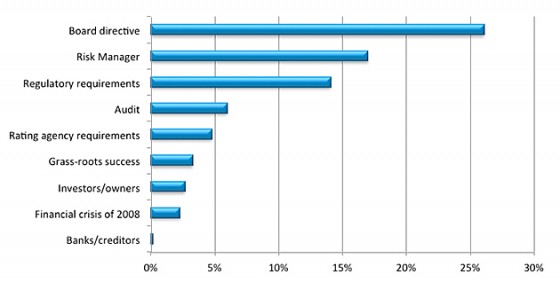

Fewer boards of directors are seen as their company’s top ERM program drivers, dropping to 26% in 2013 from 34% in 2011, according to the 2013 RIMS Enterprise Risk Management Survey, released today. This year risk managers came in as the second driver at 17%. By comparison, the second highest category in the 2011 report, which did not include risk management as an option, was “other” at 19%. Commenting on the 2011 report, Carol Fox, RIMS director of strategic & enterprise risk practice confirmed that many respondents wrote in their comments, that “other” was a risk management department initiative. “While I can’t do a direct comparison to this year’s 17%, I’d say it may be a shift as risk professionals take more of a leadership role in instituting ERM programs,” she said.

In 2011, in fact, part of the survey’s response was that “risk managers needed to take more of a leadership role with ERM. And since board leadership showed a drop [in 2013], risk managers may have taken up the slack,” she said.

Fox observed that concerns about rating agency requirements resulting from the financial crisis of 2008—that were some of the drivers for ERM in 2011—were also lower. “In 2013 ‘regulatory drivers’ for implementing ERM was 14%, dropping from 18% in 2011—so it is a shift,” she said.

What this means, she explained, is that more organizations understand the value of ERM. “It’s no longer about compliance with regulations or pressure from the rating agencies. They’re seeing the value in ERM itself.”

The board is still the largest driver, however. “That hasn’t changed, ERM is still very much top of mind for the board. As you look at the types of risk that can affect the objectives of the organization, they are mostly strategic. They are still the primary driver, but they were a higher driver in years past,” she said, adding, “This doesn’t say the board is less interested. The primary driver is the leadership role the risk professional is bringing.”

The 2013 RIMS ERM Survey was produced with Advisen LTD as a follow up to previous surveys in 2009 and 2011. The survey is free for both RIMS members and non-members and can be downloaded in RIMS newly revamped Risk Knowledge library at www.rims.org/RiskKnowledge.