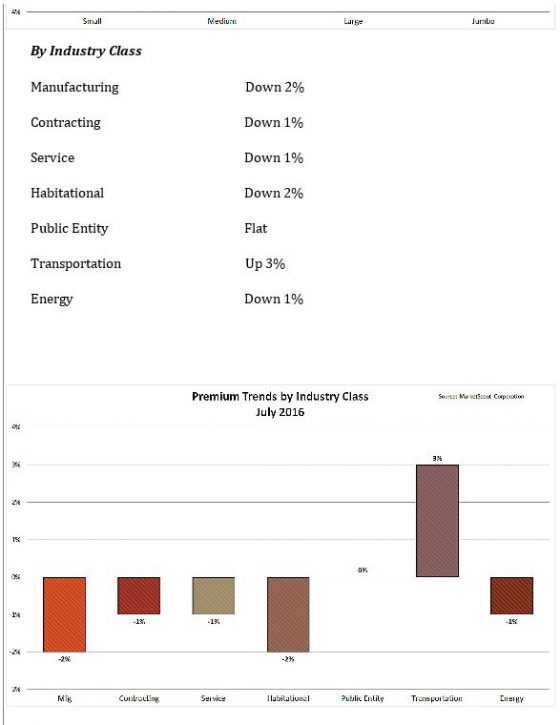

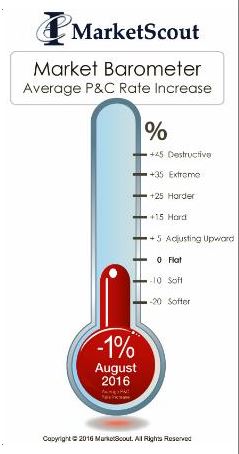

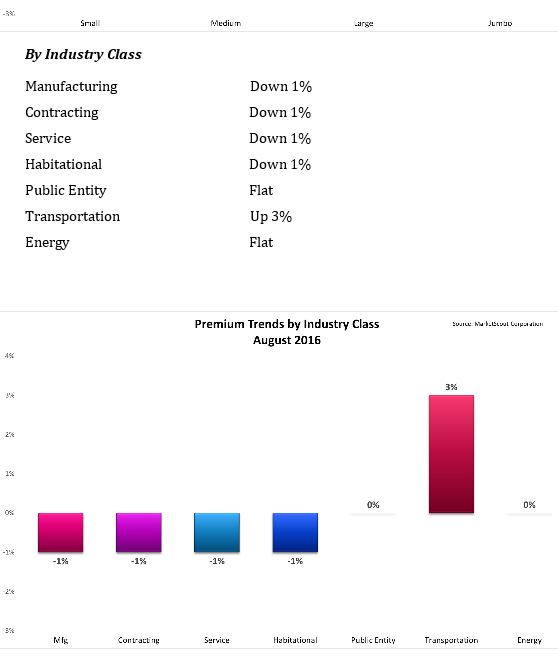

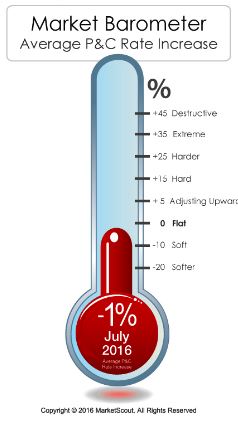

The U.S. property and casualty composite rate for August was stable at minus 1%, the same as July, MarketScout reported. By industry classification, manufacturing, habitational and energy each moderated 1% , while all other industry classifications remained unchanged.

industry classifications remained unchanged.

“While the month to month composite rate is stable, there is clear movement in commercial auto and transportation accounts with each showing a year over year rate increase of plus 3%,” said Richard Kerr, CEO of MarketScout. “Insurers have decided it is time for commercial auto and transportation accounts to start paying up.”

