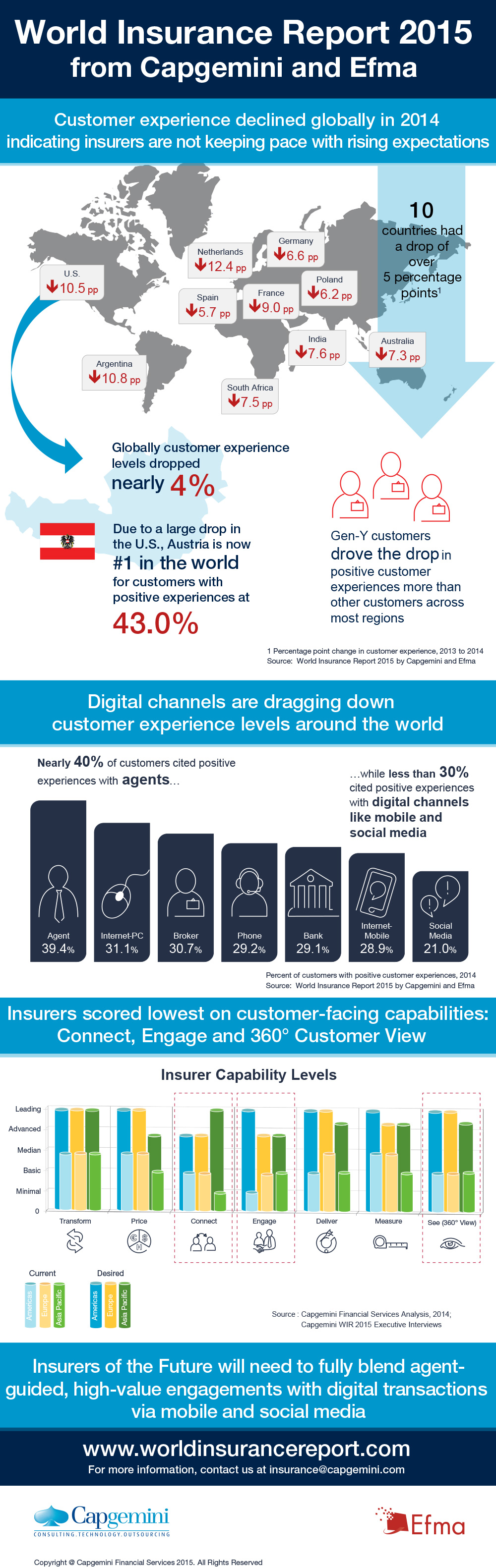

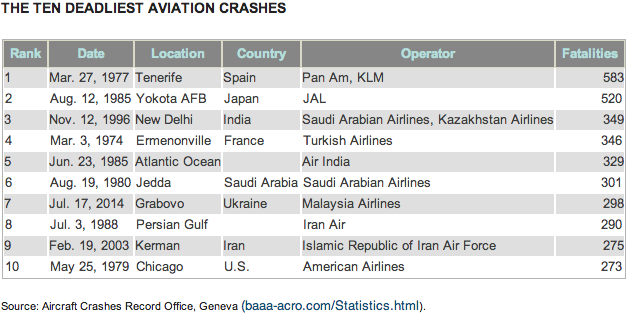

First, Malaysia Airlines flight MH370 mysteriously disappeared in March, dominating the news cycle and baffling aviation experts, government officials and civilian observers alike. This month, three tragedies in short succession have kept the industry in the hot seat. Malaysia Airlines made headlines once again on July 17 after Flight MH 17, a Boeing 777 flying from Amsterdam to Kuala Lumpur, was shot down over Ukraine. It is now the seventh most deadly aviation crash in history. Exactly who fired on the plane remains unclear, as do many questions of insurance, as war has not officially been declared, despite months of fighting in the region. An act of war would exclude losses from insurance coverage, but remaining uncertainty does as well. Plus, “Unless Russia has declared war on Malaysia, that would knock out the exclusion,” RIMS Vice President Rick Roberts told Mashable. But for it to fall under under terrorism coverage, “someone has to certify that the act that occurred wasn’t a mistake—that it was a malicious act.” The already struggling company may not be able to survive this second disaster, or the reputational devastation.

Tragedy has further plagued the industry this month. On July 23, a TransAsia flight from Taiwan crashed, killing 48. The next day, an Air Algérie flight from Burkina Faso to Algeria disappeared less than an hour after takeoff in the air space over Mali. Approximately 24 hours later, peasants found the plane’s wreckage near Gao, Mali, and French soldiers dispatched to the scene were able to recover a black box, but no survivors.

