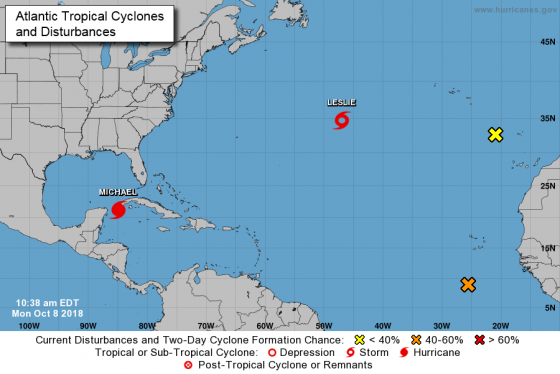

The National Hurricane Center classified Tropical Storm Michael as a category 3 hurricane Monday morning as it passed through Cuba and approached Florida.

Over the weekend, Florida Gov. Rick Scott declared a state of emergency for several counties from the Gulf Coast to Navarre on the Panhandle to the Suwanee River. Gov. Scott also directed the state’s National Guard to activate 500 guardsmen to assist with planning and prepare for response in impacted areas as the state monitors the storm.

Michael is currently located in the Yucatan Channel about 600 miles south of Apalachicola, Florida with maximum sustained winds of 75 mph. The storm is moving to the north at 7 mph and is expected to continue strengthening as it accelerates northward across the Gulf of Mexico. It is expected to make landfall as a Category 3, with maximum sustained winds of 120 mph, in the Florida Panhandle or Big Bend on Oct 10.

buy stendra online https://royalcitydrugs.com/stendra.html no prescription

Storm surges are expected as well, with eight to 12 feet possible. Homeowners and business owners who might be in its path are encouraged to visit floridadisaster.org and FloridaDisaster.biz and register to receive updates as the storm progresses.

Hurricane Irma hit Florida in August 2017, and that category 5 storm caused an estimated $64.76 billion, causing 134 fatalities and affecting several crops and agricultural producers. With Florida still recovering from the damage wrought by Irma, Hurricane Michael may provide major challenges for businesses caught in its path.

Business Continuity Plans

In January, Risk Management Monitor reported that 62% of large U.S. companies with operations in Florida, Texas or Puerto Rico said they were not fully prepared for major storms and hurricanes in 2017.

“These candid admissions drive home a fundamental truth about catastrophe,” Louis Gritzo, vice president and manager of research at FM Global said in a statement in conjunction with the company’s findings. “People routinely fail to understand or acknowledge the magnitude of risk until they’ve experienced a fateful event.”

FEMA’s business disaster continuity plans can be found here, and a Hurricane Ready Business Toolkit can be found here. According to FEMA and the Department of Labor, 40% of small businesses will not reopen immediately after a hurricane hits, 25% more will close about one year later, and 75% of business without a continuity plan will fail within three years. In the aftermath of Hurricanes Harvey, Irma and Maria in 2017, Risk Management Monitor provided critical tips for small businesses preparing for the next natural disaster.

The first step for any small business is to prepare internally. Here are three best practices that small-business owners can adapt to prepare for a future hurricane or any other natural disaster.

- Establish a recovery plan: Often, disaster recovery plans fall to the bottom of small-business owners’ to-do lists, especially if their business is located in an area that doesn’t typically experience high-risk weather. However, no business is immune from a harmful storm’s impact. Disaster preparedness starts with a formal plan that’s comprehensive and allows the company to quickly restore its normal operations following an emergency.

buy renova online www.mariettaderm.com/wp-content/uploads/2022/08/pdf/renova.html no prescription pharmacy

- Discuss your plan with all employees: It is crucial for your entire staff to be on the same page when it comes to what your disaster plan involves in order for it to be effective. So once small-business owners have a plan in place, they need to ensure that their employees know what’s included and what their responsibilities are should a natural disaster strike.

buy zithromax online www.mariettaderm.com/wp-content/uploads/2022/08/pdf/zithromax.html no prescription pharmacy

Owners can share this information by emailing a copy to all employees and discussing the plan in detail at the next all-hands meeting.

- Back up your business’s data: Small-business owners should ensure their data is backed up both virtually and physically in a secure location. Doing so can prevent a natural disaster from turning into an even worse data loss debacle.

The last October landfalling hurricane in the Florida Panhandle was Hurricane Opal in 1995. Throughout the storm’s path from Central America into the Ohio Valley, 63 people died in storm-related events. Losses attributed to Opal exceeded $4.7 billion, much of which took place in the United States.

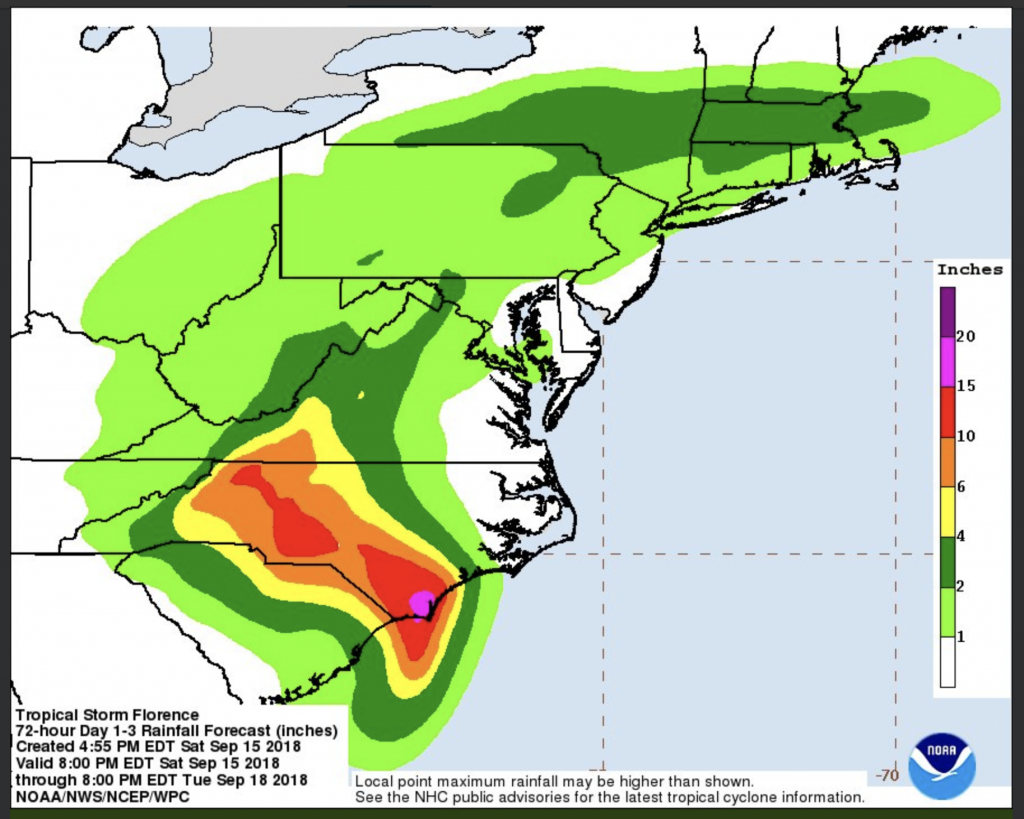

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.

Now a tropical depression, Florence hovered primarily over North and South Carolina over the weekend, dumping record-breaking rainfall in those states and killing at least 17 people. Remnants of the system are heading north, bringing rain through Tuesday.