A mass shooting at a video game tournament in Jacksonville, Florida on Sunday has once again shined a spotlight on the growing risks businesses face even as they conduct normal operations.

A lone shooter, 24-year-old David Katz, opened fire on football video gamers at a pizza restaurant, killing two and injuring at least nine before turning the gun on himself in an adjacent restaurant. Reports indicate that Katz was allegedly upset at being eliminated from the tournament. One of the deceased victims was a player who defeated Katz in a prior tournament, leading investigators to believe there had been a motive for the shooting.

The effect of mass shootings has left Florida numb, especially since this follows the Feb. 14 massacre at Marjory Stoneman Douglas High School in Parkland, which left 17 dead and 17 injured; and the Pulse Nightclub shooting in Orlando in 2016, leaving 49 dead and 53 injured. These tragedies demonstrate that no business or venue should consider itself inherently safe and serve as reminders to risk professionals in all sectors that their organizations could be vulnerable to a mass shooting.

Public Safety

The shooting was unique in that it occurred during a live broadcast of the football gaming tournament. Gunshots were clearly audible as players delivered commentary during their simulated contests, prompting them to take cover and call the police, who responded minutes after receiving the first call.

The incident marked the 235th mass shooting in the U.S., according to the Gun Violence Archive, an organization that collects information about gun-related violence in the country. The FBI and the United States’ Congressional Research Service consider a mass shooting to be one that injures at least four people, excluding the shooter.

In light of this increasingly commonplace threat, understanding how to respond to an active shooter situation can mean the difference between life and death. The U.S. Department of Homeland Security has provided the Run.Hide.Fight plan for guidance in what to do in an active shooter scenario.

Mental Health

As more information about Katz emerges, the links between gun violence, mental health and public safety in the United States become more evident.

CNN reported that Katz had a history of mental health issues and legally purchased a 9mm handgun and a .45-caliber handgun in Maryland. How he transported the weapons and ammunition across state lines and into the event are details still being investigated.

CNN also obtained police records that show 26 calls to the police from the Katz family home in Columbia, Maryland, from 1993 to 2009, for issues ranging from “mental illness” to domestic disputes. At least two of those calls involved Katz arguing with his mother, although none of the reports provided to CNN indicate any physical violence.

Since 2013, residents in Maryland must obtain a handgun qualification license from the state police before purchasing a pistol or revolver. That means Katz would have submitted his fingerprints, undergone a background check (which includes disqualifying individuals who were voluntarily or involuntarily hospitalized for more than 30 days), and passed a firearms safety training course to buy those guns. This scenario has been met with wide skepticism. And since some of his documented mental health issues may have occurred before the gun laws were revised, the disqualifications may not have applied to Katz.

“That clearly is an area in need of reform,” said Democratic Sen. Robert Zirkin, who chairs a Senate committee that handles gun laws.

Insurance

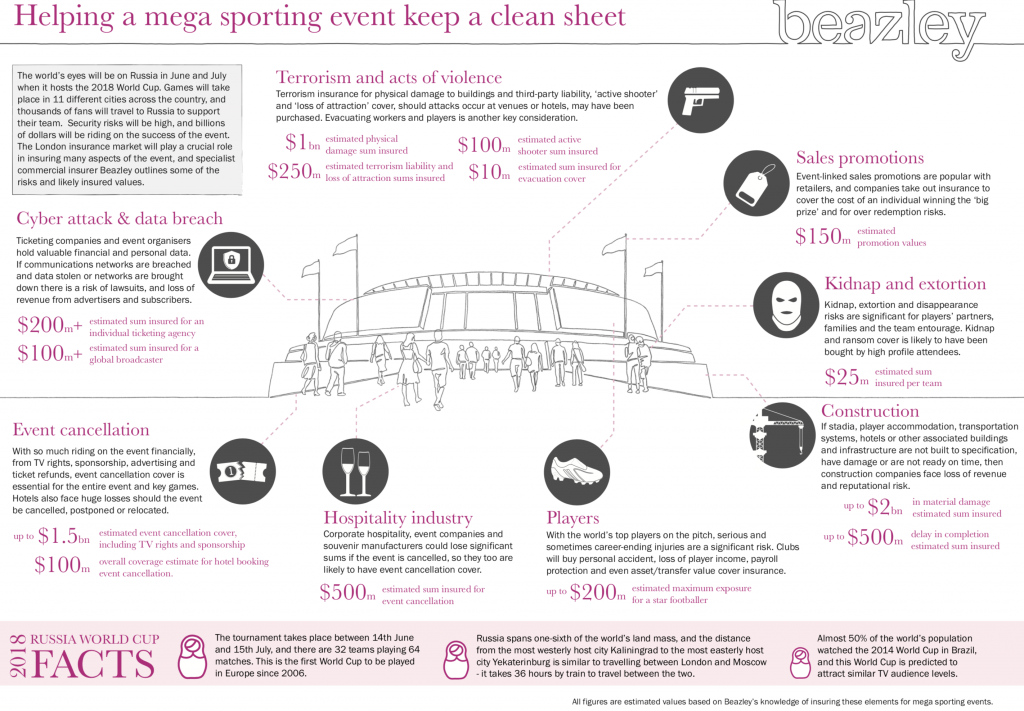

Risk Management magazine recently reported that companies may not be aware of potential gaps in their coverage or that the limits of their coverage, when considering active shooter incidents, are insufficient.

“You might have property coverage, but you might not have assessed your properties in specific locations against this type of risk,” said Robert Hartwig, clinical associate professor of finance and co-director of the Risk and Uncertainty Management Center at the University of South Carolina’s Darla Moore School of Business.“You almost certainly would not have crisis management under your ordinary property or liability policy. So these represent gaps that, as a risk manager, you might be unaware of.”

Beyond property damage, it can be unclear what is covered after a shooting. For example it is difficult to establish the liability for allowing an assailant on a property. “Unfortunately, the increase in the number of active shooter situations has probably gotten ahead of the law on this issue,” Hartwig said. He added that a number of states do allow individuals to carry concealed weapons much, if not all, of the time. “So it’s not necessarily the case that, just by entering the premises with a weapon, individuals are violating the law. Therefore, a business is not necessarily negligent by allowing an armed individual to enter its premises.”

Security scanners that screen passengers entering stations and terminals are being tested around the country and have been installed in subway stations in Los Angeles. The

Security scanners that screen passengers entering stations and terminals are being tested around the country and have been installed in subway stations in Los Angeles. The  Above: Luzhniki Stadium in Moscow

Above: Luzhniki Stadium in Moscow