While Texas, Florida and other states dry out from the trillions of gallons of water dumped by Hurricanes Harvey and Irene, there is much to be done and many hazards to watch out for when clearing trees and removing soggy remains from homes and offices.

While cleaning up outdoors, people should keep in mind that many animals are also displaced. These include 20 species of snakes (in Texas), alligators, deer and raccoons, according to the Washington Post.

What they may not be on the lookout for, however, are floating rafts of fire ants, which have a painful, itchy sting, Smithsonian reported. The ants, which send some 25,000 people to the hospital each year, can be found in a number of states, including Texas, Florida, Alabama, Mississippi, and California. They have a way of coping with large amounts of water by clinging to each other and forming floating rafts that can contain 500,000 or more fire ants.

Photo: ScienceNews

Photo: ScienceNews

These rafts are actually floating colonies protecting the queen, which is in the middle. They can survive for weeks until they find a dry surface—any dry surface.

Normal ants bite and then spray acid on the new wound, but fire ants are much worse. They bite, hold on, and inject a venom containing 46 different proteins, including poisons that sometimes affect the nervous system. They also have a more brutal attack pattern than many social insects. If you knock over a beehive, not all the bees will come after you—most colonies have a few dedicated warriors to protect the clan. When fire ants are disturbed, however, they all attack. About one in every hundred people will have a full-body response to the stings, such as an allergic reaction or even hallucinations.

As Eric Chaney at the Weather Channel warns, the ants can remain a problem even after the floodwaters recede and it is easy to accidently happen upon them, hunkered down amidst debris piles. According to the Imported Fire Ant Research and Management Project, “Laundry piles are convenient places that present lots of tunnels for the ants. They may be attracted to moisture or food residue or oils on soiled clothing. Often, reports of ants in laundry occur following a flood.”

Those venturing into flood waters are advised to wear rubber boots, cuffed gloves and protective rain gear to keep ants off their skin. Popular Science recommends spraying ant rafts with their kryptonite—soapy water—which can cause them to sink.

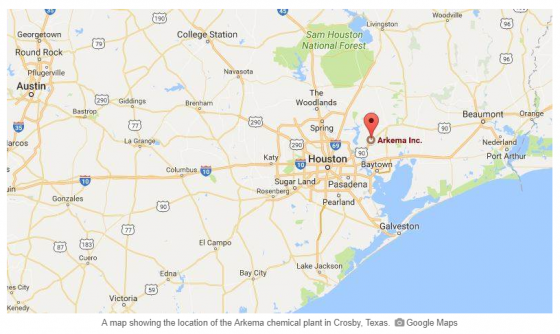

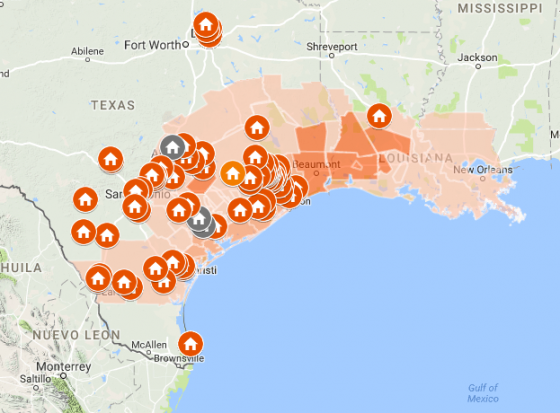

Hurricane Harvey, which made landfall in Texas on Friday night as a Category 4 hurricane, has so far caused at least five deaths and more than a dozen injuries. Now a tropical storm, Harvey has dumped more than 30 inches of rain on the Houston area, with another 15 to 20 inches anticipated by Friday.

Hurricane Harvey, which made landfall in Texas on Friday night as a Category 4 hurricane, has so far caused at least five deaths and more than a dozen injuries. Now a tropical storm, Harvey has dumped more than 30 inches of rain on the Houston area, with another 15 to 20 inches anticipated by Friday.