On October 18, more than 10 million Californians participated in The Great Shakeout to prepare for the next catastrophic earthquake and bring awareness to earthquake preparedness across the state. The United States Geological Survey (USGS) predicts a 99% chance of a magnitude 6.7+ earthquake in the Bay Area within the next 30 years, preparation is essential.

Kate Stillwell is a structural engineer and founder and CEO of Jumpstart, a new earthquake insurance provider which helps families and individuals following a disaster via text. As a business owner and lifelong Californian, Stillwell took part in the Shakeout and shared her experience and insight for earthquake preparedness.

Risk Management Monitor: How difficult is it to get businesses to take part in an event like the Shakeout?

Kate Stillwell: The trick is to make it fun. It only takes a few minutes, and if you can get some good laughs out of it, all the better. Also, for the San Francisco Bay Area, the anniversary of the 1989 Loma Prieta earthquake is always the same week as ShakeOut, so people remember and talk about it around the proverbial water cooler.

RMM: How beneficial is it for them to take part?

KS: It builds muscle memory. You need to know what to do without thinking because you won’t be thinking. Just as important is that the drill strikes up a conversation about other ways to get prepared, not just at work, but at home, too.

RMM: What did you take away from this year’s event?

KS: We got a great video of ourselves and since we’re in a co-working space, we did it in front of all the other startups, which reminded them they need to practice and get prepared, too.

RMM: What are some commonalities that small, medium and large businesses share when preparing for earthquakes?

KS: Businesses of all sizes must keep their employees safe. Employees need to know how to react, to “Drop, cover, and hold on,” like we emphasize during the ShakeOut, and to climb under desks or other sturdy objects and stay put. Businesses also generally face the challenge of convincing employees to take preparation seriously and review preparedness plans, that’s why national events like the Great ShakeOut are such an effective tool.

RMM: How do small, medium and large businesses differ when preparing?

KS: Small businesses have the advantage of all co-workers knowing one another and being able to physically look out for each other in the event of a disaster. For homeowners, we always say that neighbors are the people you’ll rely on in the event of a disaster, and it really is similar at work. Colleagues are able to look out for each other in the event of an earthquake, and this is much easier for smaller teams. In a larger business, you can replicate these positive effects by grouping people by team.

RMM: How have preparedness plans changed in recent years? What significant improvements, if any, have you noticed or instituted?

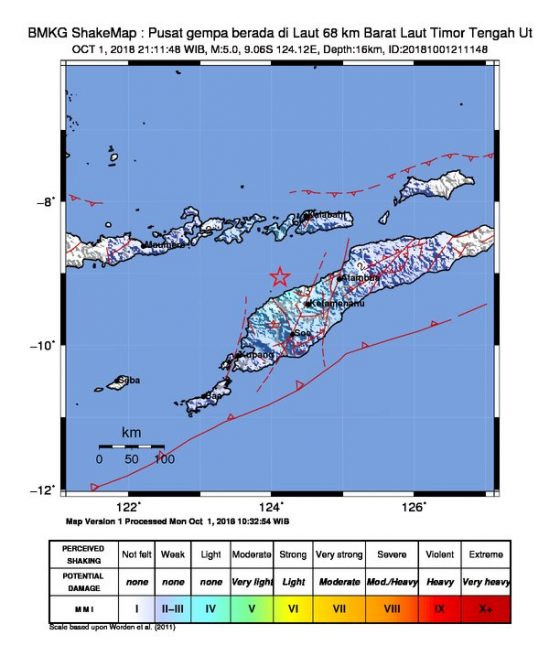

KS: The rapid development and improvement of earthquake sensor networks have been the most significant improvement in earthquake preparedness recently. The USGS ShakeAlert system began Phase 1 operations just a couple days ago, providing hospitals, transit systems, and other institutions the earliest possible earthquake warnings so they can initiate life-saving operations. It’s not enough time to evacuate a building, but it is enough time to stop the elevators and open the doors, so people don’t get trapped. These kinds of full-system improvements are making huge strides in helping us prepare and stay one step ahead of the next big earthquake.

RMM: What are some difficulties California businesses – or businesses with operations there – face, that differ from those in other high-risk areas?

KS: One of the biggest factors is downtime. There are so many externalities outside of a business’ control, which affect how soon an operation can get back up and running. The prudent approach for a business with operations in California is to locate any operations requiring continuous uptime, such as out-of-state data centers. Also, consider designating a secondary location for executive operations until the home facilities can be occupied.

RMM: What are the most effective safety drills businesses can perform?

KS: No matter what type of emergency, a really important drill is to practice an alternative chain of command with a command-and-control style of making decisions. This is so foreign to the normal style of making decisions. In emergency situations, the best person to be in the “command” position is usually not the day-to-day business leaders; it’s someone with emergency response training.

Visit here for more information about Jumpstart.

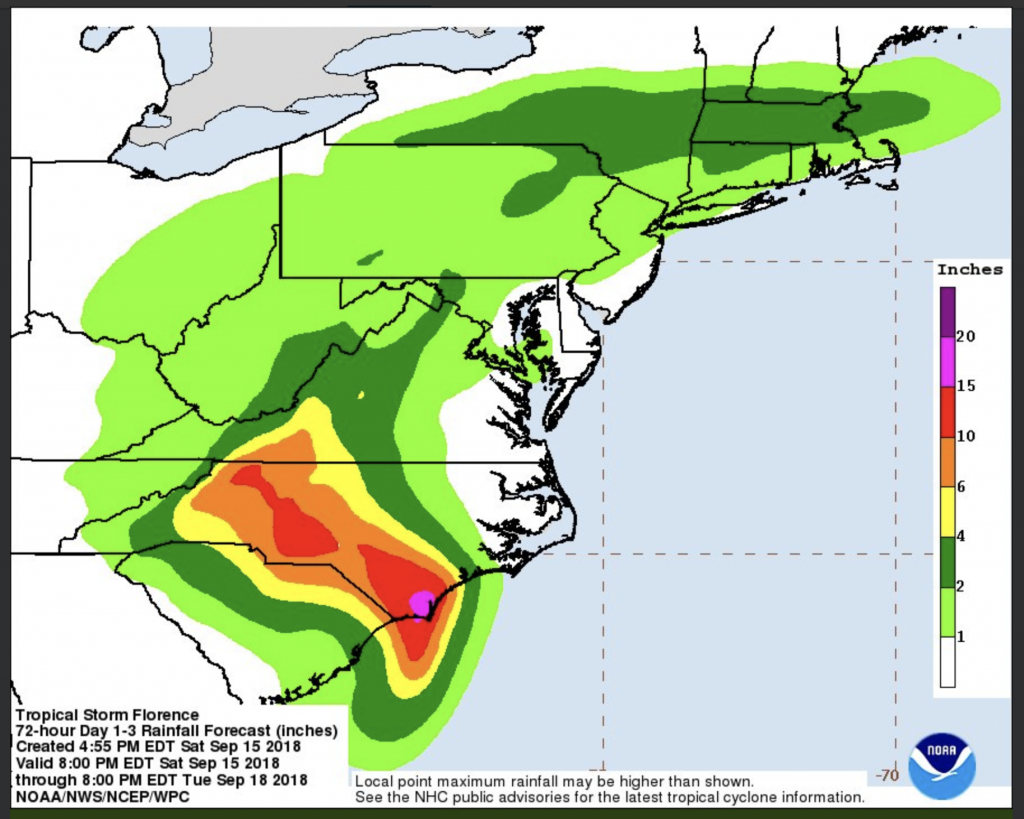

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.