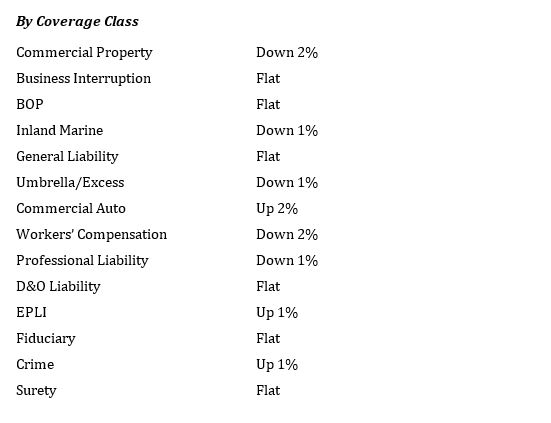

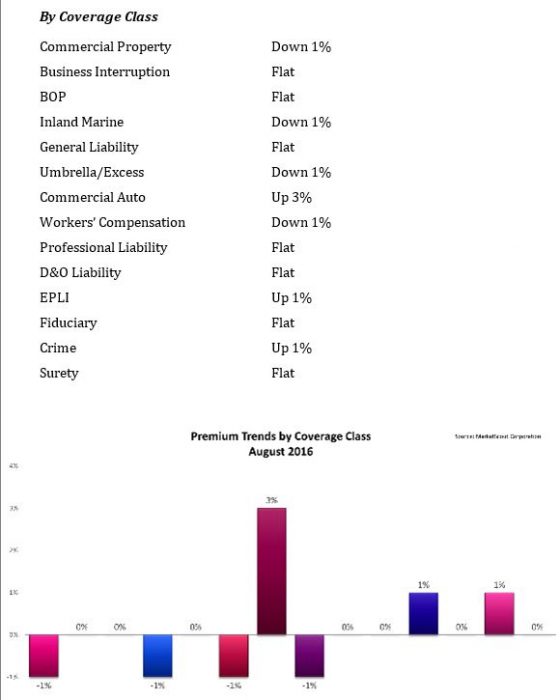

By coverage, commercial property, workers compensation and professional liability each moderated 1% in August—to minus 1% for property, minus 1% for workers compensation and flat for professional liability. Commercial auto rates went up to plus 3%, while all other coverages remained unchanged, MarketScout said.

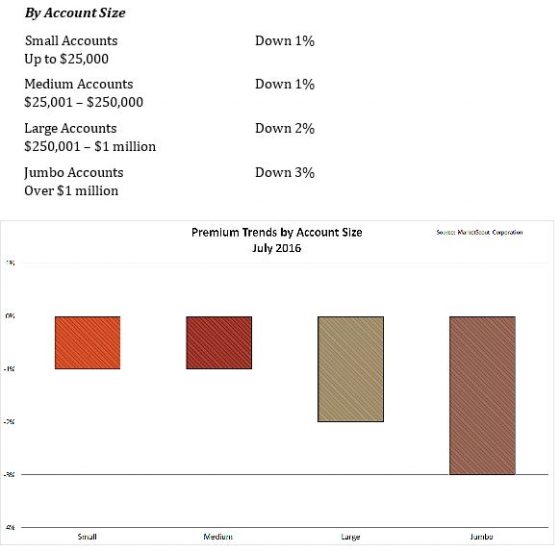

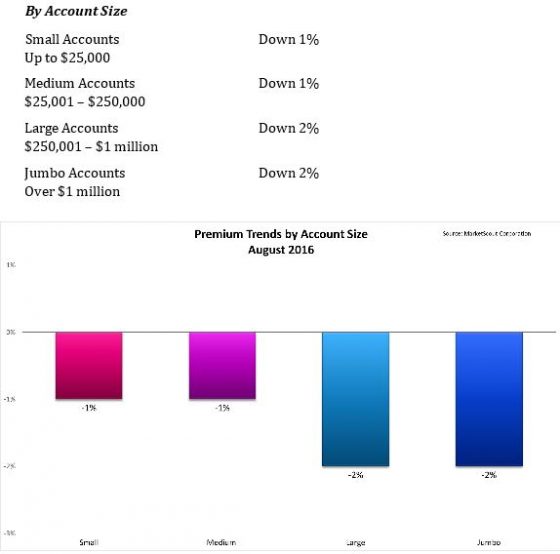

By account size the only adjustment was for accounts with more than million premium, which adjusted from down 3% in July to down 2% in August.

underwriters they can control losses are left with few options “and ultimately end up paying a much higher rate/premium which impacts their profit margins,” he said.

underwriters they can control losses are left with few options “and ultimately end up paying a much higher rate/premium which impacts their profit margins,” he said.