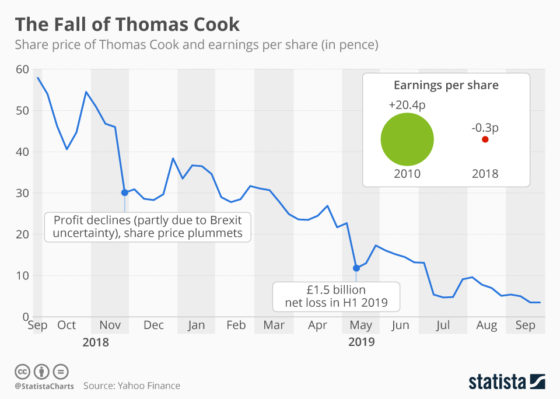

The world’s oldest travel company, UK-based Thomas Cook—which operates hotels and resorts around the world as well as its own airlines—all but collapsed this week, cancelling all of the company’s bookings (including flights and holiday packages), and closing its retail locations. The shutdown left 600,000 customers stranded, and Reuters called the effort to get passengers home “the biggest ever peacetime repatriation,” with 64 flights bringing 14,700 back to the United Kingdom on Monday, and hundreds of thousands more are expected to be transported over the next two weeks. The collapse also leaves more than 20,000 employees out of work.

Thomas Cook was buried in debt, partially due to its reluctance to adapt quickly to online travel booking and worries about Brexit, and lenders stopped funding the company. The company had requested £900 million ($1.1 billion) from its creditors and the Chinese company Fosun, Thomas Cook’s largest shareholder, but the deal did not materialize. According to The Guardian, as the company slipped further into debt, payment card companies like American Express and Barclays also limited cash collections and payment services to mitigate harm from a collapse.

The UK government also denied Thomas Cook a last-minute $310 million bailout, partially because, as UK business secretary Andrea Leadsom said, “Thomas Cook is sitting on trying to service £1.7 billion [$2.1 billion] of debt, and it would have been a waste of taxpayers’ money to be throwing good money after bad.” Reportedly, the Turkish government and some Spanish hotel businesses offered to front £200 million ($247 million) to save the company if the UK government would guarantee the investment. But the UK government rejected the deal, saying that the amount would not have sustained the company for more than two weeks.

Leadsom said that she also asked for an expedited investigation into the corporate collapse by the UK’s Insolvency Service—a branch of the Department for Business, Energy and Industrial Strategy that handles corporate liquidations and personal bankruptcy cases, including investigating companies’ bankruptcies for misconduct. Others raised the issue of company higher-ups earning millions while the company sank, with Prime Minister Boris Johnson saying, “I have questions for one about whether it’s right that the directors, or whoever, the board, should pay themselves large sums when businesses can go down the tubes like that.” The UK’s Financial Reporting Council said that it may investigate Thomas Cook’s auditors, PwC and EY, in relation to the company’s collapse.

For stranded passengers, the UK government and other airlines are stepping in to ensure everyone can make it home. In 2017, when UK company Monarch Airlines went under, the government brought all passengers home, and it appears they will do the same in this case. Of the 600,000 stranded customers, 150,000 to 160,000 are British, and UK foreign secretary Dominic Raab told the BBC that the country will be arranging alternative flights for those travelers. Customers with tickets on Thomas Cook subsidiary airline Condor will be fine, as Condor will continue to function after a £380 million loan from the German government.

Others will be able to take seats on flights provided by a variety of airlines, including US-based provider Atlas Air, British Airways, Lufthansa, and possibly Malaysian Airlines, among others.

Regarding payment, things may get more complicated. According to the BBC, UK travelers who booked a package trip are covered by the Air Travel Organiser’s Licence (ATOL), an insurance program that will cover the cost of repatriating travelers.

Those who just bought flights will reportedly have to appeal to their travel insurance or credit card companies for refunds. Hotels and resorts are also reportedly asking guests who booked through Thomas Cook to pay out of pocket for their stays, as the company’s payment is in question.