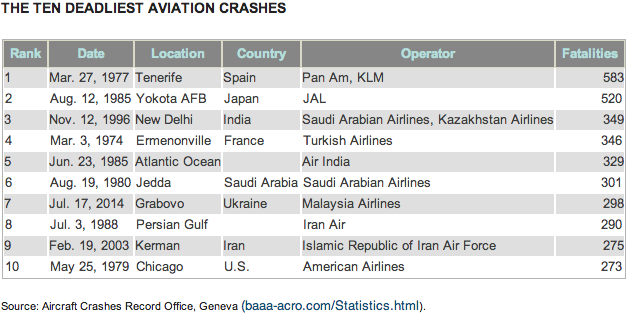

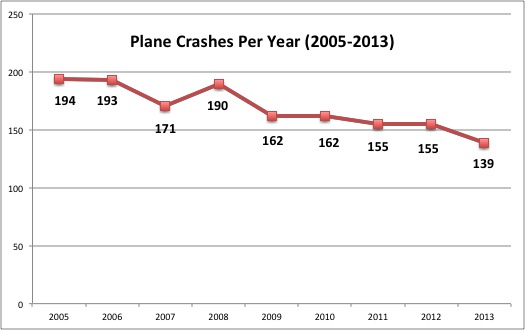

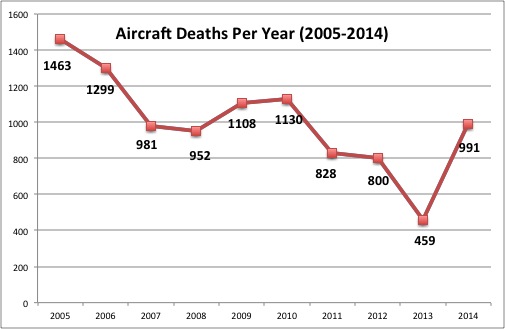

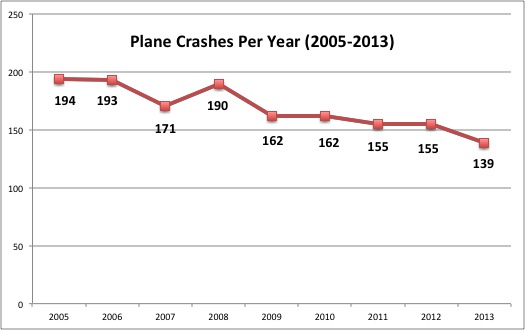

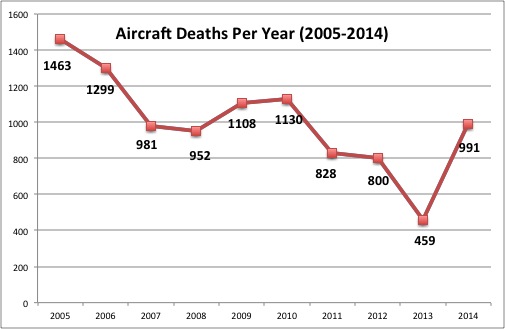

Despite the string of disasters, there is no evidence that air travel is in any way more dangerous on the whole. In fact, it is safer than ever before. Nearly three billion people fly safely each year on more than 37 million flights, the International Air Transport Association (IATA) reports, and the global plane accident rate fell to the lowest level in aviation history in 2012. Over the past 10 years, both the crash and fatality rates have trended downward, according to statistics from the Bureau of Aircraft Accidents Archives. But, little more than halfway into 2014, the number of people killed in plane crashes is more than double the total for 2013 (991 and 459, respectively).

Based on BAAA data:

Looking back even further, this chart from the Wall Street Journal leaves little doubt that the aviation industry has grown drastically safer:

While 2014 has been more fatal thus far, the overall number of crashes continues to decrease. There have been 70 commercial-plane crashes globally so far, versus 81 for the comparable period a year earlier, according to Aviation Safety Network, part of the Flight Safety Foundation. Further, the four tragedies do not have any common root causes for their failures.

Insurance Changes on the Horizon

International carriers are feeling most of the strain, and that is likely to have serious implications for insurance premiums. “Given the accumulation of losses, including the loss of Asiana Airlines’ Boeing 777 in San Francisco last year, an explosion causing damage to 20 aircraft in Tripoli recently, and this week’s losses in Africa and Taiwan, these will, altogether, put pressure on the global insurance market,” said Robert Hartwig, president of the Insurance Information Institute. “I expect most of the impact to be focused on international carriers, particularly those operating in or traversing parts of the world that I would characterize as ‘hotspots,’ currently experiencing military or political instability. That would certainly include Ukraine, parts of the Middle East, and parts of Africa.”

While the recent spate of tragedies may leave many travelers wary of getting on a plane, American airlines have less to worry about regarding premiums than their foreign counterparts. There have been are no notable losses this year among domestic carriers, or U.S.-based airlines that fly internationally. As Hartwig pointed out, however, “With a few exceptions, they do not tend to traverse many of those hotspots to begin with.”

In Africa and other developing regions, “you identify accidents in many places that would have happened 30 or 40 years ago in the West, because oversight is lagging,” Dominique Fouda, spokesman for the European Aviation Safety Agency, told the Wall Street Journal. “You also see different accidents linked to local conditions.”