Thanks to some high-profile derailments over the past several months, the zeitgeist is set against the transportation of crude oil by rail.

The latest salvo to appear in a major media outlet is Jon Bowermaster’s Op-Doc “A Danger on the Rails,” appearing in the New York Times on April 21. Bowermaster focuses on oil cars rolling along the Hudson River, but his critiques of these trains are applicable to the national debate as well.

They are, by now, predictable: the transports are derided as “bomb trains,” and they’re creeping past schools, hospitals, and major urban centers (even within a few miles of Manhattan!).

The production values are good, but Bowermaster ventures deep into NIMBY-ism. He’s not alone: when it comes to the transportation of oil, Americans want it done quickly and cheaply so the economy can keep humming along. Just make sure it’s routed somewhere else.

Fear of oil trains is nearing fever pitch, but the best alternative—pipelines—earn emotionally charged reactions as well. Take Politico’s thorough investigation of the Pipeline and Hazardous Materials Safety Administration, also published on April 21. Despite the great journalism it contains, editors gave it the inflammatory title “‘Pipelines Blow Up and People Die.’” The authors write:

“Oil and gas companies like to assure the public that pipelines are a safer way to ship their products than railroads or trucks. But government data makes clear there is hardly reason to celebrate.

Last year, more than 700 pipeline failures killed 19 people, injured 97 and caused more than $300 million in damage. Two of the past five years have been the worst for combined pipeline-related deaths and injuries since 2000.”

So much for an easy decision between rail and pipeline.

If the United States is going to be a leading producer and exporter of oil and gas, we have to transport it from the interior to our ports. And as domestic production increases, the number of accidents will almost certainly increase. If we cast a risk manager’s eye on the situation, where should we invest our money?

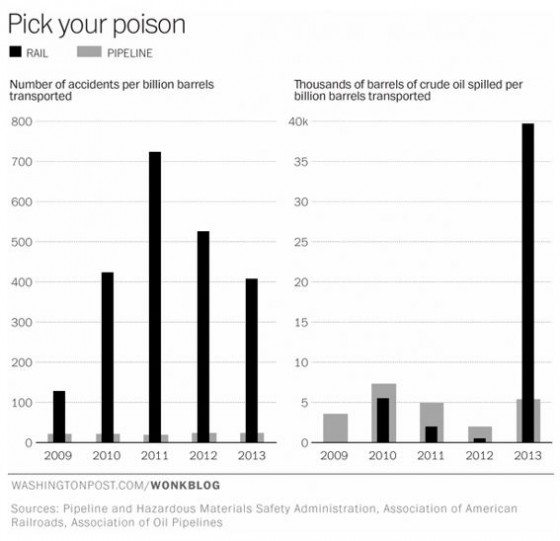

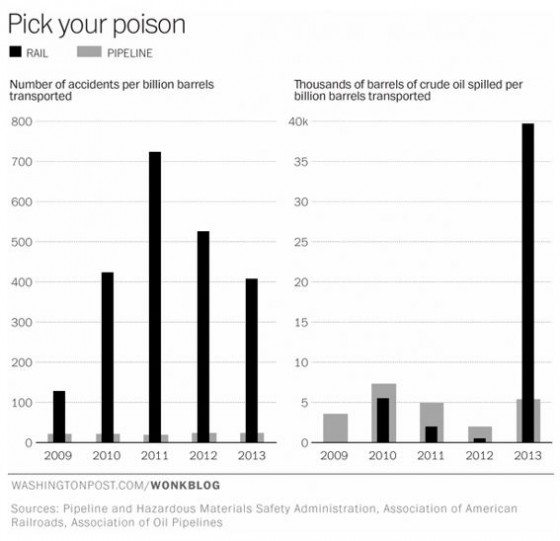

The data on rail transportation accidents makes a strong case for pipelines. Christopher Ingraham of the Washington Post put it succinctly in his February article: “It’s a Lot Riskier to Move Oil by Train Instead of Pipeline.” His charts tell the story:

Oil trains clearly have more accidents than pipelines, and in a bad year (like 2013) the amount of oil they spill can dwarf that of pipeline accidents. Oil trains have another huge risk: security. As Bowermaster noted in his documentary, these combustible trains are essentially unguarded and travel through populated areas. A determined terrorist could do a lot of damage with that situation. Pipelines, on the other hand, are buried: out of sight and out of mind.

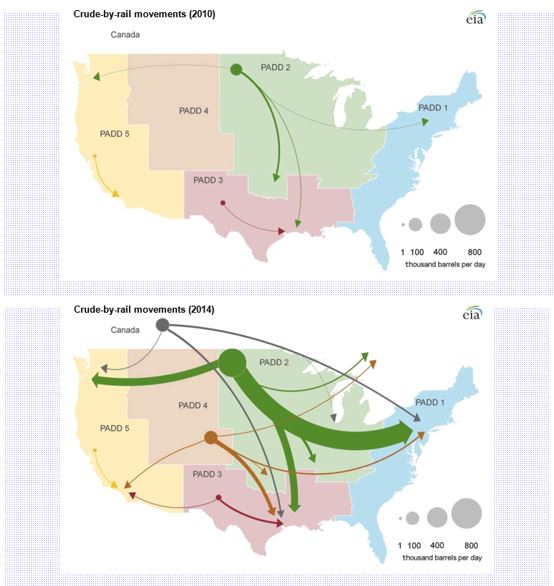

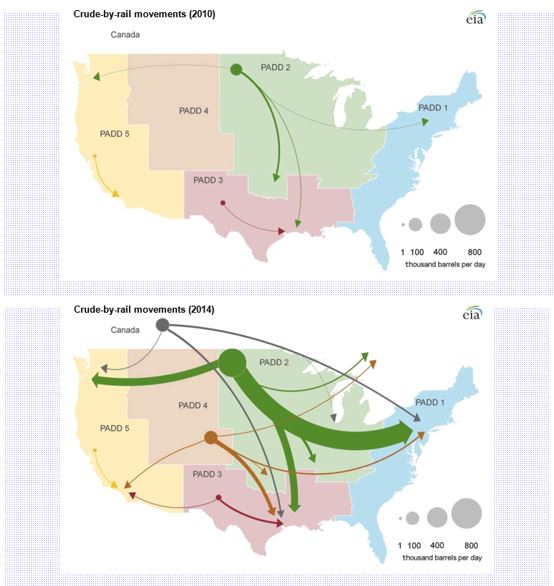

An April 6 article in Businessweek helps us visualize the magnitude of the risk from rail shipments. Check out the growth since 2010:

While imperfect, pipelines can mitigate much of this risk that’s now moving along the nation’s rails.

Rail transport won’t go away, of course. It’s easily scalable to demand and thus more attractive than building thousands of miles of pipeline that could, in the future, be underutilized. What’s best is a two-pronged approach: pipelines can reduce risk in the most heavily trafficked corridors, and new rail standards can improve the safety of oil trains.

To read more about improving safety requirements for oil trains, see Risk Management Magazine.