Above: Luzhniki Stadium in Moscow

Above: Luzhniki Stadium in Moscow

The 2018 World Cup tournament began on June 14 and lasts until July 15. Thousands of fans will travel to Russia for the event, which consists of 64 matches and 32 teams in 11 cities. Like other mega events, it presents countless challenges for a number of industries including construction, travel, hospitality and security.

Circuit Magazine for security specialists reports that threat for terrorism is high, as there have been attacks in Moscow and the North Caucasus and most recently, a suicide attack on a Metro Train in St. Petersburg. It notes, however, that “Past performance in security terms of Russia at large events has been very strong, the Sochi Olympics was well controlled with no terrorist incidents affecting fans.

Based on our assessment we continue to recommend that any attendance at large events, or corporate travel in Russia is supported by additional risk management measures.”

The article also recommends that attendees remain vigilant in public places, adding that to address this risk, security has been increased at airports and transportation hubs. It warns of street crime, including pickpocketing, that targets tourists. “Bogus police officers have harassed and robbed tourists.

If you are stopped always insist on seeing identification. Avoid openly carrying expensive items, or anything that might easily identify you as a tourist. Avoid walking about late at night alone,” Circuit warned.

Not to be overlooked are health concerns.

The European Centre for Disease Prevention and Control (EU/EEA) recommends in a recent report that anyone traveling to Russia for the games make sure their vaccinations are up-to-date, particularly for diphtheria, hepatitis A, hepatitis B, measles, meningococcal infection, mumps, pertussis, poliomyelitis rubella and tetanus. According to the EU/EEA:

“As is often the case with mass gathering events, during the 2018 FIFA World Cup in Russia visitors may be most at risk of gastrointestinal illness and vaccine-preventable infections. The risk of being affected by gastrointestinal illness can be reduced by employing standard hygiene measures including regular hand washing with soap, drinking safe water (bottled, chlorinated or boiled before consumption); eating thoroughly cooked food and carefully washing fruit and vegetables with safe drinking water before consumption.”

It added that while outbreaks and spread of vaccine-preventable diseases are of particular concern during such mass gatherings. “there are no indications that the risk is higher than usual.”

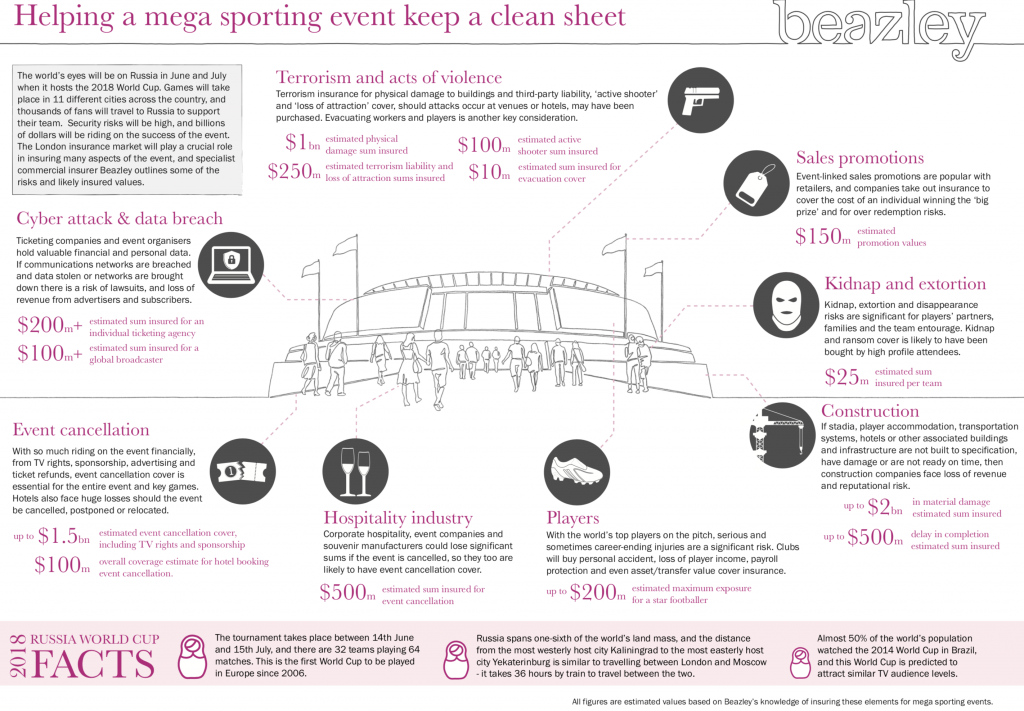

Beazley notes that many of the 2018 World Cup’s risks impacting various industries will be covered by the London insurance market. The insurer outlines some of the key risks and their likely insured values: