The recent suicide bombing in Istanbul and the Paris bombing last November killed and injured innocent bystanders and sent shockwaves around the globe. Such attacks also cause organizations to question international travel out of fear of putting their key executives and employees in harm’s way.

As the risk profile changes in some locations that were once considered safe, it is critical to reassess and more deeply examine company programs to protect business travelers abroad.

First of all, for companies and their insurance advisors, there is no substitute for great advance planning. If a company is contemplating overseas travel and can establish well in advance that there exists a need for key person insurance, the coverage is easier to obtain and more cost effective. The reality is that the heightened awareness around a dangerous trip often results in an insurance need being developed or uncovered with little notice. When this need arises, the underwriting process migrates from the traditional life and disability insurance market to the playing field of high limit or specialized risk underwriters.

In one notable example, a large U.S. company recently made a significant investment in a defense contractor. Shortly after the investment closed, the company named a new chief executive officer and sought to acquire $50,000,000 of key person life and disability insurance.

As of the day of the request, their insurance advisor had eight business days to secure the insurance before the CEO departed for the Middle East, with stops in such international hot spots as Iraq and Afghanistan. Because of the abbreviated time frame, traditional life and disability insurance was not an option. The advisor needed to turn to a specialty underwriter that deals with exceptionally large and complex human capital risks.

Armed with the CEO’s itinerary (see below) and details of the executive’s compensation and equity incentive agreement, the advisor had enough information to present the submission to the underwriters.

Within 72 hours, a policy was issued that covered the private equity firm’s loss of the CEO directly due to an accidental death or disability, as well as a result of acts of war or terrorism.

Few domestic life and disability carriers possess the ability to underwrite large risks when there is high-risk exposure in the world’s hot zones. Instead, companies and their brokers must work with large international insurers that are willing to deploy meaningful capacity.

The easiest way for advisors to access these markets is through an experienced U.S.-based correspondent who is skilled at designing and underwriting coverage in these volatile locations. Local correspondents or managing general underwriters also serve to guide brokers through the regulatory complexities that go along with underwriting risks through surplus lines carriers—something most life and health producers have little experience with.

The best brokers are masters at uncovering details from their clients, documenting them and communicating them effectively to underwriters. A well-written cover memo will often be the basis for offering coverage and can be the primary source for pricing consideration. A complete itinerary coupled with security details are the underwriter’s key points of interest, so make sure the information is gathered and communicated as early as possible.

Frequently, specific plans will be classified when working with international defense contractors, but one way or the other, the basic information must be made available. When underwriting coverage in highly hostile areas, rates can vary based on multiple factors, such as security arrangements, travel vendors, length of stay and, in highly hostile areas, rates even vary down to specific latitude and longitude coordinates, often within a single city or locale.

No detail is too small for spelling out the need for the insurance and financial justification, including the purpose of the trip and the client’s specific duties and objectives. This is the information that sets apart a submission and makes it more likely for an underwriter to go out on a limb with preferential pricing and terms.

Keep in mind, when underwriting risks in highly volatile areas—with the propensity for rapid deterioration—it may not be possible to negotiate coverage or a rate guarantee for the entire duration of the client’s journey. It is essential to keep in mind that the best underwriting offers go to advisors who deliver the most detailed and accurate information.

Example of a CEO’s itinerary:

Day 1 – Depart Commercial Air for Dubai

Day 3 – Arrive in Baghdad, Iraq – Transport to Camp Butler

Day 4 – Depart Baghdad and arrive in Dubai

Day 5 – Depart Dubai arrive Kabul, Afghanistan – Transport to Camp Gibson

Day 6 – Fly to Kandahar, Afghanistan

Day 7 – Depart Kandahar, Afghanistan – fly to Abu Dhabi

Day 12 – Depart Abu Dhabi for U.S.

It is important that we don’t allow acts of terrorism to knock the wheels off our economy. Business travel and face-to-face meetings are key elements in making us what we are, so it’s imperative that we mitigate the associated risk whenever possible.

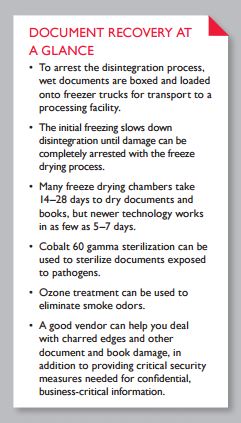

stems; they may have flooding from sprinklers, which, mixed with soot, can cause other complications; there may be smoke damage, which can by carried throughout a building through air conditioning systems; and there can be chemical residue from fire suppression systems.

stems; they may have flooding from sprinklers, which, mixed with soot, can cause other complications; there may be smoke damage, which can by carried throughout a building through air conditioning systems; and there can be chemical residue from fire suppression systems.