The risks associated with disasters extend far beyond the initial destruction. For insurers, disaster damage assessment and claims processing can pose both significant financial risk as well as introduce personal risks for claims inspection teams. The safety of these teams is dependent upon a strong understanding of the situation on the ground. As a result, insurers need to take steps to maintain visibility of the situation, efficiently handle damage claims processing, and, above all, limit the risk exposure of claims and response teams on the ground.

Utilize credible catastrophe information

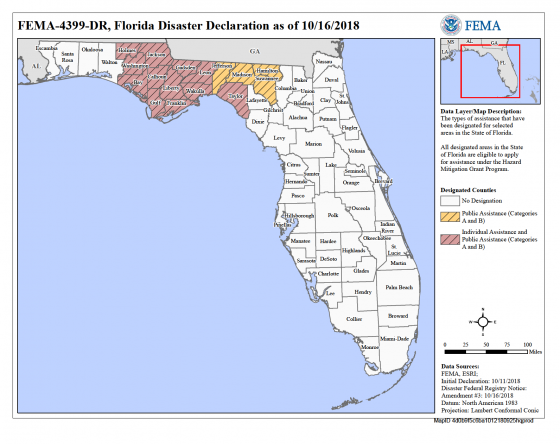

Having accurate geographic information to pinpoint potential asset damage before deploying inspection teams can aid faster claim resolution and provide more efficient claim processing. Looking to trusted resources that offer key data on approaching catastrophes can help teams better prepare for the situation at hand. The National Oceanic and Atmospheric Administration (NOAA) offers constant information and updates on pending and current weather conditions, storms and other catastrophes to allow organizations to stay up-to-date on the latest conditions. Likewise, the Federal Emergency Management Association (FEMA) can also offer deeper insight into disaster recovery efforts so that adjusters are prepared for the situations they walk into.

Knowledge is power when it comes to efficient claims processing and safe deployment of inspection agents. Data from credible resources allows adjusters to more safely maneuver through potentially hazardous conditions. But even the wealth of knowledge offered by NOAA and FEMA is often not enough to minimize an organization’s post-disaster risk profile.

Emphasize image collection of disaster areas

When disaster hits, roads can become impassable, buildings can become structurally unsound, and areas can become impossible to access. The last thing an insurer wants to do is send its claims adjusters into a hazardous zone unprepared.

Preparation is key to effective claims inspection that minimizes time in the field and the risk of unforeseen, hazardous circumstances. To that end, satellite and drone imagery have become key technologies used by insurance companies to improve processes and protect claims adjusters.

The concept of satellite and drone imagery to assist in claims processes and reduce inspector risks is hardly a new concept. Novarica recently estimated that nearly 20% of P&C carriers are pursuing imaging solutions. In fact, PricewaterhouseCoopers forecasts that drones alone will have a $6.8 billion impact on the insurance industry in the coming years.

Satellite imagery provides wide-area, high-resolution analysis of damaged areas to help organizations understand the breadth of the damage, while drones can be deployed to specific sites to conduct detailed damage evaluations at a micro-level. Combining satellite and drone imagery can give teams a full view of the extent of catastrophic damage so they know exactly what to expect upon on-site inspection.

In some cases, detailed imagery and analytics can often provide enough information to prevent adjusters from ever having to set foot on a property, allowing them to accurately and efficiently process claims from the safety of a desk. In fact, Cognizant estimated that drone usage can make a claim adjuster’s workflow 40% to 50% more efficient, which can be especially important when managing the high number of claims that come in response to a catastrophe. This can also decrease claims management costs, help protect the well-being of employees and significantly reduce adjuster accidents.

The amount and strength of natural disasters in the U.S. will not decrease anytime soon. But the use of credible information resources and thorough imaging technology can help insurers reduce their financial and safety risks, so they can better help others address their own.

RMM: How do India’s cities rank in Lloyd’s City Risk Index?

RMM: How do India’s cities rank in Lloyd’s City Risk Index?