WASHINGTON, D.C.—The menacing presence of Hurricane Florence turned the focus at the RIMS Legislative Summit to the National Flood Insurance Program (NFIP), an ever-important issue for business owners across the country.

The NFIP has been extended several times since September 2017 and the next deadline to reauthorize the program is Nov. 30. The summit’s timing was especially relevant as Hurricane Florence approached the Eastern Seaboard just 300 miles south of the summit, expected to make landfall on Friday.

An Industry Perspective of Federal Legislative Issues

Moderated by Whitney Craig, RIMS director of government relations, a panel discussion, “NFIP & Beyond” featured insight from Jennifer Webb, counsel for the Independent Insurance Agents and Brokers of America, and Joel Wood and Blaire Bartlett of the Council of Insurance Agents & Brokers and its CouncilPAC.

The panelists came to a consensus that a reauthorized NFIP was critical, and that upcoming midterm elections would influence the amount of time an extension would be granted. They acknowledged that a gap in coverage is certainly not ideal and said their offices are working on a bi-partisan resolution.

Bartlett said that improving NFIP through privatization will be a give-and-take process.

“To its credit, FEMA has done what it is able to do as far as claims processing goes. They have taken a multiyear look. If you want to open up the private markets, that will have to be balanced with some claims legislation—we’re going to have to give in some on claims language,” Bartlett said, noting that, “If Hurricane Florence does hit the Carolinas, some of the members may not be willing to call out the federal government the way New Yorkers did after Hurricane Sandy in 2012.”

And while there were some civil disagreements, the trio did find some common ground. For example, FEMA’s flood maps were rebuked for failing when put to the test by a real flood as seen in Houston in 2017 following Hurricane Harvey.

“I think we can agree that NFIP needs some modernizations, but there’s a way to do that without closing down a program that is being used by 5 million people,” Webb said. “We didn’t see that in Texas but we could see it in the Carolinas.”

Congressional Staff Panel

This panel featured two senior congressional staffers for the U.S. House of Representatives – John Y. Hair, financial services committee designee for Congressman John Duffy (R-WI); and Lucas West, legislative director for Congressman Blaine Luetkemeyer (R-MO).

Discussions largely centered on NFIP reauthorization, Hurricane Florence and the upcoming elections.

“We have just over two months to get it through before the expiration and it’s really on the Senate. We’re putting pressure on the Senate for a long-term, five-year bill that actually makes some reforms,” Hair said.

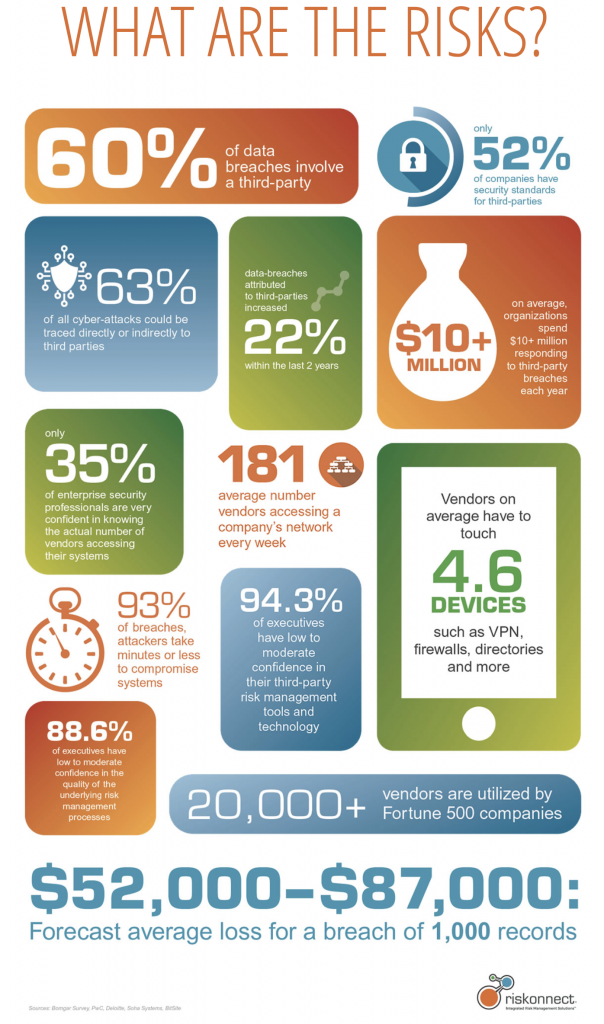

Also discussed was the Terrorism Risk Insurance Act (TRIA), which created a temporary federal program that provides public and private compensation due to terrorism-related losses, which is set to expire in December 2020. And while the traditional issues of insurance were discussed, cybersecurity, data breaches and even autonomous vehicles were also included.

Regarding autonomous vehicles, Hair said, “Certainly, access to data is going to be important on decisions regarding ‘who’s going to take the liability [in the event of a crash]?’ This could lead to a huge push to reform our liability system. We’re engaging in the risk of [commercial and taxi driver] licenses right now.”

Midterm Election: Insider Update

Mike Gula, co-founder of Gula Graham, the largest Republican fundraising firm in the U.S., discussed how attendees, members and their companies can strategically position themselves with upcoming midterm elections in November.

Gula said that because dozens of congressional seats are up for grabs in the election, companies and insurers may need to prepare for changes to laws that will impact their policies and coverage.

On day two of the summit, dozens of RIMS members descended on Capitol Hill for meetings with congressional leaders. The goal was to share RIMS priorities for a long-term, reauthorized NFIP via H.R. 2874, the 21st Century Flood Reform Act, and funding for non-regulatory maps that project future flood risks. Later, in the Rayburn House Office Building, Florida Congressman Dennis Ross spoke to RIMS members and echoed their sentiments about NFIP and how flood maps were in desperate need of a thorough update.

Access RIMScast coverage of the summit.

The concept of a culture of safety can be stalled by employers that say they want to be safer, but do little to implement real change.

The concept of a culture of safety can be stalled by employers that say they want to be safer, but do little to implement real change.