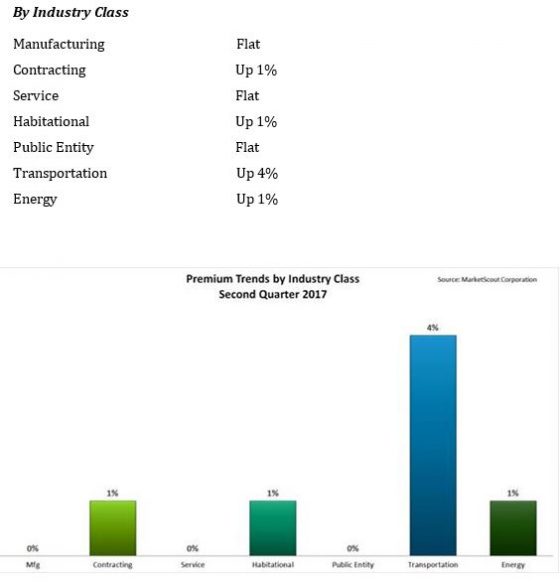

transportation sector, most notably auto-related exposures, is seeing the highest increases, up to 4%, according to a report released today by MarketScout.

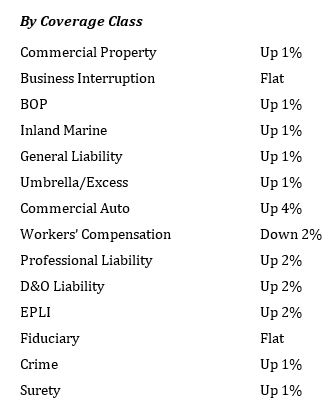

transportation sector, most notably auto-related exposures, is seeing the highest increases, up to 4%, according to a report released today by MarketScout. By coverage class, commercial property and inland marine adjusted from down 1% in the first quarter, to up 1% in the second quarter. Commercial auto rates rose from up 3% to up 4%. EPLI also went from up 1% to up 2%. Fiduciary adjusted downward to flat or no increase compared to up 1% in the prior quarter. All other coverage classifications were unchanged from the previous quarter, according to the report.

By coverage class, commercial property and inland marine adjusted from down 1% in the first quarter, to up 1% in the second quarter. Commercial auto rates rose from up 3% to up 4%. EPLI also went from up 1% to up 2%. Fiduciary adjusted downward to flat or no increase compared to up 1% in the prior quarter. All other coverage classifications were unchanged from the previous quarter, according to the report. By industry class, public entity rates moderated from up 1% to flat.

By industry class, public entity rates moderated from up 1% to flat.

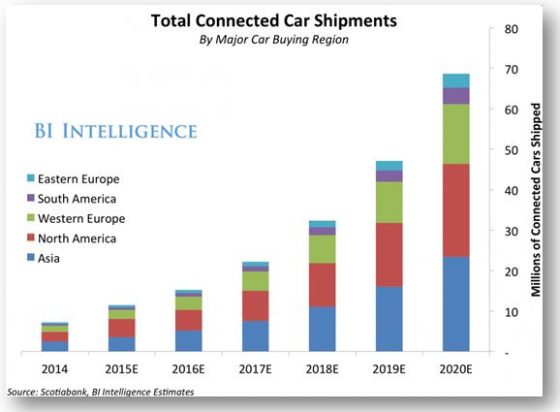

Distribution of projected connected cars (source

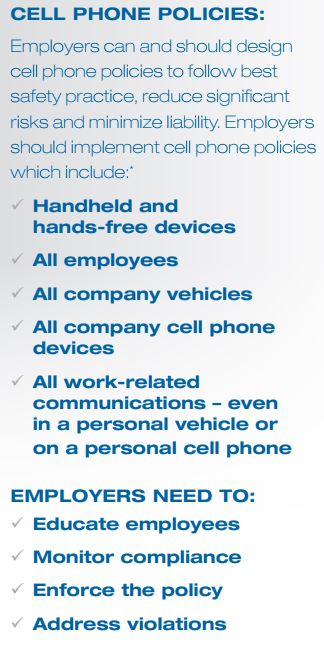

Distribution of projected connected cars (source  Employers can and are being held liable for damages resulting from employee accidents. “We might expect an employer to be held liable for a crash involving a commercial driver’s license holder who was talking on a cell phone with dispatch about a work-related run at the time of an incident—especially if the employer had processes or a workplace culture that made drivers feel compelled to use cell phones while driving,” the NSC said.

Employers can and are being held liable for damages resulting from employee accidents. “We might expect an employer to be held liable for a crash involving a commercial driver’s license holder who was talking on a cell phone with dispatch about a work-related run at the time of an incident—especially if the employer had processes or a workplace culture that made drivers feel compelled to use cell phones while driving,” the NSC said. blurred in some cases involving:

blurred in some cases involving: