Three apparent suicides that occurred in late March reaffirmed the need for post-incident plans that address long-term trauma in the aftermath of workplace violence and mass shootings.

All three decedents had either survived a school shooting or had been related to a victim. Two youths who survived the Marjory Stoneman Douglas High School shooting in Parkland, Florida died by apparent suicide just 13 months after a former student killed 17 and injured several more. Shortly after, it was reported that the father of a child killed in the 2012 Sandy Hook Massacre–in which a gunman killed 26 children and adults in a Connecticut elementary school–allegedly died by suicide.

As of March 31, 2019, the Gun Violence Archive confirmed 68 mass shootings for the year, and with statistics sure to rise, companies and institutions should be mindful of the delayed effects of workplace violence. Risk Management Monitor previously reported the number of suicides in the United States has risen in nearly every state between 1999 and 2016. Employers may use these tragedies to reconsider their own prevention and awareness efforts, and ways they can productively contribute to the dialogue and keep their workers safe.

Paul Marshall, managing director of Active Shooter and Workplace Violence at McGowan Program Administrators said post-incident trauma counseling is critical when it comes to preventing or reducing long-term effects.

“The trauma counseling for the mental anguish needs to be aggressively pushed, almost like the way post-traumatic stress disorder is for first responders,” Marshall said.

Counseling for physical and non-physical injury survivors and witnesses is something that could be missed when drafting a premises or employer liability policies, he said. In fact, Risk Management magazine reported that companies may not be aware of potential gaps in their coverage or that the limits of their coverage, when considering active shooter incidents, are insufficient.

Marshall said that instead of a duty to defend when it comes to a commercial general liability policy, insurers can address long-term trauma with a duty of care clause. This, he said, demonstrates an employer’s willingness to help victims from the outset.

“There’s a typically a year limit on these policies – in the insurance industry you need to apply some sort of time limit,” Marshall said. “But it’s still a year longer than you’d otherwise get. And there has been a huge uptick in these policies from a year ago.”

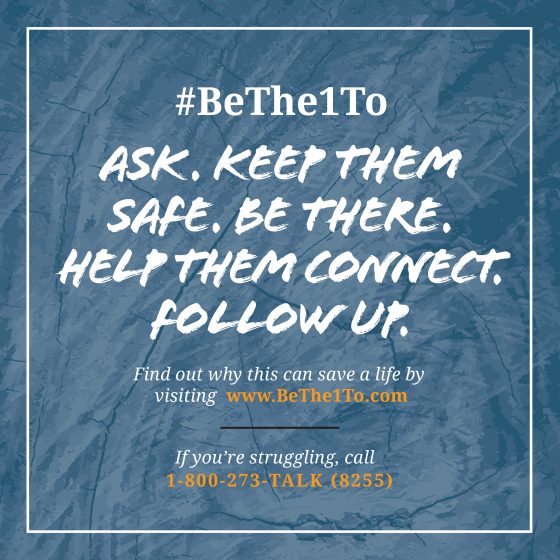

#BeThe1To is the National Suicide Prevention Lifeline’s campaign to empower people to help those in crisis.

How Employers Can Help

Addressing post-incident trauma in an insurance policy is important, but equally paramount is the need to ensure that employers make training available for affected employees – regardless of where the incident occurred. Regina Phelps, president of Emergency Management & Safety Solutions, said that post-incident crisis management protocols should be added to workplace violence preparedness plans. Therapy and grief counseling are critical details of those protocols.

“Always give co-workers the option of attending any funeral or memorial service for the victims,” Phelps said. “Be aware of employees’ feelings of guilt – some might feel that they could have done something to stop the suicide or perhaps the victim told them of their plans, and they dismissed the comments. Incidents like that will make co-workers feel like it is their fault. Engage your employee assistance program [EAP] to provide education and training about the suicide threat and the complexities of the situation. If appropriate, support employees who start a tribute or fund to support the worker’s family.”

Phelps said that regular post-incident training can be just as crucial as prevention.

“It is essential to conduct regular exercises with the individuals responsible for the plan and its implementation. This could include the organization’s crisis management team as well as key departments such as human resources, security, facilities and communications,” Phelps said. “Plans are written in a vacuum. During most incidents, plans are not pulled out and people instead operate on muscle memory. Exercises are the best way to ensure that the muscle memory will be helpful.”

Finally, Phelps stressed that employers communicate that their EAPs are typically available to employees’ families as well.

“Providing mental health services to employees and their families is essential,” she said. “The incident will affect not only the employee but their families. Ensure that counseling services are very convenient – offering an option at work, off-site as well as virtually is essential to make sure that employees get the help that they need. It is also critical to provide these same services to their immediate family.”

For more about active shooter preparedness, RIMS members can access a new professional report, “Active Shooter Preparedness and Your Organization.” To download the report, visit RIMS Risk Knowledge library at www.RIMS.org/RiskKnowledge.

If you or someone you know might be at risk of suicide, here’s how to get help: In the United States, call the National Suicide Prevention Lifeline at 1-800-273-8255. The International Association for Suicide Prevention and Befrienders Worldwide also can provide contact information for crisis centers around the world.